The US Securities and Exchange Commission (SEC) claims that Eeon has a history of representing themselves in court cases before, but their claims have consistently been unsuccessful in federal courts.

The United States Securities and Exchange Commission (SEC) and cryptocurrency exchange Binance have issued their official response in relation to the involvement of “Eeon,” a party that sought to intervene on behalf of customers in the ongoing case. Both the SEC and Binance have expressed their opposition to Eeon’s request to intervene, stating that it fails to meet the required legal criteria for intervention and consent.

According to the Court for the District of Columbia, both Binance, the defendant, and the U.S. Securities and Exchange Commission (SEC), the plaintiff, opposed Eeon’s bid to intervene in the legal dispute.

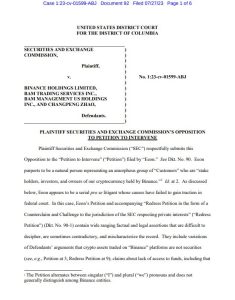

The SEC argues that Eeon has a track record of frequently acting as their own representatives in legal proceedings, but their assertions have consistently failed in federal courts. The SEC has advised the court to dismiss Eeon’s application for various reasons.

Screenshot of SEC’s response to the intervention petition. Source: Court Listener.

Initially, the Exchange Act forbade private parties from intervening, rendering Eeon’s appeal impermissible. The SEC claims Eeon’s involvement won’t impact the case as their allegations match those of the defendants. Lastly, Eeon’s petition does not fulfill the essential prerequisites for intervention. Moreover, Eeon’s counterclaims, seeking remedies against both the SEC and Binance, display inherent contradictions.

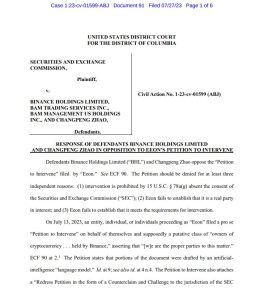

Binance presented three reasons for rejecting Eeon’s plea. Firstly, the absence of the SEC’s approval; secondly, Eeon’s inability to establish its legitimacy as an involved party; and thirdly, the failure to meet the essential legal prerequisites for intervention. Moreover, Eeon’s counter-allegation was deemed imprecise and unrelated to the ongoing lawsuit.

Screenshot of the Binance’s reply to the intervention request. Reference: Court Listener.

Consequently, the plaintiff (SEC) and defendants (Binance and CEO Changpeng “CZ” Zhao) stand united against Eeon’s intervention in the SEC’s lawsuit.

You might like: What Are Cryptocurrency ETFs?

Meanwhile, Binance has filed a motion to dismiss the lawsuit the US CFTC initiated. They claim the CFTC lacks jurisdiction over the global crypto exchange and its CEO, CZ. Extended court deadlines for responses from both parties may prolong the dismissal process into next year.

Feel free to share your thoughts in the comments section. Stay updated on instant news by following us on Twitter, Telegram, and YouTube.