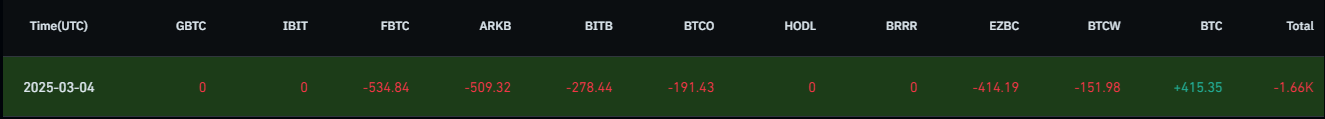

The cryptocurrency market continues to surprise investors with its volatility. On March 4, 2025, notable movements were observed in Bitcoin (BTC) and Ethereum (ETH) spot ETFs. Bitcoin ETFs saw a total outflow of -1.66K, while Ethereum ETFs recorded an inflow of +6.80K.

Outflows from Bitcoin ETFs!

On February 4th, a total of -1.66K net outflows were observed from Bitcoin spot ETFs. The outflows, particularly from some large funds, have created a negative sentiment in the market, raising concerns among investors about Bitcoin’s short-term direction.

The largest outflows occurred as follows:

- FBTC: -534.84 BTC

- ARKB: -509.32 BTC

- BITB: -278.44 BTC

- BTCO: -191.43 BTC

- EZBC: -414.19 BTC

Recent outflows from Bitcoin ETFs are putting pressure on prices, as investors closely monitor the impact of regulatory uncertainties and macroeconomic developments on the market.

A Different Situation for Ethereum ETFs!

Ethereum ETFs showed a mixed picture on February 4th. While ETHA experienced outflows, FETH, ETHE, and ETH funds saw significant inflows. Overall, a total of +6.80K was observed.

- ETHA: -12.24K ETH

- ETHE: +4.98K ETH

- ETH: +3.96K ETH

- FETH: +10.10K ETH

In an environment where outflows from Bitcoin ETFs are increasing, Ethereum’s fund flows present a more balanced outlook. The demand for FETH and ETHE especially highlights that investor interest in Ethereum remains strong.

Outflows from Bitcoin ETFs, Balanced Trend in Ethereum ETFs

On February 4th, 1.66K outflows were recorded from Bitcoin spot ETFs. Sales from large funds indicate a decrease in investor risk appetite and an increase in uncertainty. On the other hand, Ethereum ETFs show a more balanced trend. While ETHA saw outflows, significant inflows were observed in funds like FETH and ETHE.

As trade wars escalate, global market uncertainty may lead to accelerated outflows from Bitcoin ETFs. A strengthening US dollar could drive investors away from riskier assets. However, the continued institutional interest in Ethereum ETFs provides a relatively more stable outlook for the market.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.