Hours are left until the cryptocurrency market’s long-awaited start of Ethereum ETF trading. The New York Stock Exchange has approved two Ethereum ETF products. Bloomberg analyst James Seyffart expects Ethereum ETF products to begin trading tomorrow.

NYSE ARCA Approves Bitwise Spot Ethereum ETF Product

According to the official website of the U.S. Securities and Exchange Commission (SEC), the New York Stock Exchange ARCA has approved the listing and registration of beneficial common shares in the Bitwise spot Ethereum ETF under the Exchange Act of 1934. Previously, the SEC approved the listing of Grayscale Ethereum Mini Trust and ProShares Ethereum ETF on the Arca electronic trading platform of the New York Stock Exchange (NYSE).

Some Spot ETFs Expected to Be Traded Tomorrow

Bloomberg analyst James Seyffart noted that some spot Ethereum ETFs are expected to begin trading tomorrow. This means we should see a bunch of documents on the SEC website saying that the ETF prospectus has “gone into effect.” Presumably these documents will be published after or around the market close.

Which ETF Product Provides Better Service?

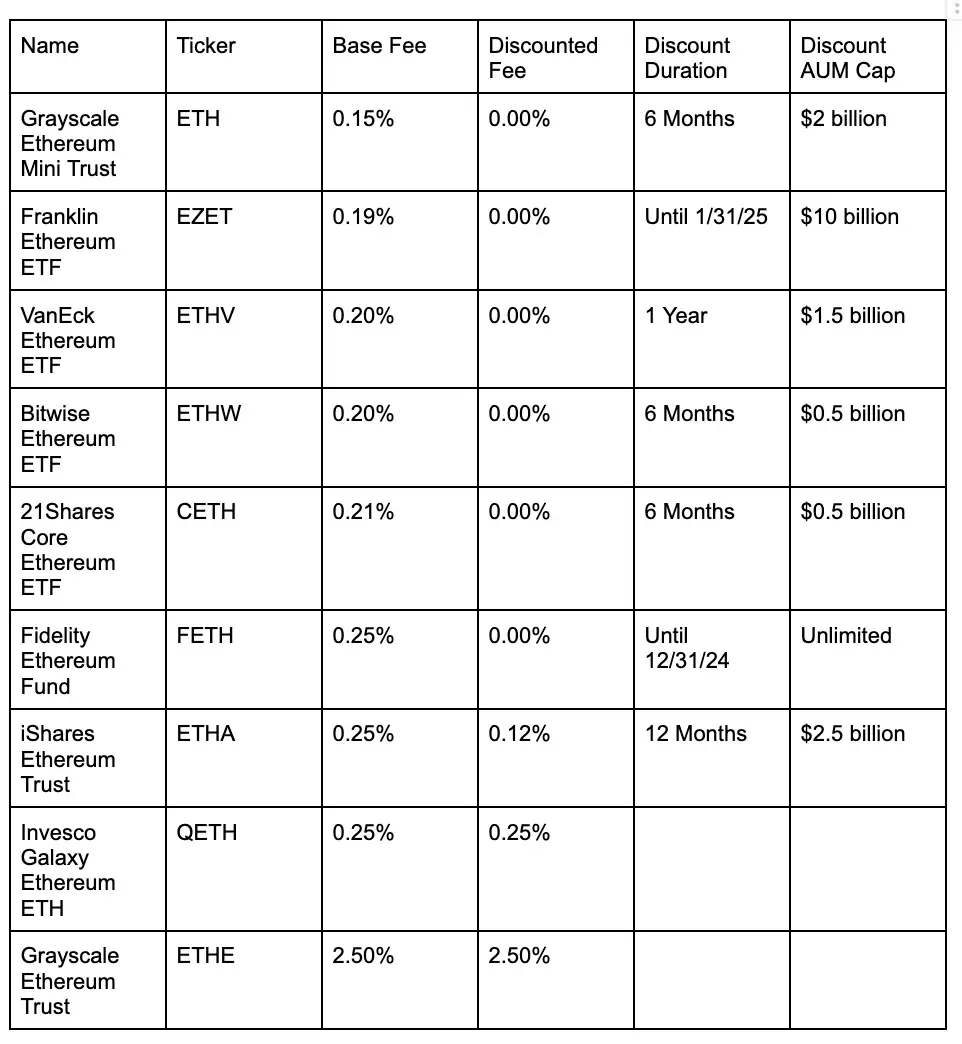

Following approvals, 9 spot Ethereum ETFs will begin trading. In terms of basic mechanics, the funds are almost identical. Each ETF is backed by a reputable fund manager, holds spot ETH in a qualified custodian, and relies on a core group of professional market makers to create and redeem shares. They also all benefit from the same standard investor protections, including insurance against underwriting errors and cybersecurity risks. The deciding factor for most investors is fees. Management fees for eight of the nine ETFs range from 0.15% to 0.25%. The only major exception is Grayscale Ethereum Trust (ETHE), which began trading under a different fund structure in 2017 and still charges a 2.5% management fee.

Most Ethereum ETFs are temporarily waiving or discounting fees in an attempt to attract investors. Grayscale Ethereum Trust is among the major outliers, along with the Invesco Galaxy Ethereum ETF (QETH). Ironically, the clear frontrunner in the fee race is a Grayscale product. A newer fund created specifically to list as an ETF, Grayscale Ethereum Mini Trust (ETH), has a management fee of just 0.15%. Another attractive option is Franklin Templeton’s Franklin Ethereum ETF (EZET). Management fees are the second lowest in the group at 0.19% and are not fully charged until January 2025 or until the fund reaches 10 billion AUM.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.