Ripple CEO stated that RLUSD will “soon be active on exchanges” following the approval from the New York Department of Financial Services.

Ripple Labs CEO Brad Garlinghouse announced that the New York Department of Financial Services (NYDFS) has approved the company’s RLUSD stablecoin after months of evaluation.

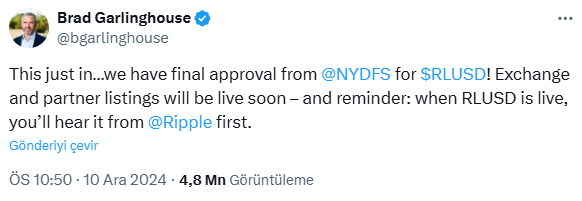

In a post on X on December 10, Garlinghouse stated that following the NYDFS approval, Ripple will soon announce exchange and partner listings for RLUSD. The company had launched plans for this stablecoin in April, positioning it as a competitor to Tether’s USDT and Circle’s USD Coin.

Ripple executives have predicted that the stablecoin could reach a market value of $2 trillion by 2028.

The company began testing RLUSD in August on the XRP ledger and Ethereum mainnet, and in October, it announced partnerships with exchanges such as Uphold, Bitstamp, Bitso, MoonPay, Independent Reserve, CoinMENA, and Bullish.

In September, Garlinghouse mentioned that Ripple planned to focus RLUSD on institutional players. As of December 10, the combined market value of USDT and USDC was recorded at approximately $180 billion.

How will Ripple manage both XRP and RLUSD?

Like other USD stablecoins, RLUSD will be pegged 1:1 to the US Dollar.

In April, Ripple announced plans to back the tokens with USD deposits, short-term US Treasury bonds, and “other cash-like assets.”

In June, Ripple President Monica Long stated that RLUSD would be “complementary and additive” to XRP.

Garlinghouse appeared in a 60 Minutes segment aired on December 8, discussing the cryptocurrency industry’s influence on the 2024 United States elections.

Ripple is also engaged in an ongoing legal battle with the US Securities and Exchange Commission (SEC) regarding XRP token offerings.

In the comment section, you can freely share your comments about the topic. Additionally, don’t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.