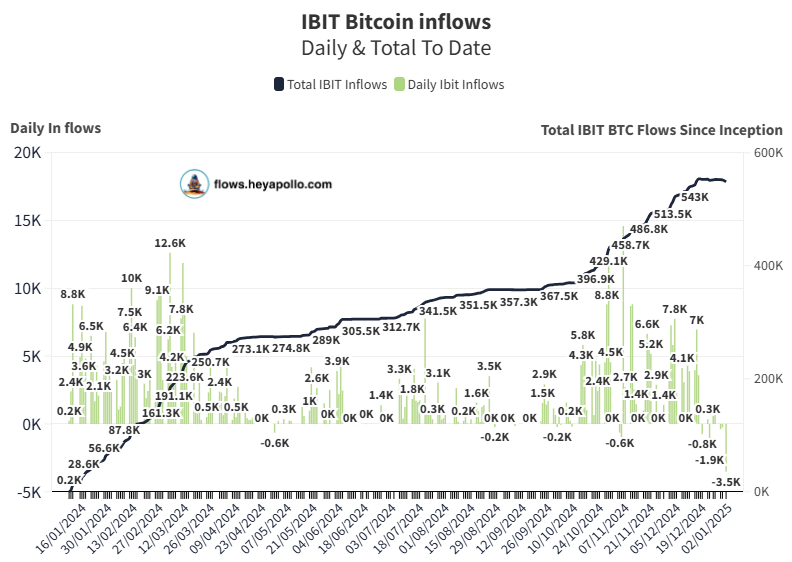

- Bitcoin investors pulled a record total of $333 million from BlackRock’s IBIT ETF over three consecutive trading days.

BlackRock’s iShares Bitcoin Trust (IBIT) saw its largest daily outflow since launching a year ago. After the New Year holiday, trading resumed in the U.S., and on January 2, IBIT experienced a record outflow of $332.6 million, according to data from Farside Investors.

This outflow marks the highest amount since the product’s launch in January 2024, surpassing the previous record of $188.7 million set on December 24. Additionally, it highlights a new record of three consecutive trading days of outflows for this BTC investment product. Over the past week, IBIT has seen a total outflow of $392.6 million.

BlackRock ETF Outflows Accelerate

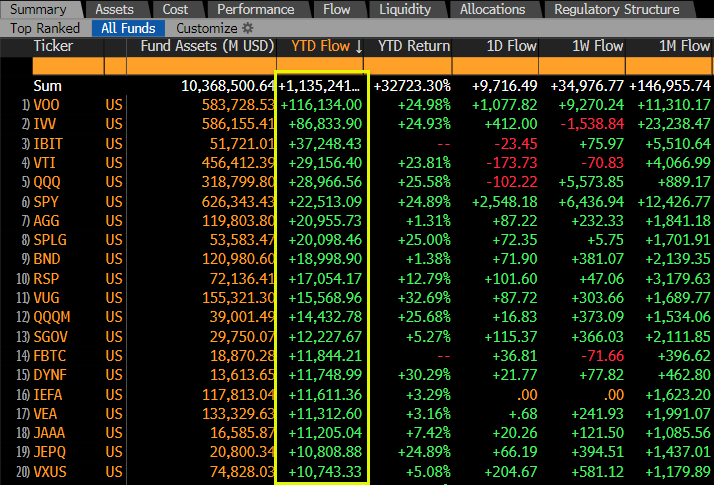

The latest outflows can be seen as a minor fluctuation in the broader picture. According to Bloomberg data shared by senior ETF analyst Eric Balchunas, BlackRock’s fund ranked third among all exchange-traded funds in the United States in 2024, with inflows totaling $37.2 billion.

The leading ETF for the year was Vanguard 500 Index Fund, with inflows of $116 billion, while iShares Core S&P 500 ETF came in second with $89 billion in inflows.

Bitcoin pioneer Adam Back commented, “Maybe in 2025, Bitcoin ETFs will take the top spot with more inflows and higher prices.”

Top ETFs in the U.S. by Inflows in 2024

On January 2, despite the outflow trend from BlackRock’s spot Bitcoin ETF, Bitwise, Fidelity, and Ark 21Shares saw inflows of $48.3 million, $36.2 million, and $16.5 million, respectively. Grayscale’s Bitcoin Mini Trust also saw a small inflow of $6.9 million, while its larger GBTC fund experienced an outflow of $23.1 million.

The total net outflow for the day came to $242 million, as BlackRock’s outflows offset the inflows of its competitors.

On the same day, ETF Store President Nate Geraci shared some predictions for crypto ETFs in 2025.

These include the merging of spot Bitcoin and Ether ETFs, the trading of spot ETH ETF options, in-kind creation and redemption options for spot BTC and ETH ETFs, staking for spot Ether funds, and the approval of a spot Solana ETF.

Geraci commented, “Actually, all of these will happen.”

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.