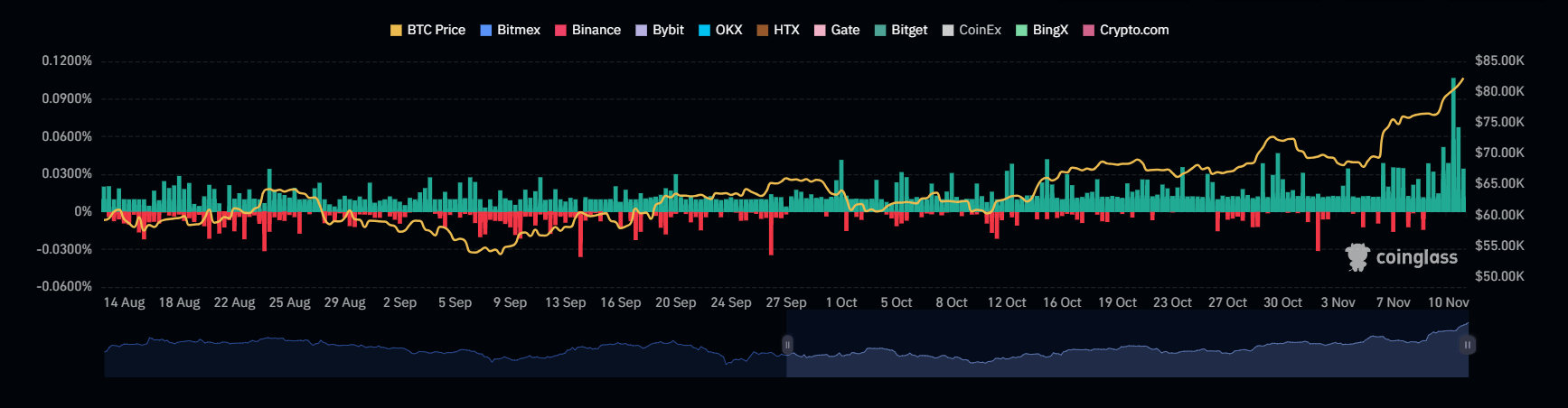

The Bitcoin futures funding rate is emerging as a bullish signal in the crypto market. According to Coinglass data, the open position-weighted perpetual futures funding rate for Bitcoin has reached a peak in recent months.

Rates exceeding 0.04% on Bitmex and 0.03% on Binance indicate that traders in the derivatives market are holding long positions.

Analysts predict that Trump’s presidential election victory could further increase this positive funding rate. Deribit CEO Luuk Strijers said, “A high positive funding rate indicates that investors are more likely to use leverage.” Strijers also points out that perpetual futures have risen more quickly than spot markets.

Outlier Ventures Research Director Jasper De Maere also considers the increase in open positions as a “confirming signal for a bullish trend.” De Maere emphasizes that the high funding rates on exchanges like Bitmex and Binance point to unresolved leveraged positions.

According to The Block, the total open positions for Bitcoin futures on crypto exchanges have reached an all-time high. The total value of open positions on 15 crypto derivative exchanges has surpassed $37 billion.

In a report by Copper.co, it is predicted that Bitcoin could reach $100,000 by the U.S. presidential inauguration on January 20, 2025. Copper.co Research Director Fadi Aboualfa stated that ETFs could accumulate 1.1 million Bitcoin during this period.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.