Ripple President Monica Long expressed that XRP is highly likely to receive spot ETF approval “very soon.”

Ripple President Monica Long also anticipates that Ripple USD (RLUSD) stablecoin will be listed “imminently” on major cryptocurrency exchanges.

In a January 7 interview with Bloomberg, Long confirmed that Ripple is actively working on additional exchange listings for RLUSD.

“We are continuing to expand the distribution and availability of Ripple dollars on other exchanges. So, I think you can expect to see more access and new announcements coming soon… very soon,” she said. However, she declined to provide specifics regarding RLUSD listings on major platforms like Coinbase.

According to Ripple’s website, RLUSD is currently available on Bitso, MoonPay, CoinMina, Bullish, Mercado Bitcoin, B2C2, Keyrock, Archax, Independent Reserve, and JST Digital.

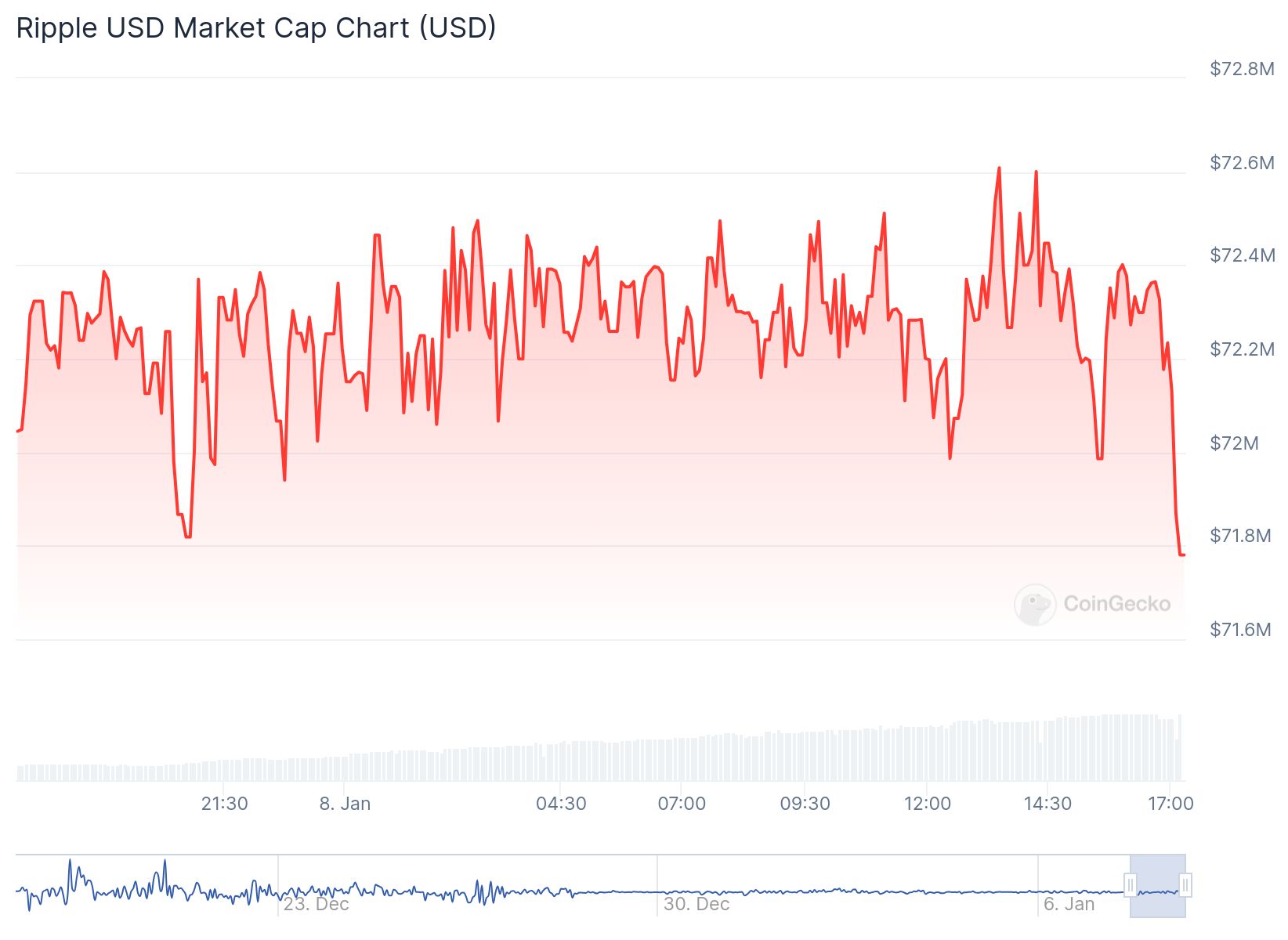

Ripple launched RLUSD on December 17 as a stablecoin pegged 1:1 to the US dollar. At the time of publication, the stablecoin’s market cap was $71.8 million, according to CoinGecko data.

Ripple Market Cap

More than 76% of RLUSD trading volume is concentrated on the Bullish crypto exchange, split between two main trading pairs, RLUSD/USD Coin and XRP/RLUSD.

Meanwhile, the decentralized exchange Sologenic handles a smaller portion of the market. The XRP/RLUSD pair on Sologenic recorded $3.4 million in 24-hour trading volume, representing 3.56% of the total volume.

Ripple President: “Our business has doubled.”

The demand for RLUSD primarily comes from Ripple’s payment services, and President Monica Long stated that this segment of the business has doubled in the past year.

“Our business in the payments sector doubled last year, and therefore we see a very strong growth potential for our payment solution. Along with that, Ripple US Dollar will play an important role,” she said.

Long anticipates strong growth for stablecoins.

“We think this year will be a big year for crypto overall, and so demand for stablecoins will increase along with that. Stablecoins are really the main way to on-ramp and off-ramp,” she added.

According to DefiLlama data, the stablecoin market has grown by 55% since last year, reaching $206.2 billion. USDt remains the largest stablecoin, holding 66% of the market share.

“XRP ETF Coming Soon!”

Long indicated that XRP could be next in line for its own exchange-traded fund (ETF):

“I think we will see one very soon […] XRP is likely to be the next asset after Bitcoin and ETH.”

Several companies, including WisdomTree, have already taken steps to launch an XRP ETF. WisdomTree filed for approval with the US Securities and Exchange Commission (SEC) on December 2, 2024. Bitwise, Canary Capital, and 21Shares have also filed for similar products.

Long expressed that with the change in the US administration, the approval process for ETF filings will “accelerate.”

Ripple Chainlink Partnership

To enhance the utility of RLUSD, Ripple partnered with Chainlink on January 7 to integrate price feeds for RLUSD on Ethereum and the XRP Ledger.

This collaboration aims to provide tamper-proof, accurate price data, support DeFi applications, and reduce risks such as price manipulation or downtime.

In the comment section, you can freely share your comments about the topic. Additionally, don’t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.