Stablecoin interest is starting to rise again. The supply of stablecoins has seen a near-8% increase in the past 4 months. The stablecoin forex reserve has reached its highest level since May 2020, thanks to whales, who currently hold nearly half of the stablecoin supply.

You might like: Binance Labs Invests in Puffer

Stablecoin Demand Is Growing Every Day

According to an analysis by Sentiment, a chain-analysis firm, the stablecoin market capitalization has increased by nearly $9.5 billion from October to January. This represents an 8% growth for us.

Currently, whales with assets worth more than $5 million actively hold more than half of the supply.

So What Does This Mean?

In general, the increase in stablecoin supply indicates that capital inflows into the crypto market are increasing. This is because most traders in traditional markets use stablecoins to enter and exit trades on crypto exchanges.

In a deep analysis by a CryptoQuant analyst, he drew attention to the strong correlation between the circulating supply of Tether (USDT) and the price of Bitcoin. In his statement, he said:

The circulating supply of USDT has increased by about 30 billion since the end of 2022. Any increase in supply has traditionally positively affected the development of BTC prices.

Stablecoins Are Regaining Their Former Strength

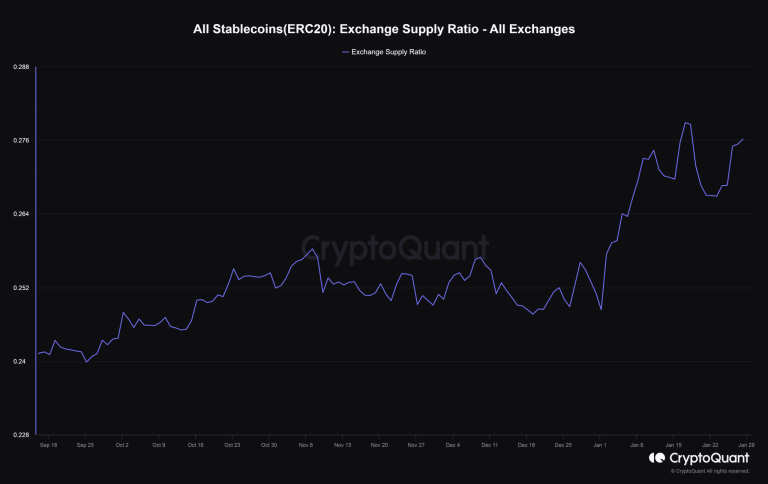

The decline in interest in these coins began with the collapse of Terra USD in 2022. The market was already on a downward trend, and the occurrence of this event took us to the impossible depths. The demand for these stablecoins, which are especially used in trading, had also decreased. However, the upward trend that emerged in the last four months has caused attention to be turned back to these cryptocurrencies. While 24% of the circulating supply was found on exchanges at the beginning of 2024, this slice has now risen to 28%.

The current stablecoin forex reserve has reached its highest level since May 2020.

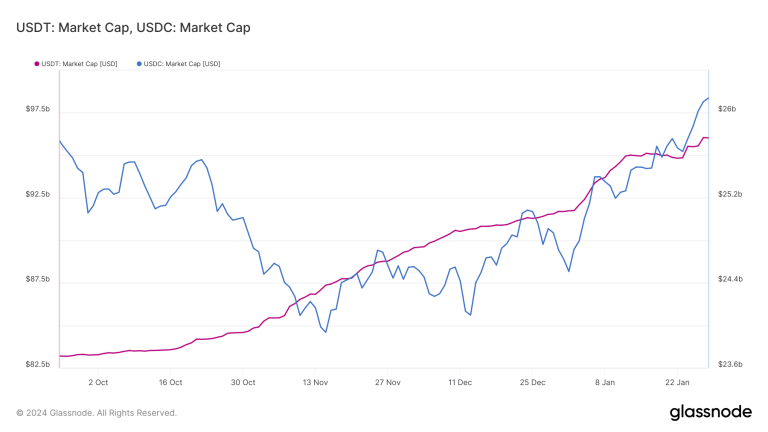

This growth in the market has also reflected in the upward trend of leading assets such as USDT and USDC.

According to AMBCrypto’s analysis of Glassnode data, USDT’s market capitalization has increased by 5.4% since the beginning of 2023.

On the other hand, even USDC, which struggled in 2023, saw an 8% increase from the beginning of the year to today.

Conclusion

The recent increase in stablecoin interest is a positive sign for the crypto market. It suggests that investors are becoming more confident in the stability and security of these assets. If this trend continues, stablecoins could regain their former prominence as a key part of the crypto ecosystem.