Solayer (LAYER), how does it work and what are the price expectations? We have prepared a detailed project and technical analysis article for this Solana-based protocol.

Solayer: Restaking Protocol Built on Solana

Solayer is an advanced restaking protocol built on the Solana blockchain. By allowing users to restake their already staked SOL tokens, Solayer enhances both network security and users’ yield potential. One of the protocol’s key components, sSOL, is a representative token issued in exchange for staked SOL. Through sSOL, users can help secure other networks, delegate to validators, and in the future, provide liquidity within DeFi applications.

The protocol operates via modules like the Shared Validator Network (SVN) and the Restake Pool Manager, enabling cross-chain security sharing and more efficient use of staked assets. Solayer also supports popular Liquid Staking Tokens (LSTs) such as Marinade (mSOL), JITO, Blaze, and Infinity. The restaking process is simple and all steps are executed in a single transaction.

Backed by prominent investors like Polychain Capital, Hack VC, and Binance Labs, Solayer has raised $12 million in funding and reached a valuation of $80 million. This backing reflects strong market confidence in the project and reinforces expectations that Solayer will become a significant long-term player in the Solana ecosystem.

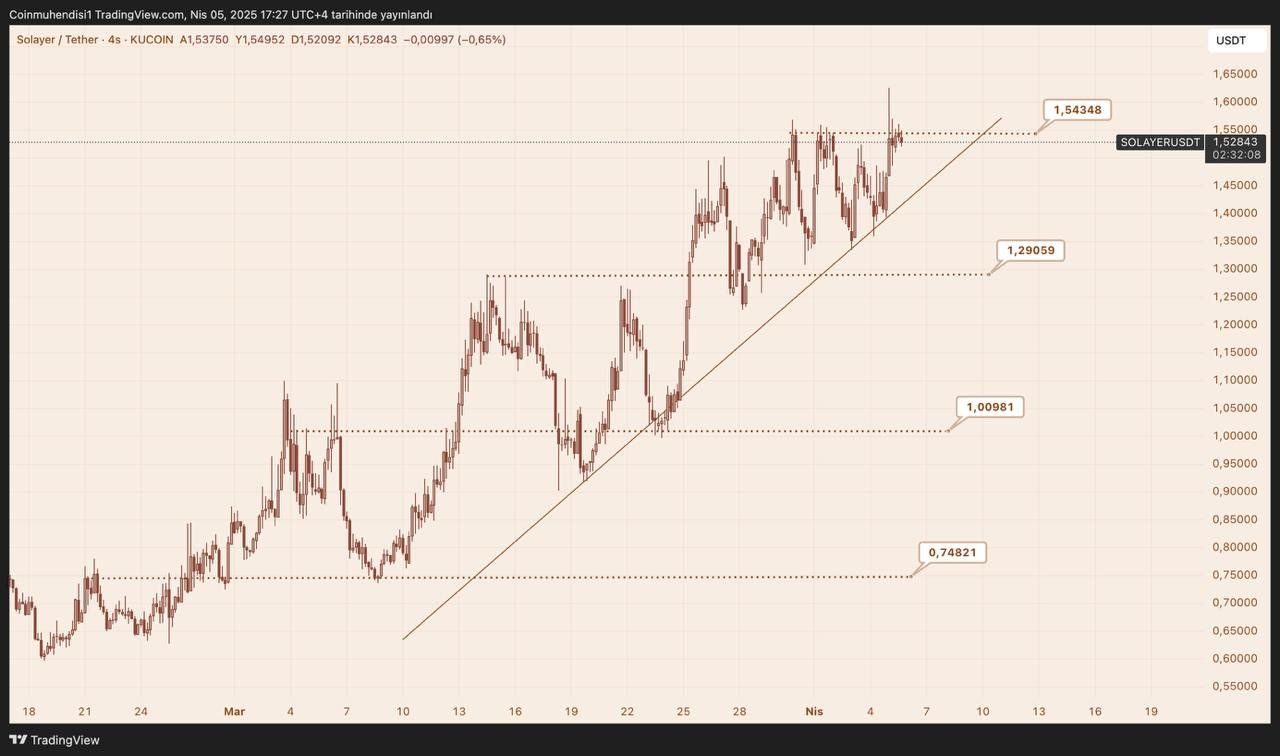

Solayer (LAYER) Technical Analysis and Price Outlook

$LAYER, the native token of Solayer, has demonstrated remarkable resilience in the current bearish market conditions. While most cryptocurrencies are struggling, $LAYER has maintained its upward trend, signaling strong investor confidence and a solid project foundation.

A closer look at the chart reveals a critical resistance zone at the $1.54 level. A breakout above this level could trigger a bullish continuation, with potential targets in the $1.90–$2.00 range. This area represents the next possible Break of Structure (BOS) level in the current trend.

On the other hand, if the price fails to break through this resistance, a corrective move to the downside may occur. In such a scenario, DCA (dollar-cost averaging) strategies could be considered by long-term investors. Particularly, the $1.30–$1.35 range stands out as a key zone to monitor for new entry opportunities.

Overall, both the technical outlook and protocol fundamentals suggest that $LAYER offers opportunities for both short-term gains and long-term growth. Investors are advised to monitor price movements closely and plan their strategies accordingly.

This content is not financial advice. Cryptocurrency markets are highly volatile and risky. Please conduct your own research before making any investment decisions.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.