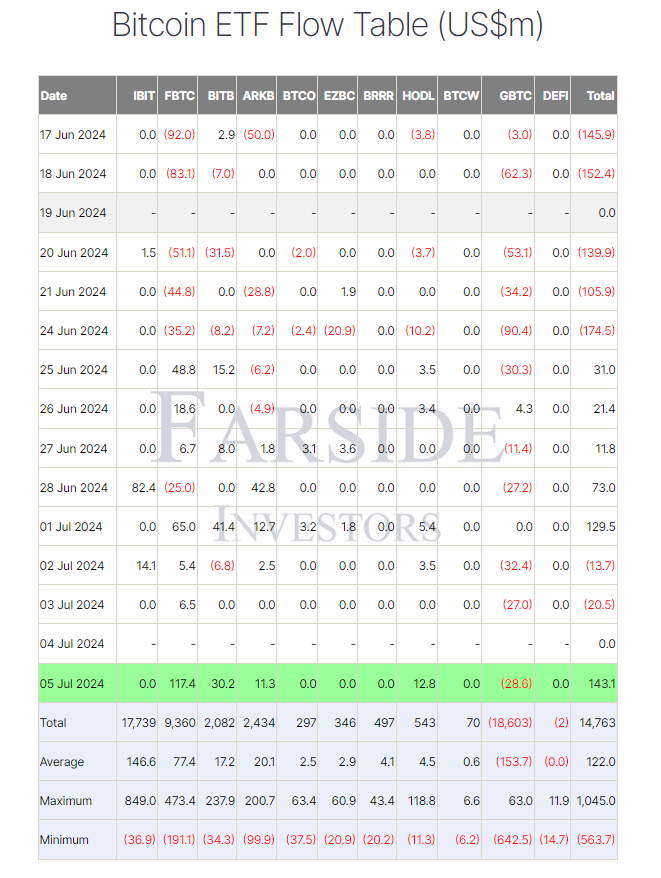

Following the recent US Independence Day, Spot Bitcoin ETFs saw a spike in inflows on July 6; Bitcoin‘s price fell below $54,000 at that point. With an amazing $143.1 million pouring into these financial instruments, Farside monitoring indicates that this is their highest net influx in a month.

Surge in Inflows and Investor Confidence

Leading with an amazing $117 million, the Fidelity Bitcoin ETF (FBTC) demonstrated great investor trust in the fund. While the ARKB and HODL ETFs experienced inflows of $11.3 million and $12.8 million respectively, the Bitwise Bitcoin ETF (BITB) reported a net inflow of $30.2 million after Facebook TCV. However, different from other spot Bitcoin ETFs, the Grayscale Bitcoin Trust (GBTC) recorded a net outflow of $28.6 million, thus standing out as the only one that pointed in the opposite direction to the rest others.

The high levels of flows into these ETFs show that information-based institutions and wholesale buyers are already using this volatility to buy their bitcoins at lower prices. Hunter Horsley, CEO of Bitwise Asset Management, underlined in a post on X social network his team’s effectiveness in purchasing Bitcoin, able to do so at a cost less than half a basis point.

Market Outlook and Predictions

Horsley also underlined the positive view of Bitcoin, implying that the present state of the market offers a good purchase possibility for both new and established investors. “The future of Bitcoin seems to be much better. For those who lack exposure yet, this week is an opportunity to purchase the decline. BITB reported inflows over $66 million during the first week of July, therefore raising its overall Bitcoin holdings to around 38,000. Such increase demonstrates that people are still confident in BItcoin’s long-term value for use despite short term volatility.

Prominent Bitcoin skeptic Peter Schiff also offered his take on the ‘strength’ of the Bitcoin ETF holders. Schiff stated that these investor have not shown fear of the market flucuations; these investors are determined to keep their invested funds. “So yet, terror does not show itself. Before they eventually give up, it will probably require a much more significant decline in Bitcoin” Schiff said. He also foresaw a big sell-off not too far off, maybe resulting in a surrender among Bitcoin investors.

Following the failed Japanese cryptocurrency exchange Mt. Gox moving 47,229 Bitcoin—worth $2.71 billion at current prices—worth to a new wallet address in its first significant transaction since May, Bitcoin dropped to $55,200 on Coinbase.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.