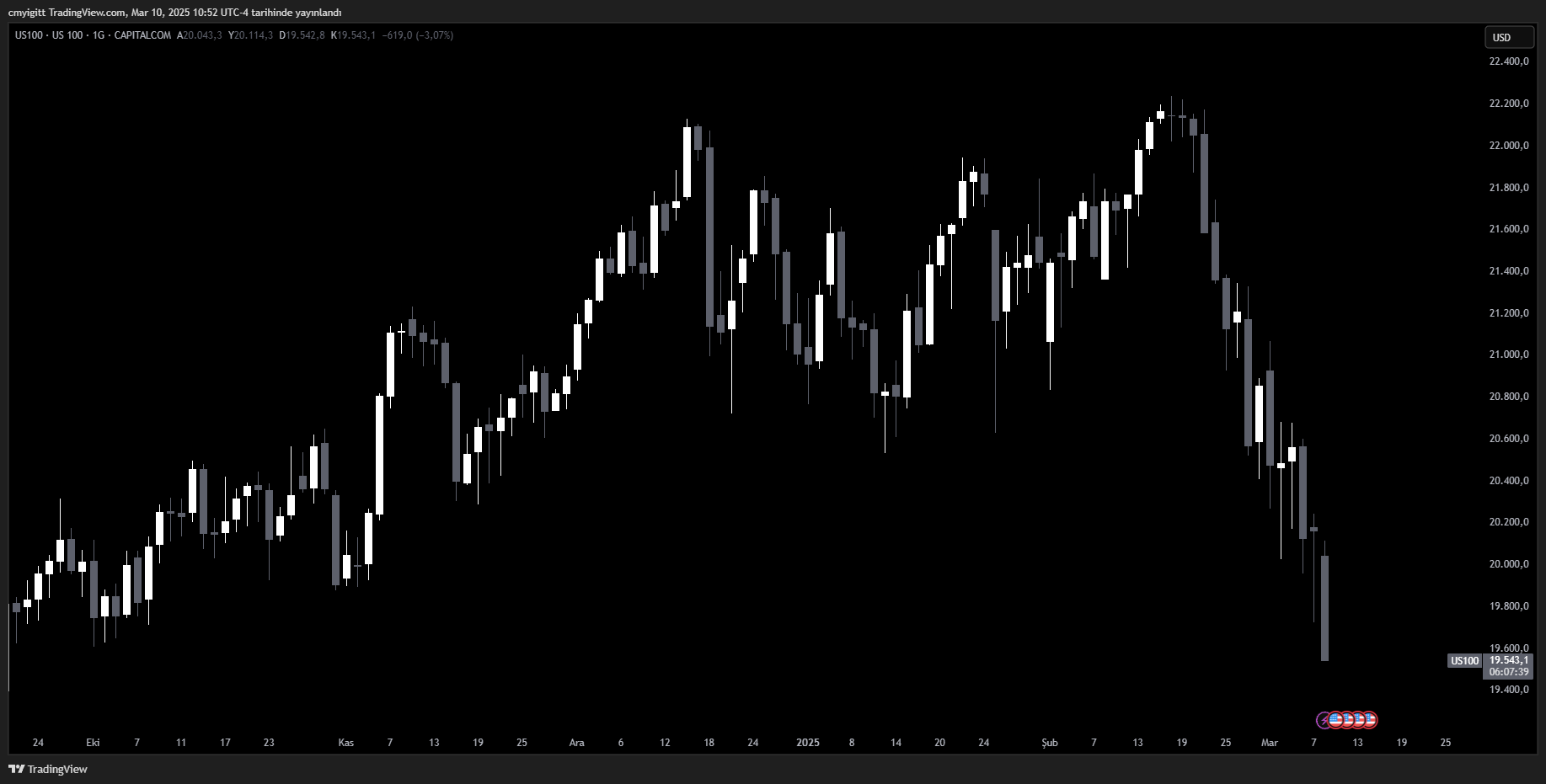

Today, the Nasdaq index saw a sharp decline of 2.88%, dropping to 19,587. Markets are facing a period of uncertainty, with rising inflation concerns and expectations of further interest rate hikes by central banks. These developments have led to significant losses in technology stocks. Today’s drop marks a major pullback after recent gains for the Nasdaq, signaling heightened volatility.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

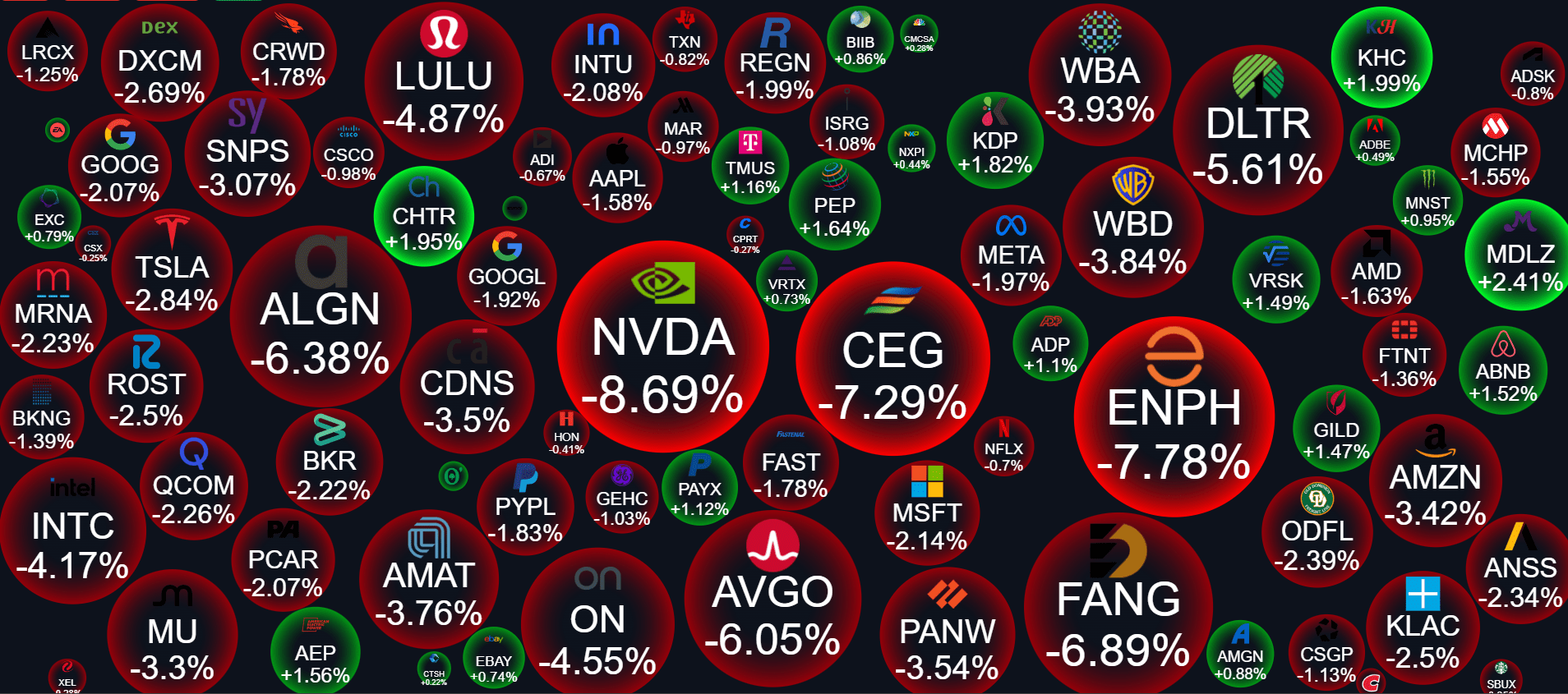

Among the biggest decliners, MicroStrategy ($MSTR) saw a 14% drop, while Tesla ($TSLA) and Palantir ($PLTR) fell 8% and 7%, respectively. Other major technology companies also experienced losses: Alphabet ($GOOGL) dropped 5%, Broadcom ($AVGO) lost 5%, Meta ($META) was down 4%, Nvidia ($NVDA) fell 4%, Amazon ($AMZN) decreased by 3%, and Netflix ($NFLX) was down by 3%. Microsoft ($MSFT) also saw a decline of 2%.

This decline deepens the 3 trillion-dollar market value loss of the “Magnificent 7” technology stocks since their peak. Rising interest rates and inflation concerns are the primary factors behind the technology sector’s struggles. These issues have created uncertainty among investors, with market analysts advising caution.

Additionally, the future challenges that technology companies may face, along with economic conditions, could further exacerbate losses. The impact of rising interest rates on technology stocks could lead to further depreciation. Investors must closely monitor market movements and adjust their strategies accordingly.

After today’s losses, investors will continue to track the Nasdaq and other technology stocks to assess their performance in the coming period. Economic data and central bank announcements will play a crucial role in shaping market trends over the next few days.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.