On July 12, United States-based spot Bitcoin exchange-traded funds (ETFs) saw notable inflows of nearly $310 million, the best-performance day since June 5.

Record-Breaking Inflows for Major ETFs

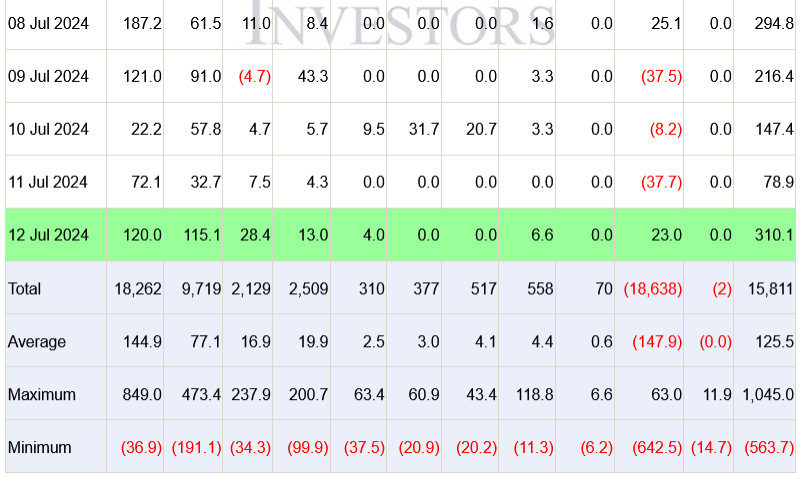

Farside Investors data indicates BlackRock’s iShares Bitcoin Trust (IBIT) and the Fidelity Wise Origin Bitcoin Fund (FBTC) lead the inflows with $120 million and $115.1 million respectively. With $28.4 million the Bitwise Bitcoin ETF trailed; the Grayscale Bitcoin Trust (GBTC) had a rare inflow day of $23 million. Furthermore mentioned were inflows of $6 million and $4 million respectively from the VanEck Bitcoin Trust ETF and Invesco Galaxy Bitcoin ETF.

Weekly Performance and Market Impact

With spot Bitcoin ETF issuers registering $488.1 million, the total inflows on July 12 amounted to the highest flow day since June 5. For the spot Bitcoin ETFs, this fresh flood drove the weekly total to $1.04 billion. These ETFs have attracted $15.8 billion in net inflows since their introduction just over six months ago. This number includes almost $18.6 billion in withdrawals from Grayscale’s flagship Bitcoin product, which was spot form converted after US Securities and Exchange Commission (SEC) permission in January. Though it is somewhat little at $2 million, the only other spot Bitcoin ETF with a net outflow is the Hashdex Bitcoin ETF (DEFI).

Market Sentiment and Future Prospects

Based on CoinGecko statistics, Bitcoin’s price has witnessed a 1.1% rise over the last 24 hours and now trades at $57,8ishi. Still, it is down around 15% over the last month and is over 21% away from its all-time high.

Meanwhile, several of these Bitcoin ETF issuers are getting ready to introduce spot Ether ETFs, which may open as early as next week, said Nate Geraci, President of The ETF Store. These issuers submitted revised S-1 registration statements and got early comments late last month; final approval from the SEC is still pending.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.