The growing M2 global money supply could increase Bitcoin prices, but analysts warn caution is needed.

The growing M2 (total of savings and short-term time deposits) global money supply could trigger a major Bitcoin rally, but an analyst warns against betting everything on the emerging signal.

Pav Hundal, the lead analyst at Australian crypto exchange Swyftx, said: “This is not a market to bet your whole stash on a quick correction, but our central scenario still predicts a strong March and beyond.”

Not All is Doom and Gloom

“In normal times, global loosening measures are a pretty reliable lead indicator for crypto,” Hundal said. “The data we have suggests that spot buyers are active right now, and the US has raised its debt ceiling by $4 trillion.”

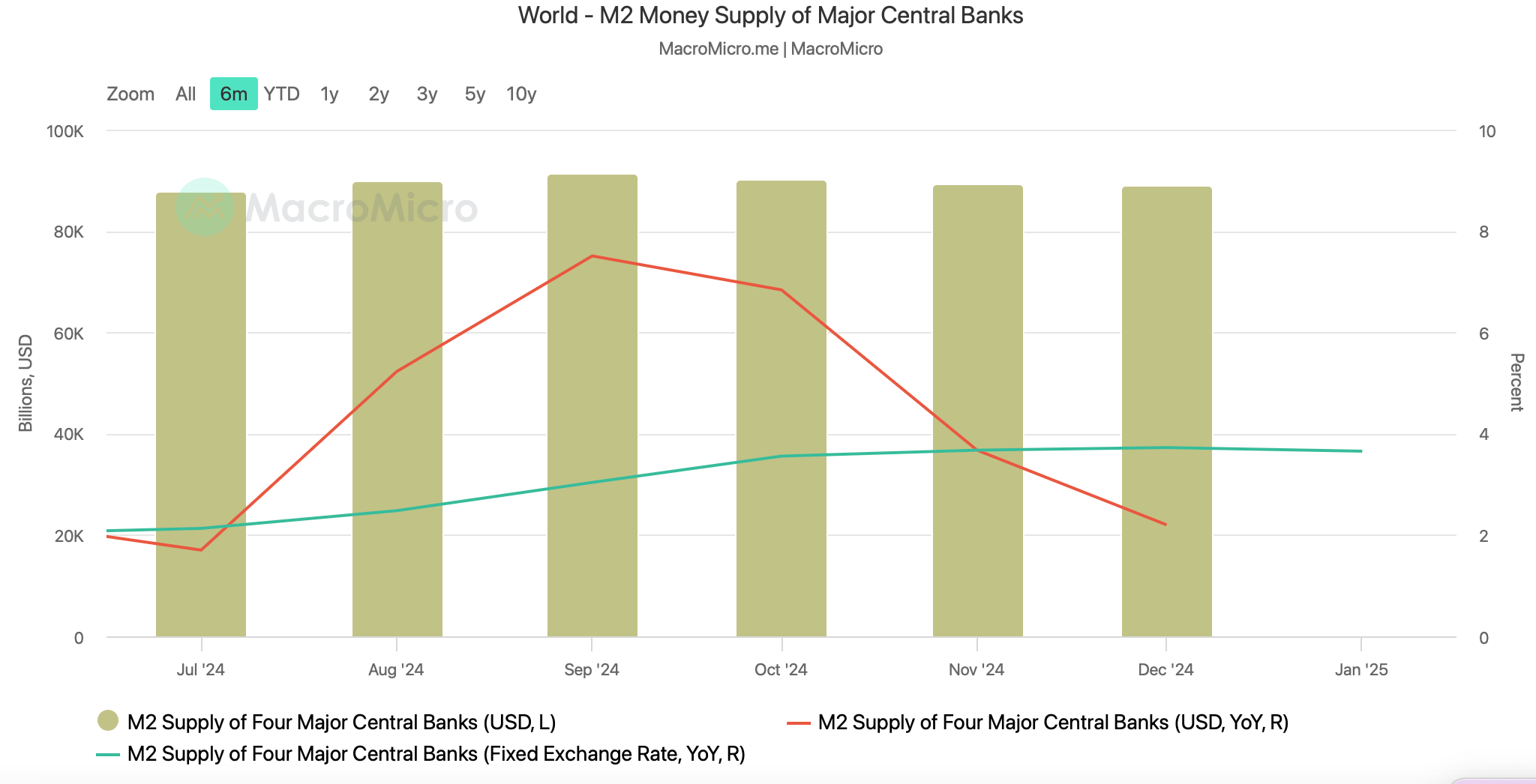

“Not all is doom and gloom,” he added. According to MacroMicro data, the year-on-year fixed exchange rate for M2 money supply of the four major central banks reached 3.65% in January.

Increase in Global M2 Money Supply Could Trigger Bitcoin’s Parabolic Rise

Many crypto analysts point to historical trends where an increase in the global M2 money supply, due to increased liquidity and lower interest rates, has led to higher Bitcoin prices.

Economist Lyn Alden wrote in a research report published in September that Bitcoin moves in the same direction as global M2 83% of the time.

US Money Supply Surge May “Fuel Bitcoin’s Parabolic Run-up”

Crypto analyst bitcoindata21 said in a February 25 X post, “With weakness in the dollar causing a net positive effect on Global M2, it’s just a matter of time hopefully before Bitcoin realizes this.”

Echoing a similar sentiment, crypto analyst Colin Talks Crypto said in an X post, “The Global M2 Money Supply predicts a BIG move is coming for Bitcoin.” Investment research account Bravo Research noted in a February 25 X post that the US money supply had doubled in just 10 years, and “this liquidity surge could fuel Bitcoin’s parabolic run-up.”

These developments come after Bitcoin fell below $90,000 on February 25, following Trump’s statement the day before that his planned 25% tariffs on Canada and Mexico “are going forward on time, as scheduled.” He had previously agreed to pause the tariffs for 30 days earlier this month.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.