MicroStrategy has successfully completed a $3 billion convertible senior notes offering to fund further Bitcoin purchases, as announced on Thursday. The company issued zero-coupon notes due in 2029, targeting institutional investors.

According to the announcement, the offering was completed in just three days. Initially seeking to raise $1.75 billion, MicroStrategy upsized the sale to $2.6 billion and added an option for initial purchasers to buy an additional $400 million in aggregate principal amount.

Investors found the notes appealing due to their conversion rate of 1.4872 shares per $1,000 principal, equating to $672 per share, a 55% premium over MicroStrategy’s recent stock price.

MicroStrategy raised approximately $2.97 billion after fees and plans to use the proceeds to buy Bitcoin, continuing its strategy of accumulating cryptocurrency. The company currently holds 331,200 Bitcoins, valued at over $30 billion, purchased at an average price of $49,874 per Bitcoin.

Calling itself the “World’s First and Largest Bitcoin Treasury Company,” MicroStrategy stated its treasury strategy provides investors with varying degrees of economic exposure to Bitcoin through a range of equity and fixed-income instruments.

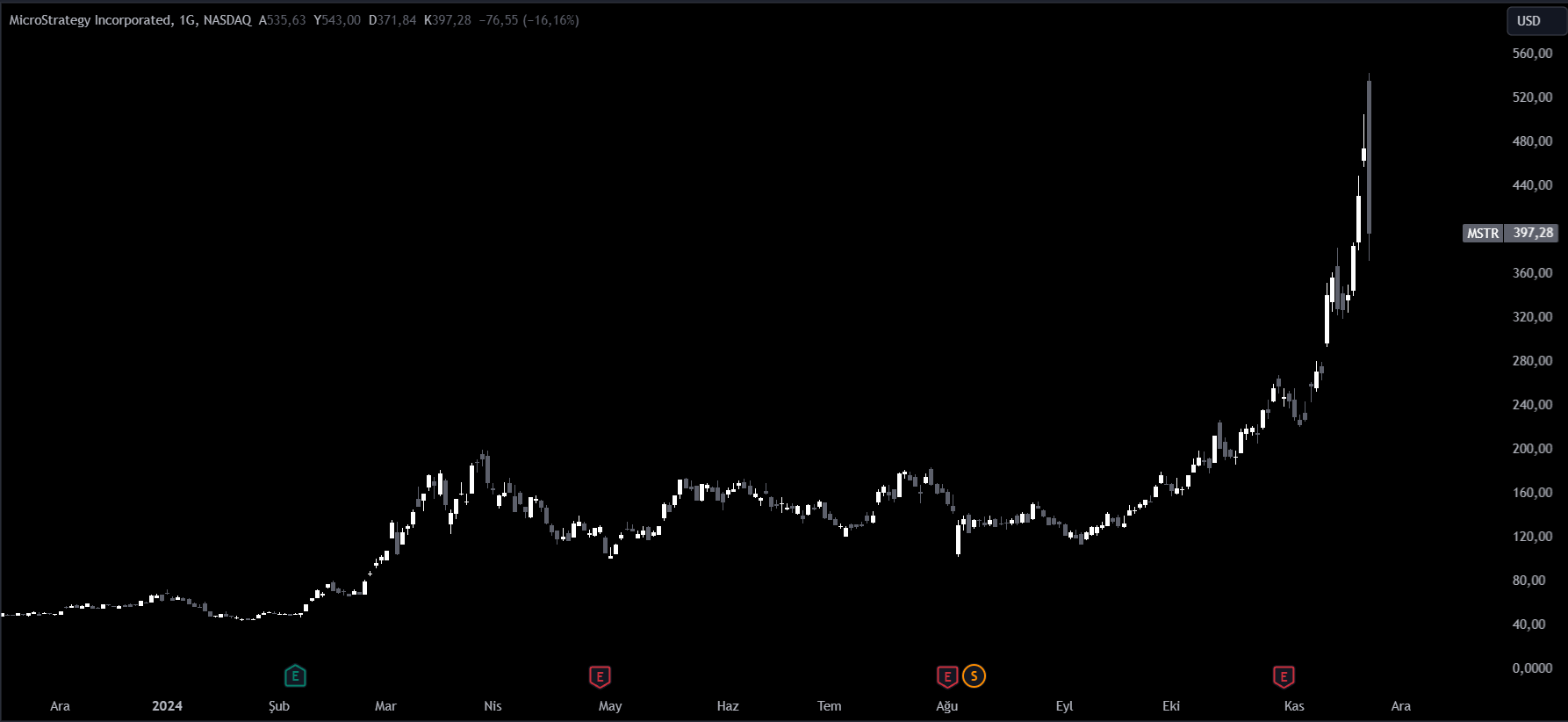

MSTR Stock Fluctuations

MicroStrategy’s stock has surged 500% this year, outpacing Bitcoin’s 110% gain and the S&P 500’s 25% increase. However, Citron Research, a prominent investment firm, criticized the company, claiming its valuation has become “detached from Bitcoin fundamentals.” Following this, MSTR shares dropped 20% on Thursday to close at $397.28.

Bitcoin was trading at approximately $98,800 at the time of reporting.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.