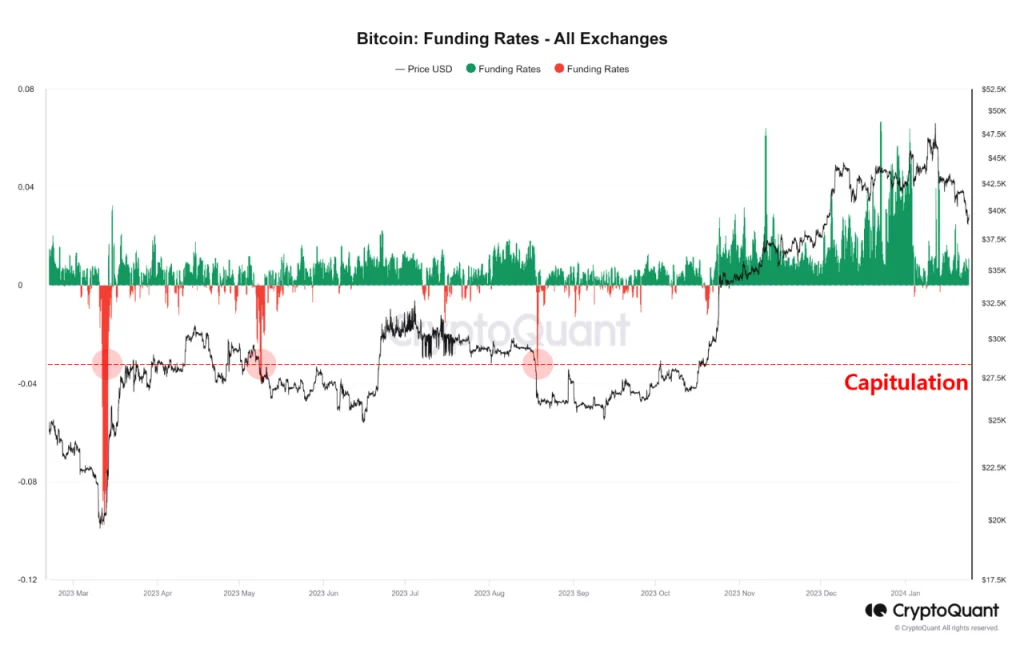

Onchain Analysis: Market Wants Capitulation! What Does This Mean? Bitcoin (BTC) Funding Rate Falls, Market Waits for It to Give Up! On January 2, the BTC funding rate rose to 0.049%, indicating that long-term futures contracts were overheated. However, a subsequent decline brought the funding rate down to 0.01%, signaling a cooling period.

You might like: Bitcoin Miners Continue to Sell

This recent positivity in the funding rate shows that futures traders continue to remain optimistic about the market, maintaining their bullish bets. In order to reverse the BTC downtrend, we need to wait for a sign of surrender from market participants.

The end of a downtrend requires the liquidation of many leveraged long positions and the absence of any more volume to sell.

A sharp price drop, accompanied by signs of extreme pessimism among leveraged traders, could present a good opportunity to buy back BTC.

This decrease in BTC’s funding rate could indicate that the market is about to gain some stability. However, this means that investors need to watch their movements more carefully.

These changes in the market could have a significant impact on the future price trends of BTC. Therefore, investors should closely follow these developments and adjust their investment strategies accordingly.

Onchain Analysis: What Does This Mean for the Future of BTC?

The recent decline in the BTC funding rate suggests that the market may be nearing a point of capitulation. This would be a sign that bears are gaining the upper hand and that the downtrend is likely to continue.

However, it is important to note that this is just one indicator of market sentiment. Other factors, such as on-chain activity and technical analysis, should also be considered before making any investment decisions.

If BTC does enter a capitulation phase, it could provide a good opportunity for investors to buy the dip. However, it is important to be prepared for a further decline in prices before the trend reverses.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.