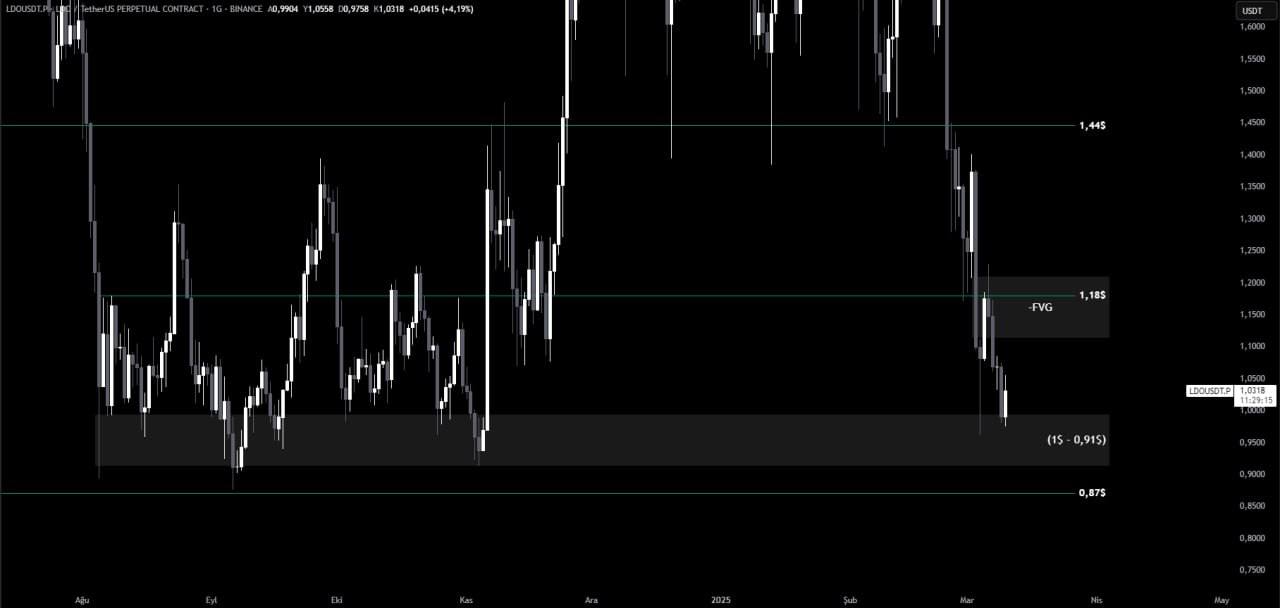

LDO (Lido) started a significant upward movement in the past, but recently, the price has retraced to the 1.00$ – 0.91$ support zone. This area is critical for LDO, as it will determine whether the decline will end and whether the price can start recovering. If 0.91$ support is lost, the price could potentially pull back to the 0.87$ – 0.85$ range. These levels are key support zones that investors should keep an eye on.

On the other hand, if LDO begins to rise, the nearest resistance is located in the downward FVG (Fair Value Gap) area. This area includes the crucial 1.18$ resistance level, which plays an important role in the potential for further upward movement. If LDO can break above 1.18$ and maintain daily closings above this level, the next target could be 1.45$. This could mark the continuation of a strong bullish trend for LDO, so it’s important to monitor how the price behaves around this level.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

For an upward movement to continue, breaking and holding above 1.18$ will be essential. If this level is successfully surpassed, 1.45$ will become the next target. However, if LDO loses the 0.91$ support, the price could experience a deeper pullback, potentially testing the 0.87$ – 0.85$ support levels.

Therefore, investors need to carefully track the price action around these key levels. Monitoring how LDO reacts to these critical support and resistance zones will play a crucial role in determining the next price movement.

In conclusion, the key levels for LDO are the 0.91$ support and the 1.18$ resistance. The price action at these levels will decide whether LDO will experience a continued rise or pull back further. Investors should pay close attention to how the price behaves in relation to these levels in the near future.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.