Following today’s inflation data, US investment bank JP Morgan moved its expectation of the FED’s first interest rate cut from November to September. Inflation data, which is closely followed by Bitcoin (BTC) and cryptocurrency markets, came below expectations, and after this data, JP Morgan brought forward the FED’s interest rate cut expectation.

According to CNBC, JP Morgan‘s chief economist Michael Feroli said: “FED President Jerome Powell stated that he wanted to see more good data on the inflation front. The data announced today are positive. We think that these data pave the way for the first interest rate cut in September. We expect to see an interest rate cut every quarter from now on.” Previously, JP Morgan predicted that the FED would make its first interest rate cut in November.

Recently, Citi analysts also predicted that they expected the first interest rate cut in September and that the FED would reduce interest rates by 25 basis points eight times starting from September. Analysts added that they expect the FED to reduce the interest rate from the current 5.25%-5.5% to 3.25%-3% by making a 200 basis point reduction in a total of 8 months until July 2025.

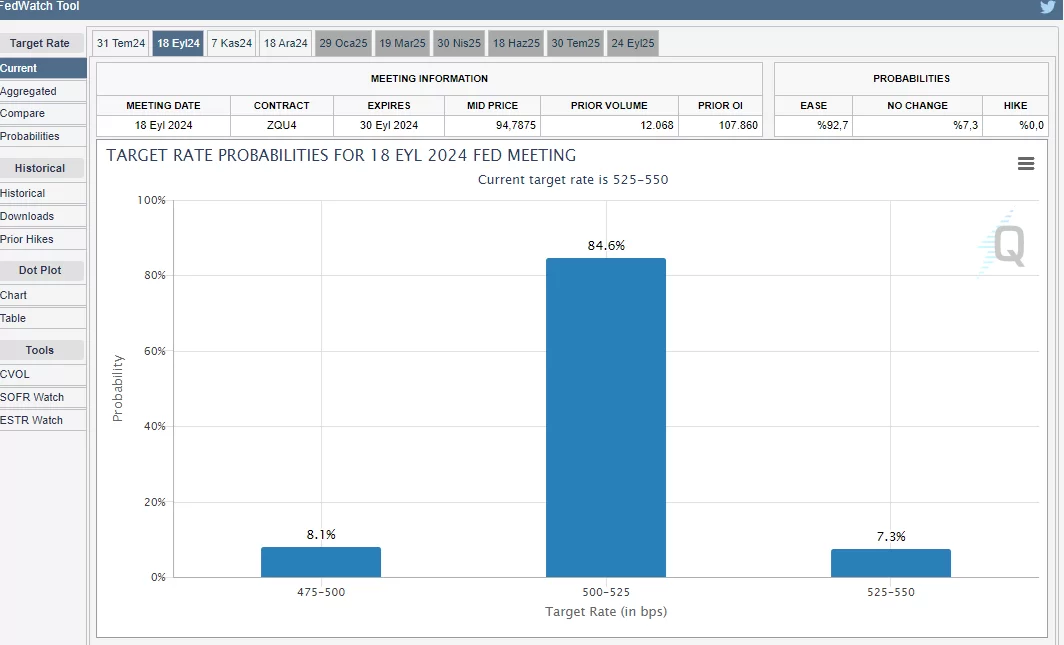

While there is little time left for the FED to announce its July interest rate decision, the earliest interest rate cut is expected to be September. According to FED Watch, the probability of interest rates remaining constant in July is priced at 91.2%, while a 25 basis point cut at the meeting on September 18 is priced at 84.6%.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.