Pump.fun, a prominent memecoin platform on Solana, has launched its own decentralized exchange (DEX) called PumpSwap, ending its reliance on Raydium for memecoin trading.

Starting March 20, memecoins that successfully bootstrap liquidity or “bond” on Pump.fun will migrate directly to PumpSwap, according to a post by Pump.fun on X. Previously, bonded tokens moved to Raydium, which became Solana’s leading DEX largely due to memecoin trading volumes.

PumpSwap is designed to operate similarly to Raydium V4 and Uniswap V2, offering “the most frictionless environment for trading coins,” Pump.fun stated. The company highlighted that previous migrations to Raydium created unnecessary friction and slowed momentum, whereas now, migrations are instant and free.

Competition Heats Up

The launch comes just days after Raydium announced LaunchLab, its memecoin launchpad designed to compete directly with Pump.fun. The shift from partners to rivals between the two platforms is set to reshape Solana’s DeFi landscape, especially as memecoin trading volumes have declined sharply from their January peaks.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

“We welcome competition because users win at the end of the day,” said Alon, co-founder of Pump.fun, in a statement to Cointelegraph on March 20.

PumpSwap also plans to adopt GoFundMeme’s popular revenue-sharing feature, where a percentage of protocol revenue will be shared with coin creators. This initiative aims to align creators with their communities and encourage higher quality memecoin launches.

Declining Memecoin Activity

Despite these innovations, memecoin activity has dropped significantly. On February 27, Cointelegraph reported that successful memecoin launches on Pump.fun had fallen by 80% from their January highs, following a series of scandals that dampened retail interest.

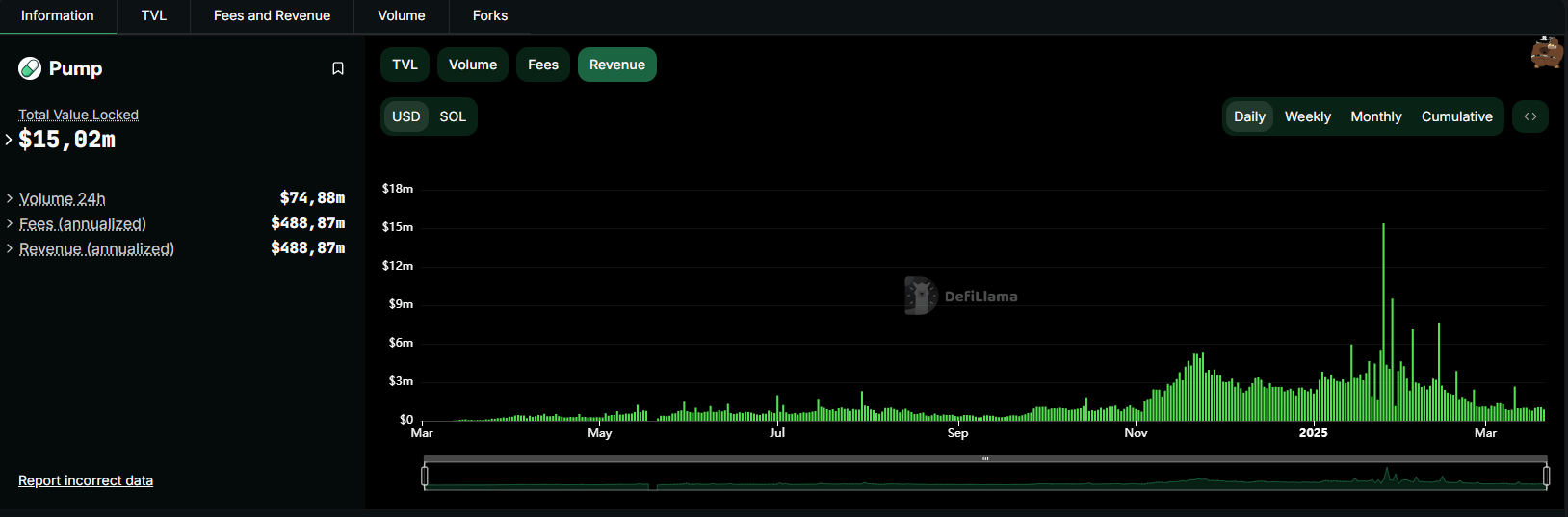

Pump.fun’s daily fee revenues have decreased from over $4 million in January to about $1 million by mid-March, according to data from DeFiLlama.

Memecoins drove explosive growth for Solana in 2024, increasing its total value locked (TVL) from $1.4 billion to over $9 billion. Raydium was among the biggest winners, with daily volumes rising from $245 million to over $2 billion during the same period.

In January, Raydium launched a leveraged perpetual futures trading platform, entering direct competition with Jupiter, another major player in Solana’s DeFi space.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.