The Federal Reserve (Fed) kept its policy rate unchanged at 4.50%, in line with market expectations. However, the statement and remarks from Fed Chair Jerome Powell contained new signals that investors should closely monitor.

Is Inflation on Target or Still a Concern?

Powell emphasized that long-term inflation expectations remain in line with the 2% target, but he did not express clear optimism for the short-term outlook. Highlighting the impact of tariffs on inflation, Powell stated, “We need a few more months to assess the effects of tariff inflation,” signaling that uncertainty will persist through the summer.

In summary: The Fed is not rushing to cut rates until it sees a “sustained decline” in inflation. This suggests that the market’s expectation of a “soft pivot” may be delayed.

New Scenario for 2025: Growth Expectations Down, Inflation Up

The Fed sharply revised down its 2025 growth forecast while raising inflation expectations. This shift indicates increasing uncertainty in the markets. Powell’s statement that “Policy is not on a pre-set course” shows that the Fed remains flexible and data-dependent.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

What does this mean? If the U.S. economy remains strong, interest rates may stay high for longer. However, if the labor market weakens, the Fed will likely take action accordingly.

Bitcoin and Ethereum Rally!

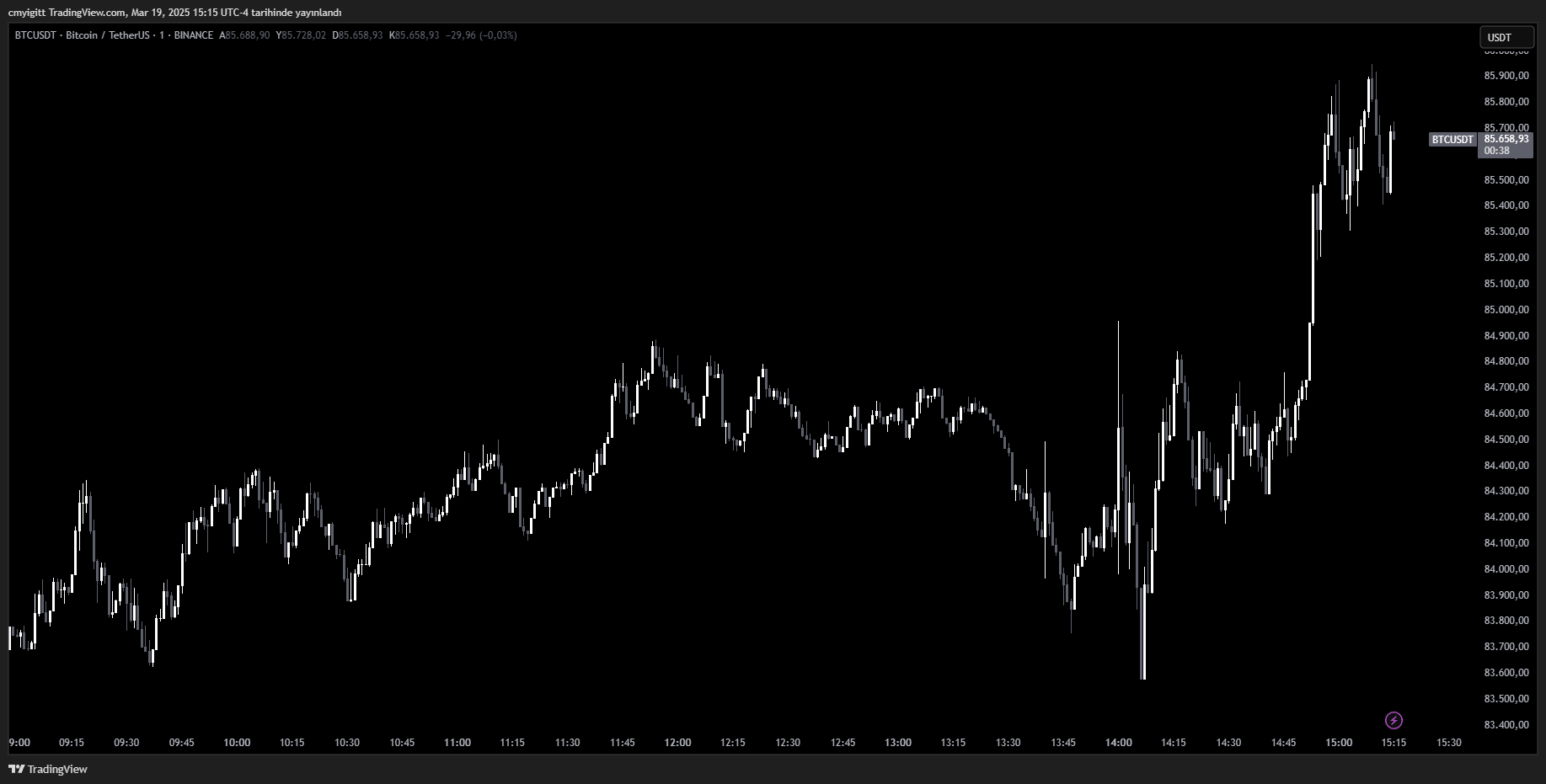

Following the Fed’s decision, Bitcoin quickly rebounded from $84,000 and surged past $85,000, gaining 1.22%. This indicates that investors are shifting toward risk-hedging assets like cryptocurrencies.

Ethereum, meanwhile, rose from $2,017 to $2,067, marking a 2.22% increase. Analysts note that the Fed’s decision to hold rates steady and Powell’s uncertainty-driven rhetoric are supporting short-term upside momentum in digital assets.

How Does the Fed’s Wait-and-See Approach Impact Markets?

Powell’s remark that “The economy is strong, but uncertainty is unusually high” clearly illustrates that markets have yet to find a clear direction. This could result in:

- Capital outflows from emerging markets as investors seek safer assets.

- Reduced foreign investor interest in Borsa İstanbul, negatively impacting liquidity.

- Higher short-term opportunities in the crypto market, but also increased volatility in the mid-term.

Key Insights and Market Commentary

- According to WSJ, the Fed cut its 2025 growth forecast while raising inflation expectations, potentially accelerating the “risk-off” sentiment in global markets.

- Powell pointed out that the labor market remains strong and is not a source of inflationary pressure. However, consumer spending is showing signs of slowing, which could influence future monetary policy decisions.

- The FOMC removed the phrase “Risks to inflation and employment are balanced” from its statement, signaling a more cautious Fed stance on economic risks.

The Fed’s decision to hold rates was widely expected, but the revised forecasts and Powell’s comments have shifted markets into a more cautious mode. Powell frequently used the word “uncertainty,” urging investors to stay alert.

Bitcoin and Ethereum are gaining traction as alternative assets amid uncertainty. However, until the Fed’s policy becomes clearer, market volatility is likely to continue.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.