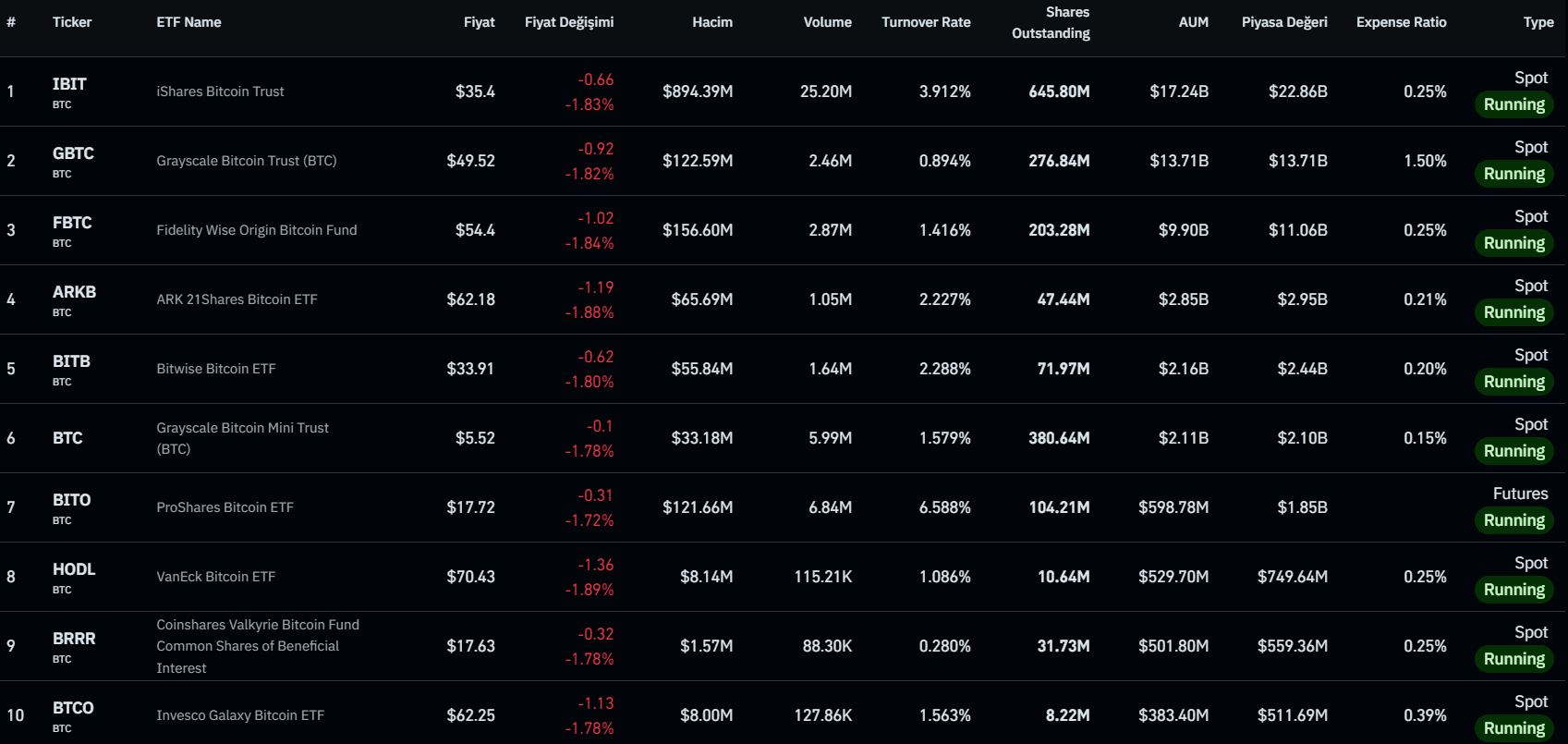

On October 9, 2024, Bitcoin ETFs showed strong inflows, signaling renewed investor interest after a slow start to the month. Over the past few days, inflows totaled $235 million, with Fidelity’s FBTC leading the charge at $103.7 million, followed closely by BlackRock’s IBIT, which brought in $97.9 million. Other ETFs like Bitwise’s BITB and Ark’s ARKB also saw positive movement, while some smaller funds like VanEck’s HODL and Invesco’s BTCO experienced modest gains.

This marks a significant shift after a brief period of net outflows seen earlier in the month. Bitcoin’s price, however, continues to show bearish momentum, trading around $62,497, down from a recent peak of $66,000. This price dip aligns with wider market volatility but has not dampened institutional interest in Bitcoin ETFs.

Might interest you: What is BabyDoge?

In contrast, Ethereum ETFs have seen a pause, with no inflows or outflows recorded on the same day, reflecting more cautious sentiment towards Ethereum-related products. This divergence between Bitcoin and Ethereum ETFs highlights differing market conditions for the two leading cryptocurrencies.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.