U.S. Spot Bitcoin ETFs see over $500 million in outflows amid crypto price drop.

U.S. Spot Bitcoin ETFs Experience Over $500 Million in Outflows in One Day

U.S. spot Bitcoin exchange-traded funds (ETFs) saw more than $500 million in net outflows on Monday, marking the fifth-largest outflow since their launch in January 2024.

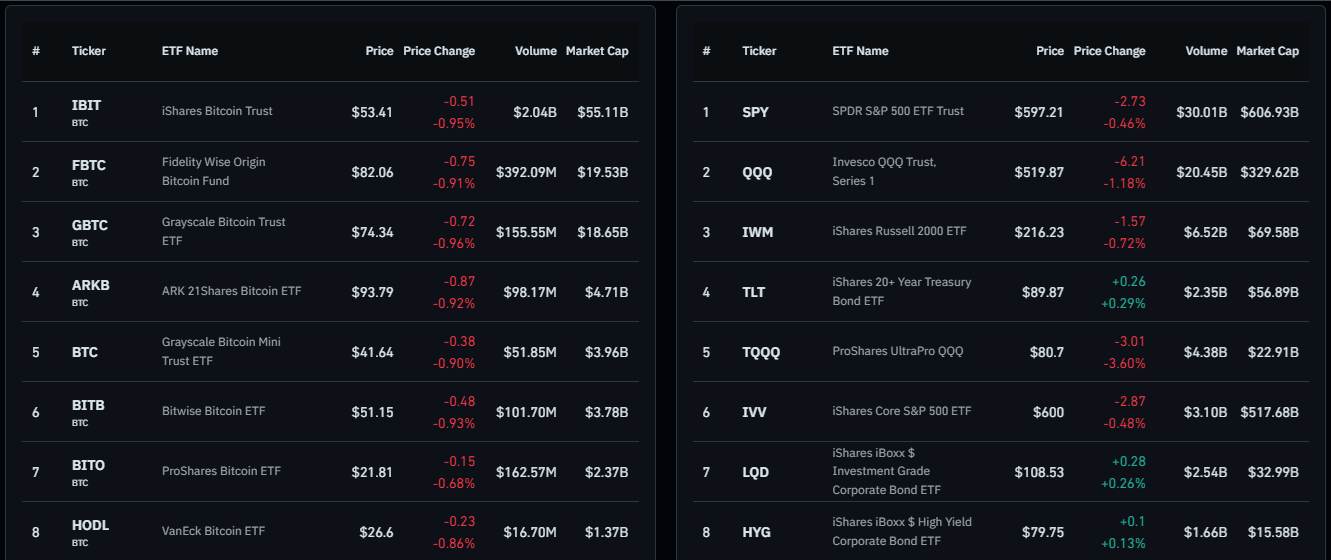

Fidelity’s FBTC fund led the outflows with $247 million, followed by BlackRock’s IBIT fund with $158.6 million, and Grayscale’s converted GBTC product with $59.5 million. In total, spot Bitcoin ETFs experienced $516.4 million in net outflows on Monday, though Ark Invest’s ARKB fund data has yet to be released. Excluding ARKB’s data, this marks the fifth-largest outflow recorded. The largest daily outflow occurred on December 19, when Bitcoin’s price dropped from its all-time high of over $108,000. The five-day net outflow streak for spot Bitcoin ETFs now totals $1.07 billion.

Meanwhile, U.S. spot Ethereum ETFs saw $78 million in net outflows on Monday, with BlackRock’s ETHA fund leading the way, bringing their three-day outflow streak to $100 million.

BRN analyst Valentin Fournier stated on Tuesday, “The outflow streak marks the longest redemption period seen in crypto ETFs since their launch. This suggests that the initial wave of investors interested in digital assets is now fully allocated. Going forward, ETFs will need new demand or a broader market catalyst to reignite inflows.”

However, David Foley, Co-Management Partner at Bitcoin Opportunity Fund, mentioned that the outflows are “not excessive.” “After a significant rise in November and December, investors are now evaluating Q1 2025 and analyzing the broader economic and asset market directions,” he said.

Despite the recent outflows, total net inflows into Bitcoin funds remain above $39 billion, with $111 billion in assets under management across the spot ETFs.

Crypto Market Downturn Continues

Spot Bitcoin ETF trading volume slightly increased on Monday, rising to $3.8 billion, with BlackRock’s IBIT leading with $2.6 billion in volume. However, the trading volume remains significantly lower than the peak of $9.5 billion on January 23 and the all-time high of $9.9 billion on March 5, 2024.

The outflows from spot Bitcoin and Ethereum ETFs on Monday aligned with a continuing downturn in crypto prices on Tuesday. Bitcoin fell by 7.6% in the last 24 hours to $88,547, while Ether dropped by 11.2% to $2,394.

Solana and XRP were hit harder, falling 14.4% and 13%, respectively, despite growing hopes for SEC approval of their own spot ETF products in the U.S.

Meanwhile, the GMCI 30 index, representing the top 30 cryptocurrencies, dropped by 11% in the last 24 hours to 147.51.

Aurelie Barthere, Head Research Analyst at Nansen, stated, “We believe the LIBRA scam followed by the Bybit hack are crypto-specific factors likely weighing on risk appetite.”

“Additionally, concerns about the slowdown in U.S. growth, after the lowest Services PMI in 22 months, which aligns with a GDP growth tracking at just 0.6%, have also contributed to market worries,” she said.

Fournier added, “Last week, concerns over tariffs, the Russia-Ukraine war, and poor AI stock performance triggered a broad risk-off sentiment.” However, Bitcoin has remained resilient, staying in line with the Nasdaq despite negative news.

He also mentioned that delays in the potential state and national Bitcoin strategic reserves under the Trump administration present a long-term accumulation opportunity. “We maintain our bullish stance on crypto, recommending staying heavily invested. Solana, in particular, stands out as a high-upside play with the potential for significant gains on the next rebound,” he added.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates