Early Pike Finance investors worried about Monday’s token-generating event since the organization only supplied $10,000 in initial liquidity on the Aerodrome distributed market on Base.

Based on DEXScreener statistics, the token’s price rapidly decreased to roughly $0.0035—a reduction of almost 90%. Launch had low liquidity.

In its March 2024 token presale, Pike Finance raised just under $6.5 million. Participants paid between $0.0280 and $0.0374 for tokens. Given the initiative had generated so much money, several investors were dissatisfied at how the coin could launch with such a limited initial liquidity allocation.

Early investors complained about the project among the price decline, and some even asked blockchain sleuth ZachXBT to look into things.

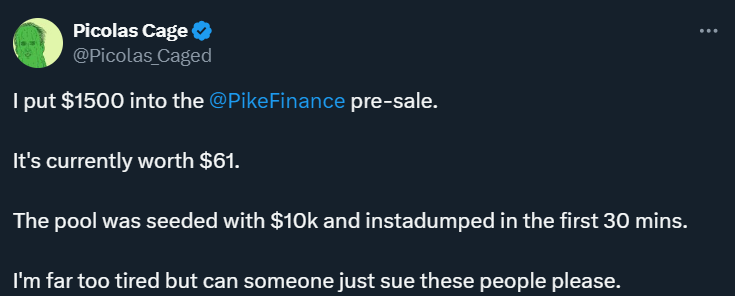

“I paid $1500 into the @PikeFinance pre-sale. Right now, it is worth 61″. One user on X going by Picolas Cage wrote: “The pool was seeded with $10k and instadumped in the first 30 minutes.”

Following the token-generating event, Pike Finance wrote a message on X outlining that the incident had happened and that the token had been used on the Base network. The Pike crew also said they “are implementing a new playbook for the Pike token launch.”

Another post on X had a screenshot of Terryljm, one of the founders of Pike Finance, trying to cool off buyers in a Discord channel for presale attendees.

Terryljm wrote in it that the team intends to buy Pike tokens from the open market and “use the remaining circulating collateral from the restitution supply” to increase liquidity. Terryljm remarked it will be a “progressive effort” done over several months.

The team behind Pike Finance, Nuts Finance, created a number of additional cryptocurrency initiatives like Taiga Protocol, Tapio Finance, and ACoconut. Launched in 2021, ACoconut witnessed a comparable sharp drop; the project’s website is already unavailable and the price never recovers.

The newest challenge Pike Finance has encountered since its founding is the token launch. Two hacks aiming at flaws in its smart contracts followed its presale. Security company Halborn estimates that the attackers stole around $1.6 million in one event and $300,000 in another, therefore causing a total loss of roughly $1.9 million.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.