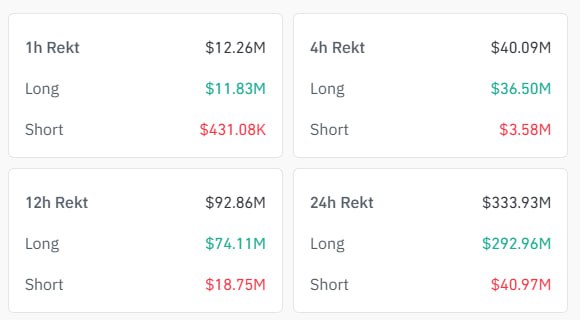

In the last 24 hours, 124,841 investors were liquidated, with the total liquidation amount surpassing $331.9 million.

124,841 Investors Liquidated in the Last 24 Hours

In the last 24 hours, there has been significant movement in the cryptocurrency market. 124,841 investors were liquidated due to a massive liquidation wave, with the total liquidation amount surpassing $331.9 million.

This large-scale liquidation can be attributed to the sharp volatility and price fluctuations in the crypto market. Traders engaging in leveraged trading suffered significant losses due to sudden price declines, leading to inevitable liquidations. This serves as a cautionary reminder for investors to be more vigilant in managing risk.

What Is Liquidation and Why Is It Important?

Liquidation refers to the automatic closure of an investor’s position following a margin call. In leveraged trades, when the market moves unfavorably, positions can be liquidated. Given the high leverage ratios in the crypto market, sudden price movements can quickly lead to liquidations.

Increase in Liquidations in the Crypto Market

The liquidation wave in the last 24 hours is primarily linked to the sudden drop in the values of major cryptocurrencies like Bitcoin and Ethereum. Due to the volatile nature of cryptocurrencies, investors are often encouraged to use leverage for short-term gains, but this can also lead to significant losses.

These sudden and large liquidations often lead to increased volatility in the market, creating opportunities for traders. However, they can also pose significant risks for long-term investors.

What Investors Should Pay Attention To

Sudden market fluctuations, especially for those opening leveraged positions, can be highly dangerous. When trading in the cryptocurrency market, it is essential to implement proper risk management strategies and avoid excessive leverage.

Additionally, after liquidation waves, prices may continue to fluctuate, presenting new opportunities for investors. However, it’s crucial to remember that these opportunities come with inherent risks.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.