Last week, Bitcoin and Ethereum ETFs saw significant activity. While high outflows were seen especially from large funds such as Grayscale and BlackRock, the continued inflows to some funds reveal the indecision of investors. In the days of large-scale outflows, sharp fluctuations were observed in the markets.

Bitcoin ETFs: Outflows Unstoppable

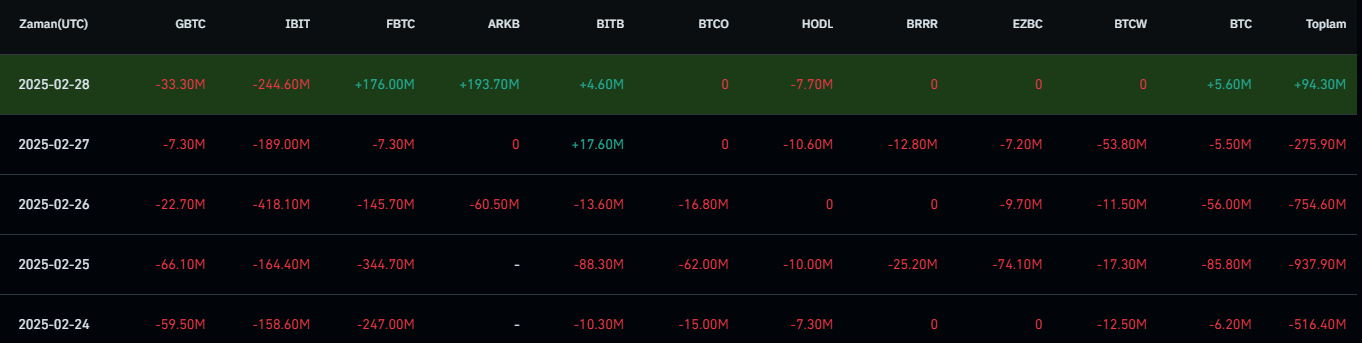

Bitcoin ETFs saw heavy selling, especially on February 25 and 26. On February 25, there was an outflow of$937.9 million worthof BTCand $754.6 million on February 26. BlackRock’s IBIT fund alone saw outflows of $418 million, suggesting that investors were risk-averse.

However, the market recovered somewhat on February 28. Although there was another large outflow from BlackRock’s IBIT fund, there were strong inflows into Fidelity and Ark Invest’s ETFs. Fidelity’s FBTC ETF saw inflows of $176 million and Ark Invest’s ARKB ETF saw inflows of $193.7 million. This development suggests that some investors believe prices are nearing a bottom.

Despite this, outflows from Bitcoin ETFs totaled a billion dollars in the last week, leading to continued bearish pressure on the markets.

Ethereum ETFs: Blood Losses at BlackRock and Fidelity

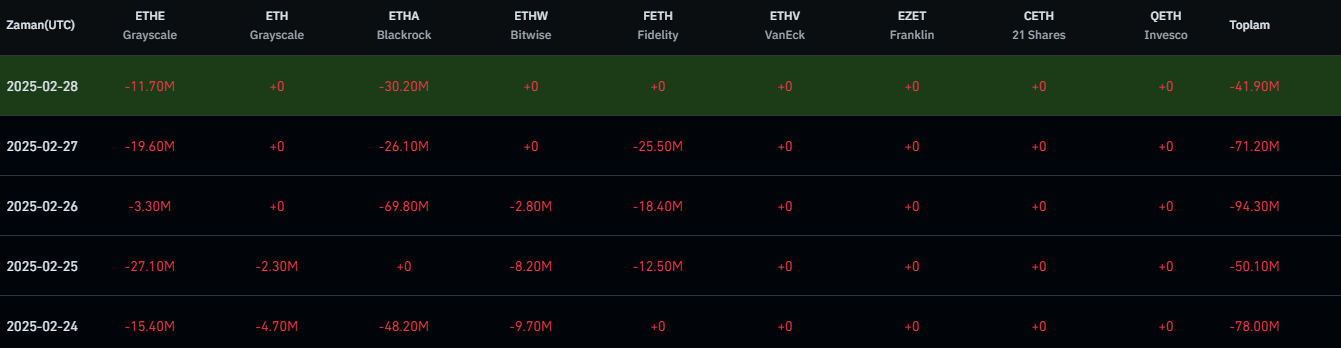

Ethereum ETFs experienced a similar picture. On February 26, there were outflows of $69.8 million from BlackRock’s ETHE fund and $18.4 million from Fidelity’s FETH fund. This movement shows that Ethereum investors are cautious.

On February 28, although some balance seemed to be achieved on the Ethereum side, there were outflows of $ 11.7 million from the Grayscale ETHE fund and $ 30.2 million from the BlackRock ETHA fund. Although it seems that Ethereum investors did not exit as aggressively as Bitcoin, fund movements show that the pressure on ETH’s price continues.

How Do ETF Outflows Affect the Market?

Outflows from Bitcoin and Ethereum ETFs have been one of the main factors triggering the downtrend in crypto markets. The outflows of institutional investors, especially from giant funds such as BlackRock and Grayscale, show that the cautious approach towards crypto assets continues.

In contrast, inflows into some funds such as Fidelity and Ark Invest prove that not all institutional investors have withdrawn from the market. However, given the volume of outflows in recent weeks, a clear turnaround in ETF flows is needed for the market to regain strength.

The impact of ETF flows on crypto markets will continue to be closely monitored in the coming days.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.