US spot Bitcoin ETFs saw a positive net inflow after four trading days of outflows exceeding $1.5 billion.

Bitcoin exchange-traded funds (ETFs) in the United States recorded net inflows the day after Christmas, halting the outflows of over $1.5 billion that occurred between December 19 and December 24.

According to CoinGlass data, on December 26, a total of 11 ETFs saw net inflows of $475.2 million. Of these, $254.4 million flowed into the Fidelity Wise Origin Bitcoin Fund.

The ARK 21Shares Bitcoin ETF followed with $186.9 million in inflows, while BlackRock’s iShares Bitcoin Trust ETF (IBIT) took in $56.5 million.

Grayscale’s mini Bitcoin ETF and VanEck ETF saw more modest inflows of $7.2 million and $2.7 million, respectively.

Since US markets were closed on December 25 for Christmas, these inflows came after four consecutive trading days of total net outflows amounting to $1.52 billion from the ETFs between December 19 and December 24.

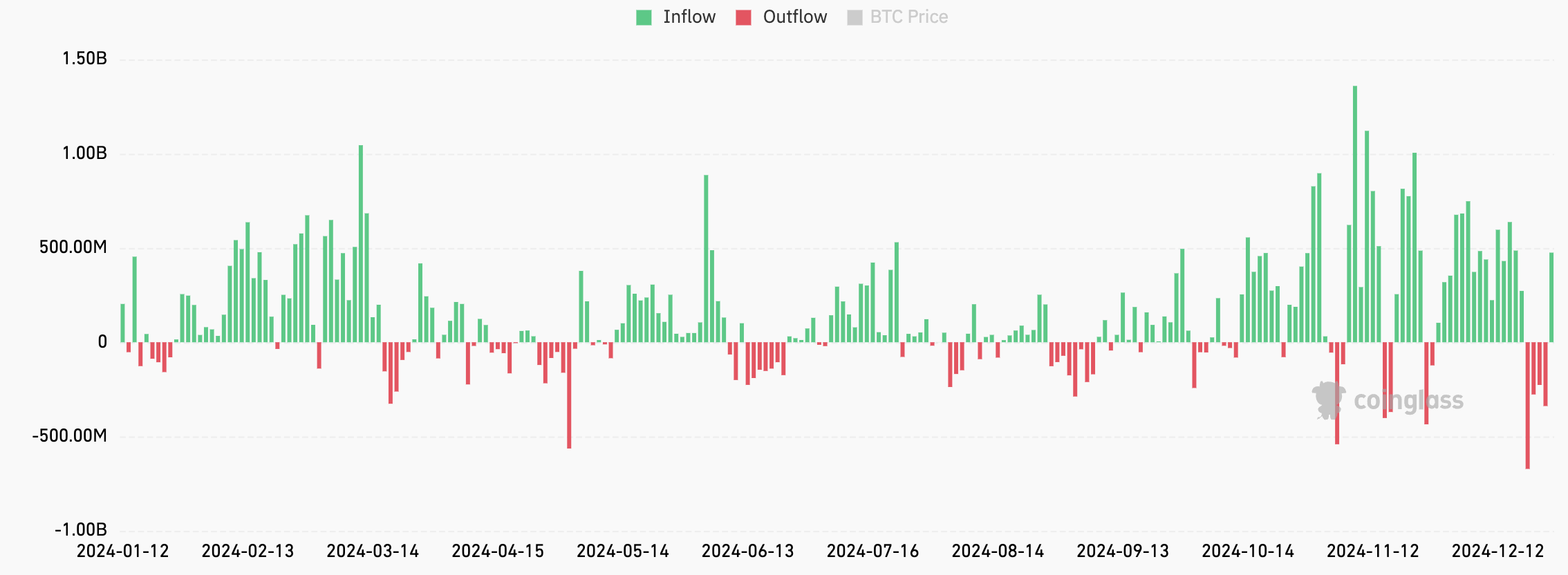

All Bitcoin ETF Inflows Since January

IBIT experienced its largest-ever single-day net outflow of $188.7 million on December 24, more than doubling its previous record of $72.7 million set on December 20. This came as Bitcoin dropped 2.2% in the last 24 hours, falling from around $98,000 to just above $96,000. According to CoinGlass data, Ether ETFs saw their third consecutive trading day of net inflows, totaling $301.6 million over that period.

On December 26, ETH funds saw a total of $117.2 million in net inflows, led once again by Fidelity’s ETF, which saw $83 million in net inflows.

BlackRock’s iShares Ethereum Trust ETF followed with $28.2 million, while Grayscale’s ETH Trust took in $6 million.

ETH dropped 1.7% in the last 24 hours, falling below $3,400. Unlike Bitcoin, which reached new all-time highs over the past two months, ETH has lagged behind.

Unlike the 24-hour, always-on assets tracked by crypto ETFs, these funds have only three trading days left in the year — December 27, 30, and 31.

In its first year, Bitcoin ETFs have seen total net inflows of $35.9 billion, with total assets under management (AUM) reaching $111.9 billion.

Ether ETFs, meanwhile, have taken in $2.63 billion in net inflows for the year, with an AUM of around $12 billion.

You can share your opinions in the comments about the topic. Also, follow us on Telegram, Twitter, and YouTube for more content like this.