The push to enable staking for spot Ethereum ETFs is gathering momentum. Global asset management giant BlackRock and NYSE Arca have taken key steps to potentially unlock staking yields for ETH ETF investors.

BlackRock Talks Up the Potential of Staking!

BlackRock’s Head of Digital Assets, Robert Mitchnick, highlighted the importance of staking in boosting returns for Ethereum ETFs. Speaking at a conference, he remarked, “The next phase in the evolution of [ether ETFs] is staking.” Since none of the Ethereum ETFs launched with staking, adding this feature could significantly enhance their investment appeal.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

NYSE Arca Files Rule Change for Bitwise Ether ETF

Meanwhile, NYSE Arca filed a proposed rule change that could allow the Bitwise Ether ETF to stake its ETH holdings and generate yield. This filing follows similar proposals from Grayscale, 21Shares, and Fidelity. If approved by the SEC, staking could become a standard feature of Ethereum ETFs.

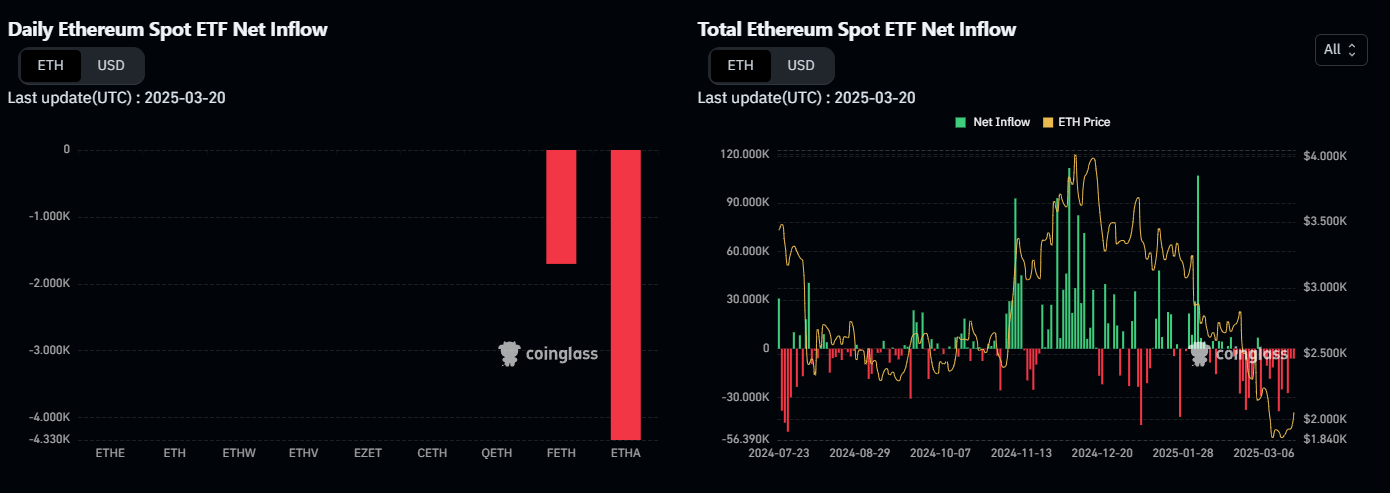

Despite attracting billions in investments, spot Ethereum ETFs have underperformed compared to Bitcoin ETFs. BlackRock’s ETH ETF manages around $2.3 billion, while its Bitcoin ETF has amassed nearly $48 billion. Adding staking yields may help Ethereum ETFs close the gap and draw greater institutional interest.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.