Crypto analyst Fred Krueger suggested that the $2 billion worth of Tether (USDT) minted yesterday evening might be linked to MicroStrategy’s efforts to accumulate Bitcoin.

In a detailed analysis shared on social media, Krueger outlined how the minting aligns with MicroStrategy’s aggressive Bitcoin acquisition strategy, a hallmark of its financial operations under Michael Saylor, the company’s Executive Chairman.

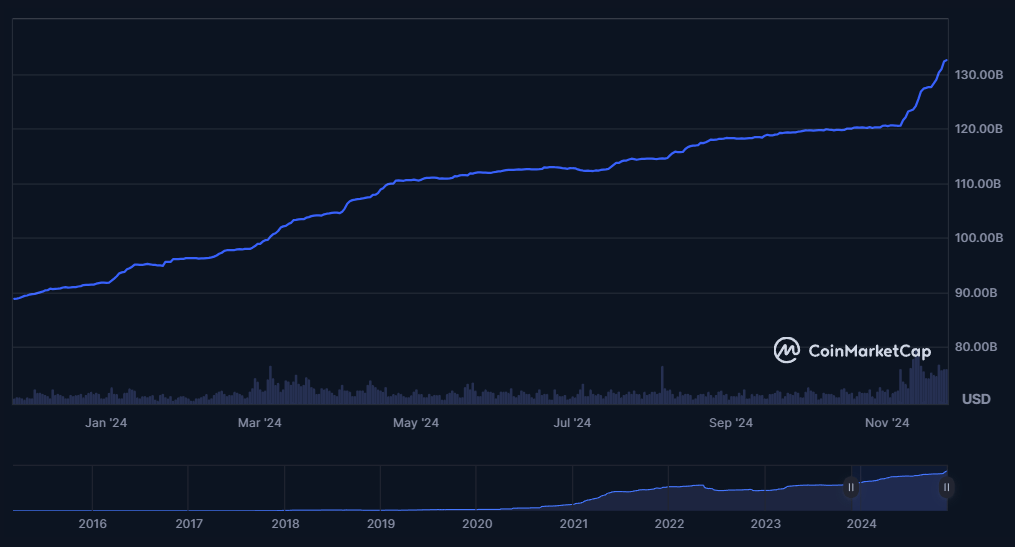

USDT Minting and Its Impact on Bitcoin

Krueger noted that $2 billion worth of USDT was minted around 9:00 PM UTC. He proposed that this liquidity might have been used by MicroStrategy to facilitate large Bitcoin purchases on major exchanges like Binance.

At the time of minting, Bitcoin was trading at $97,300. However, as alleged automated buying bots operated by MicroStrategy intensified their activity, Bitcoin’s price climbed to $98,300.

According to Krueger, MicroStrategy recently raised $3 billion through convertible bonds and may have utilized its at-the-market (ATM) equity issuance program to secure additional funds. He estimated that the company could have access to as much as $12 billion for Bitcoin acquisitions.

“$2 Billion is Just the Beginning”

Krueger stated that the $2 billion USDT mint is likely only the start of a larger operation. He suggested that this fund could be rapidly deployed, with the bulk of it likely allocated by next Wednesday. This liquidity influx could drive Bitcoin prices up by $8,000, he predicted.

If fully utilized, these funds could allow MicroStrategy to add up to 120,000 new Bitcoins to its holdings, potentially pushing its Bitcoin reserves to unprecedented levels.

Krueger also highlighted that such large purchases could impact MicroStrategy’s market-adjusted net asset value (mNAV). With the company’s stock price at $426, its mNAV could drop from $3.3 billion to $2.6 billion, he explained.

This development has sparked significant speculation in the crypto market. The potential USDT-driven Bitcoin purchases by MicroStrategy and their impact on Bitcoin’s price trajectory remain key points of interest.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.