Japan-based financial technology company Metaplanet Inc. has issued bonds worth 2 billion Japanese yen (about $13.6 million) to expand its Bitcoin investments. The company seems determined to continue its Bitcoin accumulation strategy despite the volatility in the crypto market and the sharp decline in the stock .

However, the reaction from investors was not as expected. The stock price fell nearly 20% following the news of the bond issuance. This decline is not unique to Metaplanet; it coincided with the sharp volatility in cryptocurrency markets in general and the decline in the price of Bitcoin.

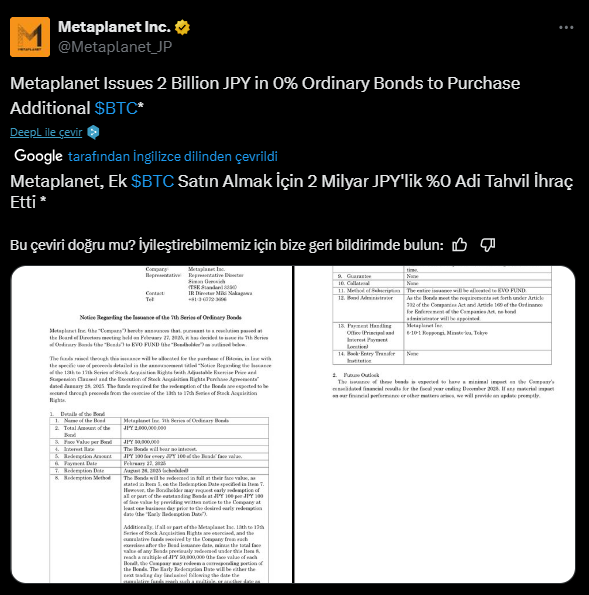

Interest-Free Bond Issuance and Payment Terms

According to the company’s statement, these bonds, issued exclusively for EVO FUND, bear no interest and will be repayable at par on August 26, 2025. Bondholders are also entitled to early redemption under certain conditions.

- Bondholders will be able to redeem their bonds early at par value.

- The early redemption request must be notified to the company at least one business day in advance.

- Metaplanet will be able to redeem some of the bonds before maturity if it raises more than JPY 50 million.

- The bonds issued do not include collateral or guarantee.

Metaplanet plans to repay the bonds with funds provided under the share acquisition program. This method is seen as an important financing tool that will enable the company to continue its Bitcoin accumulation strategy in the long term.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.