This week, major Bitcoin mining shares experienced a strong trading day with volumes surpassing $200 million, overshadowing some of the world’s tech giants.

Crypto mining firms saw robust trading volumes on Monday on American stock exchanges, with some mining stocks even outpacing well-known U.S. tech giants.

According to data from Yahoo Finance, the combined trading volume between the two largest Bitcoin mining companies, Marathon Digital and Riot Platforms, was $3.55 billion on January 8th.

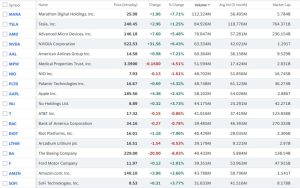

Yahoo reported that Marathon Digital (MARA) secured the position of the most traded stock in the United States that day with a total stock trading volume of 112 million.

This put the Bitcoin miner well ahead of Tesla, AMD, Nvidia, and Apple in terms of daily trading volume. Tesla, the second most traded stock in the U.S. on Monday, had a daily trading volume of approximately 85 million, comparatively lower than Marathon Digital.

Meanwhile, industry expert Eric Balchunas observed that Grayscale’s Bitcoin Trust (GBTC) traded nearly half a billion on January 8th, representing over 99% of the current 3,000 ETFs.

Referencing the expected approval of spot Bitcoin ETFs this week, he reminded that if they all start together, they will bring a (voluminous) weapon to the knife fight.

You may notice: Grayscale Updated Bitcoin ETF Application!

Grayscale hopes to convert its fund into a spot ETF or “list” it once it gets the green light from the Securities and Exchange Commission.

Marathon’s outstanding performance comes amid a broader boom in the Bitcoin mining sector. On January 8th, Core Scientific secured a $55 million equity investment as it emerged from a debt crisis.

Reportedly, the $55 million stock offering expired last week and saw overwhelming demand. Following the completion of bankruptcy proceedings, the company plans to turn to the Nasdaq stock exchange and join the high-flying mining stocks that have performed well this week.

Additionally, CleanSpark announced a strategic deal to acquire 160,000 miners by the end of 2024.