MicroStrategy, as the largest institutional owner of Bitcoin (BTC), is slowly progressing towards inclusion in the S&P 500 index. This could be a turning point where Bitcoin could be found in “nearly every portfolio”.

However, the firm focused on Bitcoin must meet stringent acceptance criteria and achieve a solid market value increase.

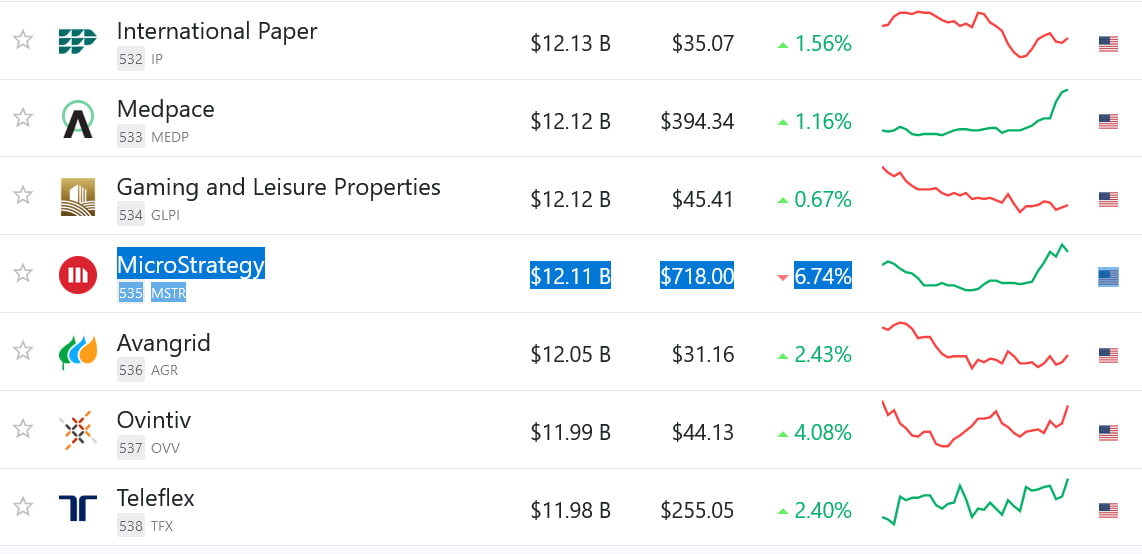

According to the data, on 15th February, following an 8-day trading process, MSTR rose by 46% to rank 535th among the largest public companies in the US.

To join the Standard and Poor’s 500 index, a firm must meet several stringent criteria, such as a minimum market value requirement. In addition, it must have been profitable for the previous four quarters (including the most recent quarter).

At least 250,000 shares must also have been traded in the last six months, and the majority of the shares must be public.

You might be interested: The Latest Situation in Bitcoin and Cryptocurrencies! – Feb 16

Under current rules, candidate firms must meet a market value requirement to be eligible. Since MSTR’s market value is $12.1 billion, all other things being equal, it would need to rise from its current price of $718 to $937.

However, even if the criteria are met, the S&P’s 11-member executive committee must approve the listing of MicroStrategy. In May 2022, the committee temporarily removed Tesla from the S&P 500 ESG index.

The broad index fund rebalances every third Friday of March, June, September, and December.

Bitcoin ‘in nearly every’ portfolio (MicroStrategy)

If MicroStrategy embarks on an S&P 500 listing journey and succeeds, this could trigger a “massive positive feedback loop” of Bitcoin exposure in almost every ETF portfolio. If MicroStrategy is included in the S&P 500, Bitcoin will automatically be present in “nearly every” portfolio. This includes traditional 401ks, retirement funds, and any 60:40 portfolio.

The three largest ETFs under asset management, State Street‘s SPY, BlackRock‘s IVV, and Vanguard‘s VOO, each track over $400 billion in assets according to VettaFi‘s ETF database.

If MicroStrategy enters the S&P 500, the portfolio weight would be approximately 0.01% of the index fund.

Data shows that the S&P 500 currently has a market value of $41.9 trillion, which means that with MSTR’s 0.01% weight, it would allocate $12 billion in passive capital.

Rising market cap and TTM profitability could position $MSTR for S&P 500 eligibility, pending U.S. Index Committee approval.

If MSTR is included, it could spark a massive positive feedback loop enabling #bitcoin to begin automatically infiltrating nearly every portfolio. pic.twitter.com/2e4m6oXGJu

— Joe Burnett (🔑)³ (@IIICapital) February 15, 2024

Passive index inflows drive markets. Inclusion brings automatic buying, which raises the share price, enables further share issuance for BTC purchases, and attracts more passive inflows,” it was stated in a separated X post.

MicroStrategy currently owns 190,000 BTC at an average purchase price of $31,224 – which means the company has made a gain of $3.9 billion on its investment.

This comes after the company’s founder and chairman Michael Saylor announced on February 9 that MicroStrategy was turning into a “Bitcoin development company”.

Saylor found the infinite money glitch:

• Buy #Bitcoin

• MSTR goes up

• Take out more debt

• MSTR goes up

• Sell personal holdings

• MSTR goes up

• Issue more stock

• MSTR goes up

• Join the S&P 500

• MSTR goes upThis is the playbook of the century. 🤯

— The ₿itcoin Therapist (@TheBTCTherapist) February 15, 2024

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.