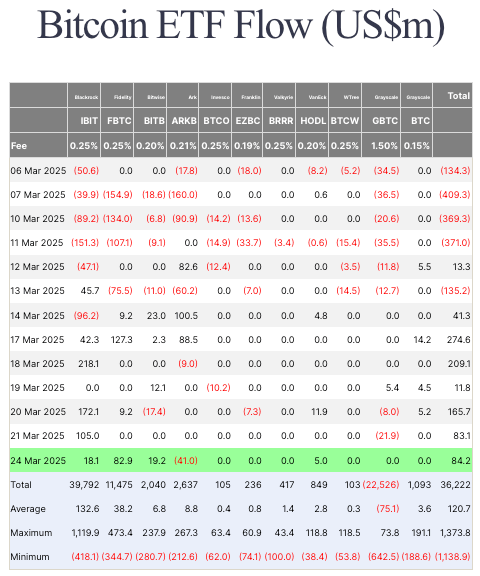

Spot Bitcoin ETF inflows remained positive on March 21 and March 24, marking seven consecutive days of inflows.

Positive Momentum in Spot Bitcoin ETF Inflows on March 21 and 24

Spot Bitcoin ETF inflows remained positive on March 21 and March 24, marking seven consecutive days of inflows after a challenging start to the month. This indicates a positive momentum in the market and suggests growing investor confidence.

On March 21, the standout performer was iBIT, which attracted $105 million in new capital. This was the second-largest single-day inflow for iBIT that week, highlighting the increasing liquidity provided by the platform. However, BTCW recorded a notable outflow of $21.9 million, marking the only negative figure among the ETFs that day. All other ETFs—including FBTC, BITB, ARKB, BTCO, EZBC, BRRR, HODL, GBTC, and BTC—remained unchanged on March 21. This indicates that investor interest in these ETFs remained stable on that day. As a result, March 21 ended with a net inflow of $83.1 million.

Spot Bitcoin ETF Inflows Continue Strong Performance on March 24, Bullish Momentum Persists

On March 24, FBTC maintained its lead with an inflow of $82.9 million. This indicates that FBTC is performing strongly, with growing investor confidence in this ETF.

Other notable inflows came from BITB, which saw $19.2 million, and iBIT, which received $18.1 million. However, ARKB experienced an outflow of $41 million, which slightly dampened the overall inflows. BTCW added a modest $5 million, showing a slight increase.

As on March 21, other ETFs remained unchanged. The net inflow for March 24 was $84.2 million, confirming that the bullish momentum continued following a positive week in the market.

Last week, iBIT saw consistent strong inflows, with over $218 million recorded on March 18 alone. These large inflows suggest increased investor interest in iBIT.

Additionally, periodic outflows from ARKB and BTCW were notable. However, by March 21, the overall weekly picture remained highly positive, with a net total of $83.1 million for that day. Against this backdrop, the $84.2 million inflow on March 24 continued the prevailing bullish momentum, signaling that investors remain optimistic and continue to see opportunities in the market.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, please don’ t forget to follow us on our Telegram, YouTube and Twitter channels for the latest news.