The cryptocurrency market was once again shaken following a series of decisions by the US Securities and Exchange Commission (SEC) on March 11, 2025. The regulatory body has postponed its rulings on a number of altcoin-based exchange-traded fund (ETF) applications. However, according to experts, these delays do not reduce the likelihood of approval within 2025. Bloomberg ETF analyst James Seyffart stated that the delays were “expected” and that approval prospects remain strong.

Details of the Postponements

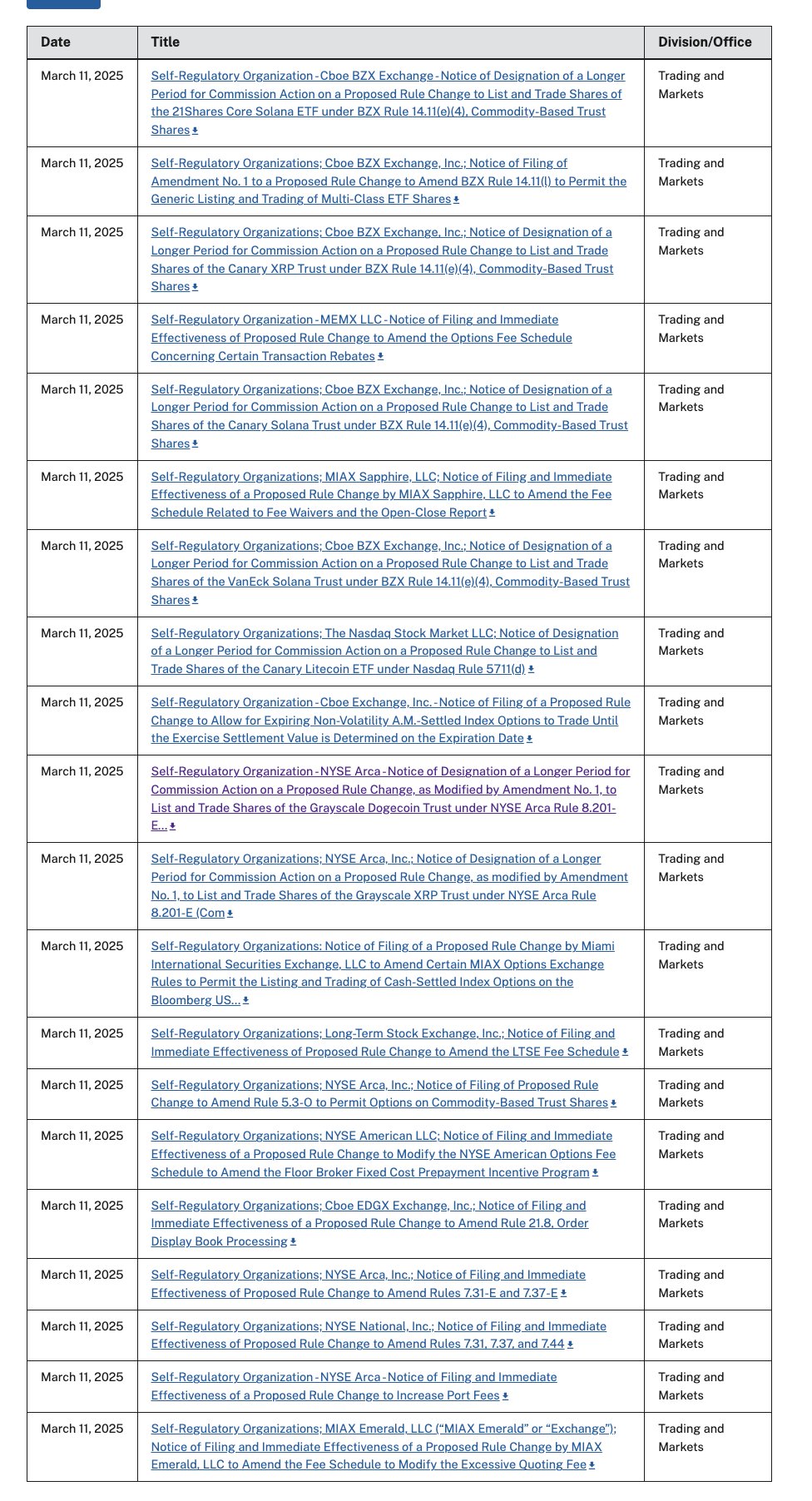

The SEC has postponed decisions on several high-profile ETF applications, including Grayscale’s filings for Dogecoin (DOGE), XRP, Litecoin (LTC), and Cardano (ADA). Additionally, Canary Capital, Bitwise, and 21Shares have also seen delays in their XRP ETF applications.

The regulator further delayed decisions on Solana (SOL) ETFs submitted by 21Shares, Canary, and VanEck. The last of the altcoin-related ETF postponements was Canary Capital’s Litecoin (LTC) filing.

Other crypto ETF delays include in-kind creation and redemptions for BlackRock IBIT ETF, as well as Fidelity’s Wise Origin Bitcoin ETF (FBTC) and Fidelity Ethereum ETF (FETH). Additionally, 21Shares’ Core Ethereum ETF proposal to include staking has also been postponed.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

New Applications and Market Race Intensify

Despite these delays, the SEC has acknowledged new filings, including Grayscale’s Hedera (HBAR) ETF and Bitwise’s updated Dogecoin (DOGE) filing. Moreover, on March 11, Franklin Templeton filed an S-1 Form for its own XRP ETF, further intensifying the altcoin ETF race.

Strong Approval Odds for 2025!

Bloomberg ETF analyst James Seyffart emphasized that these delays are part of standard procedure and should not raise concerns. He also noted that Paul Atkins has yet to be confirmed as the new SEC chair, which may have influenced the delay timeline.

In February, Seyffart and Bloomberg Senior ETF Analyst Eric Balchunas published their approval probability estimates for Litecoin (LTC), Solana (SOL), XRP, and Dogecoin (DOGE) ETFs. According to their analysis, Litecoin (LTC) leads with a 90% chance of approval in 2025, followed by Dogecoin (DOGE) at 75%. Solana (SOL) has a 70% probability, while XRP holds a 65% chance of approval.

The analysts highlighted that these approval odds were below 5% before Donald Trump’s election victory in November. Since then, regulatory sentiment has shifted, significantly increasing the likelihood of ETF approvals. If the regulatory environment continues to improve in the US, these odds may rise even further.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.