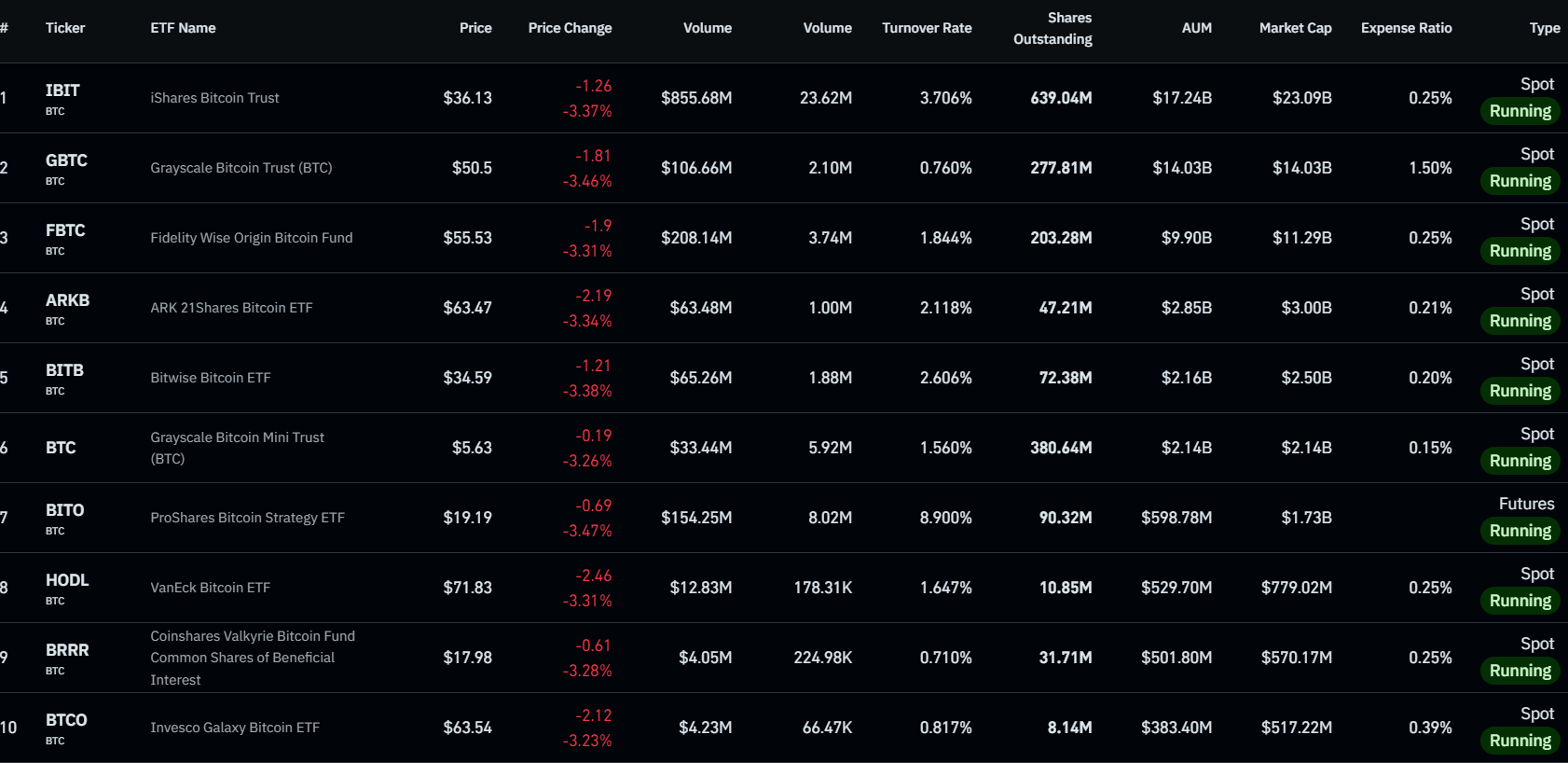

On October 1, 2024, Bitcoin and Ethereum ETFs saw notable but divergent trends in inflows and outflows. Bitcoin ETFs recorded impressive gains, bringing in over $1.1 billion for the week. The biggest contributors were BlackRock’s iShares Bitcoin Trust and the ARK 21Shares Bitcoin ETF, with inflows of $499 million and $289.5 million, respectively. These ETFs saw heightened activity, likely influenced by broader market trends and rising interest in Bitcoin as the U.S. Federal Reserve’s recent decisions fueled optimism.

On the other hand, Ethereum ETFs, while showing a significant uptick, saw comparatively lower inflows. With $84.6 million in new investments, Ethereum ETFs hit their highest inflow since early August, yet they continued to trail behind Bitcoin. Despite short-term price drops in Ethereum, the ETF maintained positive momentum, with signs of bullish sentiment remaining due to its positioning above key technical indicators.

Might interest you: Mark Cuban Wants to Replace Gary Gensler!

This disparity between Bitcoin and Ethereum can be attributed to Bitcoin’s first-mover advantage and its dominant market share. While Ethereum is experiencing growth, Bitcoin’s entrenched position continues to draw the majority of institutional investment interest.

These trends reflect the ongoing market dynamics, where Bitcoin’s ETFs lead the pack, but Ethereum is starting to gain traction as a secondary option for crypto-focused investors.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.