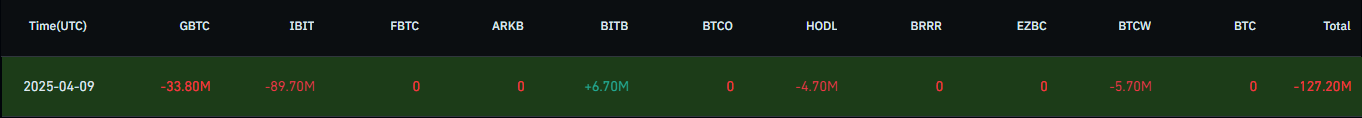

Spot Bitcoin ETFs in the U.S. recorded a total of $127.12 million in net outflows on Wednesday, extending their streak of negative flows to five consecutive days. Interestingly, this occurred even as the market rallied following Trump’s announcement of a 90-day pause on new tariffs.

Major Outflows From IBIT and GBTC

BlackRock’s iShares Bitcoin ETF (IBIT) saw the largest outflow at $89.71 million, while Grayscale’s GBTC lost $33.8 million. Other major funds like VanEck and WisdomTree also reported outflows.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

Bitwise’s BITB was the only spot Bitcoin ETF to post inflows, receiving $6.71 million.

Trump Pauses Tariffs Amid Trade War Concerns

U.S. President Donald Trump on Wednesday announced a 90-day pause on most tariffs and reduced reciprocal duties to 10% for the majority of countries, while raising tariffs on China to 125%. The move triggered a surge across both traditional finance (TradFi) and crypto markets.

Nasdaq Posts Best Day Since 2001

Following the news, the Nasdaq jumped 12.16%, marking its biggest single-day gain since January 2001. Other major indices also surged:

- Dow Jones: +7.87%

- S&P 500: +9.52%

Crypto-linked stocks also posted sharp gains:

- Coinbase: +16.91%

- Strategy (formerly MicroStrategy): +24.76%

Asian Markets Follow U.S. Rally

Asian stock markets mirrored Wall Street’s momentum. Japan’s Nikkei 225 climbed 8.68%, South Korea’s Kospi rose 6.07%, the Shanghai Composite gained 1.34%, and Hong Kong’s Hang Seng advanced 3.13%.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.