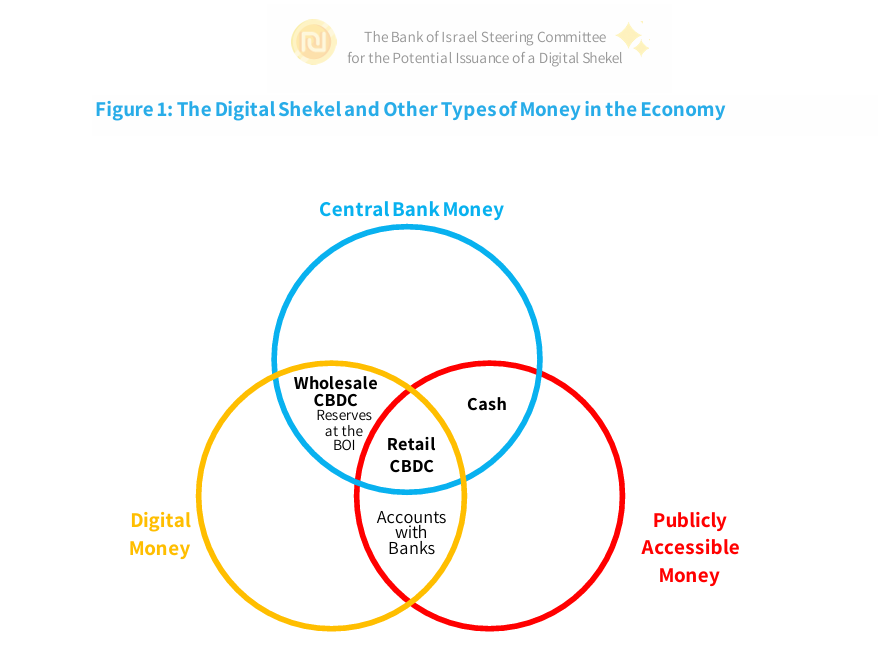

The Bank of Israel has made public the initial design plan for the digital shekel (DS), the potential central bank digital currency (CBDC). While no official launch decision has been made yet, design details focus on ecosystem structure, technical framework and regulatory considerations.

Key Features of the Digital Shekel

According to a report by the Bank of Israel, the digital shekel aims to create a new payment infrastructure in the financial system and reduce transaction costs. The digital currency will be used by individuals as well as businesses and public institutions.

The report states that the digital shekel will support offline transactions, be compatible with other payment systems and offer instant transaction confirmation. It is also emphasized that digital sugar will offer advanced solutions for privacy and can be used to combat the informal economy.

Role of the Private Sector and Technical Structure

The issuer of the digital shekel will be the Bank of Israel, but private sector firms will be involved in the user registration process and the development of additional financial services.

According to the plan:

- The digital shekel will be integrated with other payment systems.

- Support offline payments.

- Allow instant transfers.

The Central Bank said the system will allow users to transact even if they do not directly own digital shekels.

Feedback Process Started

The Bank of Israel has launched a program called the “Digital Shekel Challenge ” to assess how the digital shekel can be applied. Technology firms and experts in the financial sector are encouraged to submit potential use cases for the CBDC.

The final implementation of the digital shekel will be decided after 2026.

- Public feedback will be collected until April 30, 2025.

- Technology firms will be asked for CBDC implementation ideas.

The Bank of Israel will make its final decision based on extensive research and public feedback.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.