Metaplanet announces new bitcoin purchase! How much did it buy, what’s in its portfolio, and what’s the 2025 target?

Japanese Investment Firm Metaplanet Expands Its Bitcoin Holdings

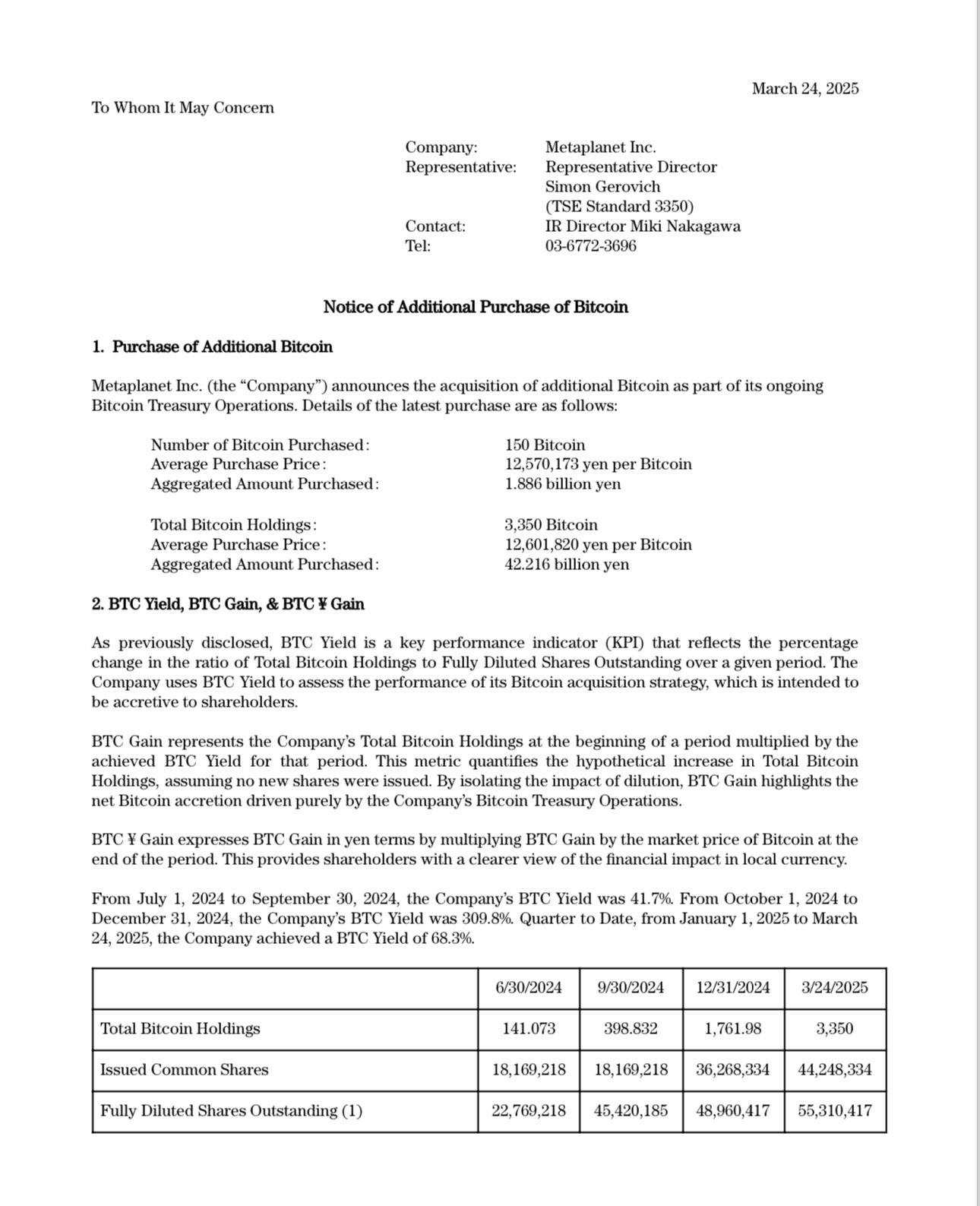

Japanese investment firm Metaplanet has increased its Bitcoin holdings by acquiring an additional 150 BTC. The company purchased the Bitcoin at an average price of ¥12.57 million (approximately $83,000) per BTC.

This latest acquisition cost a total of ¥1.886 billion ($12.1 million), bringing Metaplanet’s Bitcoin reserves to 3,350 BTC. Across all purchases, the company’s average acquisition price stands at ¥12.60 million ($80,200) per BTC.

Metaplanet Becomes Asia’s Largest Corporate Bitcoin Holder

By making Bitcoin a core part of its corporate strategy, Metaplanet has emerged as Asia’s largest corporate Bitcoin holder.

The company has been utilizing innovative financing methods, such as stock acquisition rights via EVO FUND and the issuance of zero-coupon bonds, to fund its Bitcoin purchases without relying on traditional debt.

In March, Metaplanet redeemed ¥2 billion ($12.8 million) in bonds ahead of schedule while simultaneously raising an equivalent amount through a new bond issuance. This approach has enabled the company to expand its Bitcoin treasury while avoiding interest-bearing liabilities.

Metaplanet has set a target of accumulating 10,000 BTC by the end of 2025 and has already acquired over 1,400 BTC in the first 12 weeks of the year.

The company tracks its performance using a proprietary metric called BTC Yield, which measures the growth in BTC holdings relative to its fully diluted shares. This metric surged 309.8% in Q4 2024 and has already reached 68.3% in Q1 2025.

Investor confidence in Metaplanet’s Bitcoin strategy is evident, with the company’s share price skyrocketing by over 3,000% since initiating its BTC accumulation strategy.

Metaplanet Appoints Eric Trump to Newly Formed Advisory Board

Last week, Metaplanet announced the formation of a strategic advisory board, with Eric Trump as its first member.

Eric Trump, the second son of U.S. President Donald Trump, has been a longtime advocate for cryptocurrencies. Recently, he warned Wall Street to embrace crypto or risk becoming obsolete.

Metaplanet stated that the advisory board will include influential voices, speakers, and thought leaders from the industry. CEO Simon Gerovich praised Trump’s business acumen and strong support for Bitcoin, calling his appointment a major step toward Metaplanet’s goal of becoming one of the world’s top Bitcoin treasury companies.

Eric Trump is also actively involved in his family’s crypto venture, World Liberty Financial, which recently completed its second token sale, bringing its total funding to $550 million.

His personal crypto portfolio includes Bitcoin, Ether, Solana, and Sui.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.