Canada is set to launch its first spot Solana (SOL) ETFs on April 16, according to Bloomberg ETF analyst Eric Balchunas. A private client note from TD Bank revealed that the Ontario Securities Commission (OSC) has approved asset managers Purpose, Evolve, CI, and 3iQ to issue these funds.

The upcoming ETFs will include a staking feature, allowing issuers to stake a portion of the SOL holdings for additional yield — a notable advantage for investors seeking passive income.

Canada Ahead Of The U.S. In Altcoin ETF Race

Unlike the United States, Canada does not have a federal securities regulator. Instead, each province manages its own financial markets, with Toronto’s exchange overseen by OSC.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

In the U.S., the SEC has only approved spot Bitcoin and Ether ETFs so far. Altcoin ETFs — especially those with staking capabilities — remain in regulatory limbo. Bloomberg’s James Seyffart predicts Ether staking ETFs could get greenlit by May, though delays are likely.

Demand Still Uncertain

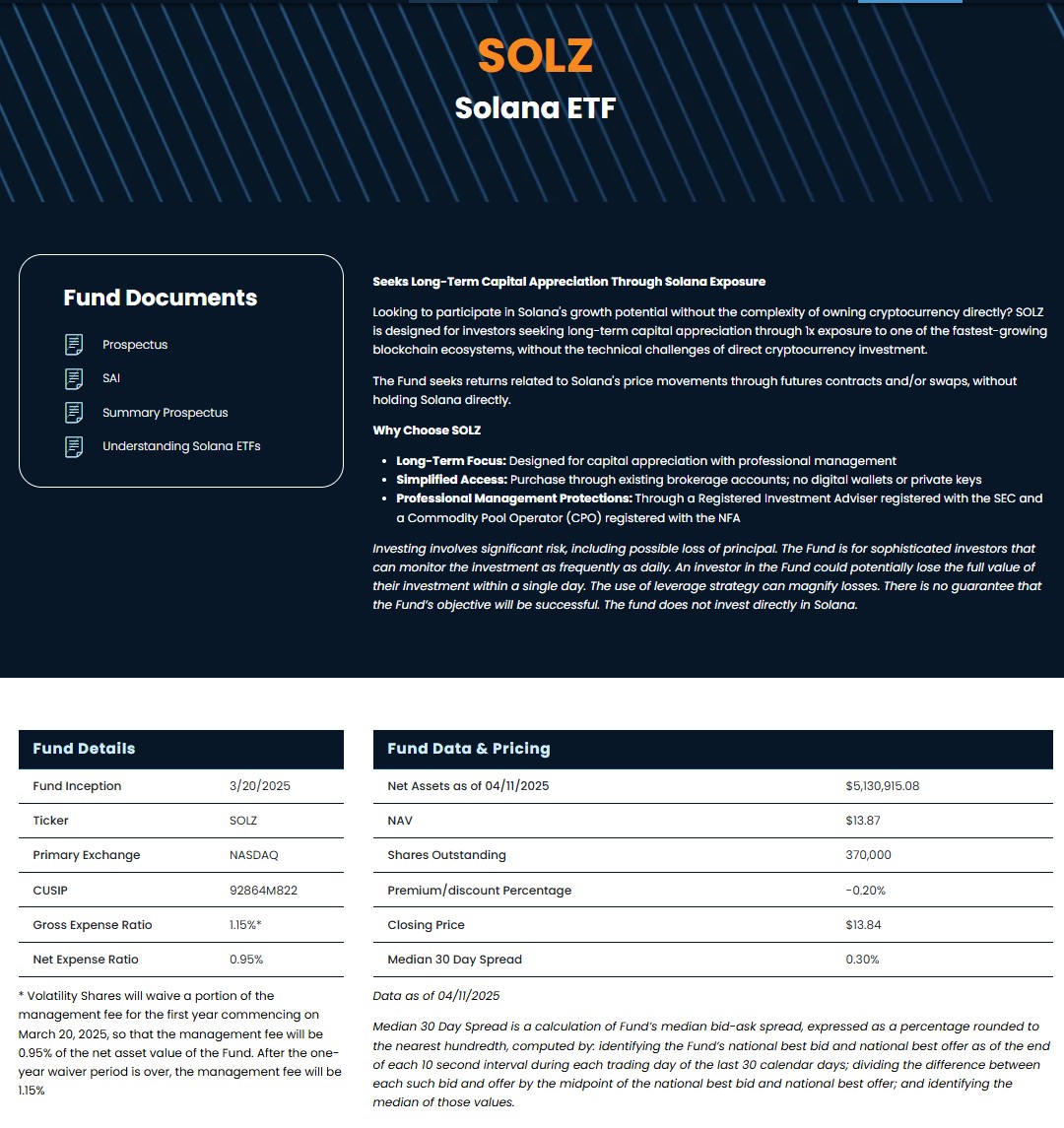

Despite the launch, some experts warn that investor appetite may be limited. For instance, the Volatility Shares Solana Futures ETF (SOLZ), launched in March in the U.S., has attracted only $5 million in assets as of April 14.

Balchunas cautioned against using futures ETF performance as an indicator for spot ETFs, stating that “the 2x XRP already has more AUM” than existing SOL futures ETFs.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.