As PumpFun looks to take the lead in the Solana ecosystem, Raydium’s token RAY, one of the leading decentralized exchanges (DEX), has plummeted over 25% in the last 24 hours. The sharp sell-off is being blamed on rumors that memecoin-focused launchpad platform PumpFun is testing its own automated market maker (AMM) system. If these claims are true, Raydium’s dominance in the memecoin market could be in jeopardy.

Is PumpFun’s New Move a Threat to Raydium?

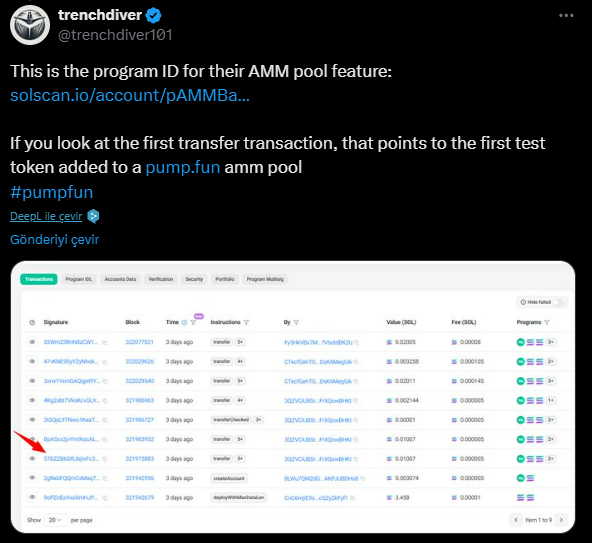

This rumor, which has made a big noise in the crypto market in recent days, was brought to the agenda by X (formerly Twitter) user “trenchdiver”. According to the information shared, the PumpFun team is testing its own AMM liquidity pools and the beta version of this system has already been opened to some users.

If PumpFun does indeed launch its own AMM system, memecoins created on the platform will no longer be moved directly to Raydium. Instead, they will remain within the PumpFun ecosystem, bringing transaction fees directly to the platform and offering a new liquidity model.

Trenchdiver commented on this situation as follows:

“It looks like PumpFun will be promoting its own AMM by preventing tokens from going to Raydium. This way, they can earn more transaction fees and offer additional rewards to their users.”

Has PumpFun Really Started AMM Tests?

Strengthening the allegations was the appearance of a beta AMM interface on PumpFun’s website. In addition, in an on-chain transaction on February 20, PumpFun allegedly added its first test token to its liquidity pool.

The so-called test token, “Snowfall (CRACK)”, reached a market capitalization of $5.4 million within an hour of the announcement . However, after a rapid rise, it fell sharply by 40% and its market capitalization dropped to $1.8 million.

So far, the PumpFun team has neither confirmed nor denied these allegations, but on-chain data and test repositories offer serious clues that the platform is developing its own AMM system.

Why Raydium (RAY) Crashed?

After these rumors spread, Raydium’s token, RAY, lost over 25% of its value and fell as low as $3.19. Some analysts sharing on the X platform interpreted this situation as “RAY is falling off a cliff”.

Gabriel Tramble, founder of Shoal Research, said Raydium charges a 0.25% commission on its AMM system, but PumpFun could double its revenue by setting higher transaction fees.

“High transaction fees don’t particularly deter memecoin investors. PumpFun could be a great source of revenue if it replaces Raydium.”

According to DefiLlama data, the PumpFun platform has generated over $500 million in transaction fees since January 2024 alone, suggesting that the platform could be a major financial powerhouse if it creates its own liquidity pools.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.