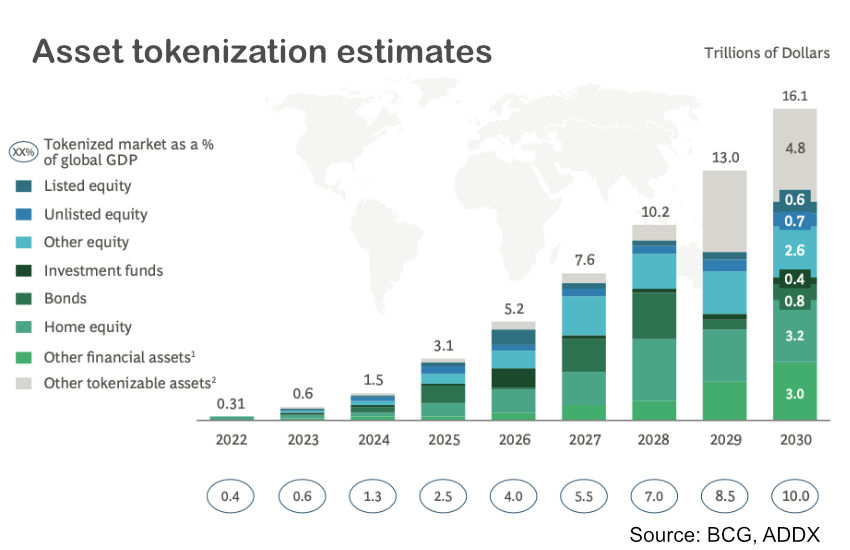

Real-World Assets (RWA) are expected to show significant growth over the next five years, with total assets potentially exceeding $600 billion by 2030.

Boston Consulting Group describes RWA tokenization as “the third revolution in asset management.” The research suggests that assets under management in tokenized funds could reach 1% of global mutual funds and exchange-traded funds (ETFs).

Additionally, bonds are noted as the most suitable asset class for tokenization, while real estate and private equity face various challenges. There is increasing interest in areas such as government debt and payment tokens within the RWA market.

Elliot Hentov, head of macro policy research, and macro policy strategist Vladimir Gorshkov stated, “The complex nature of the instruments, recurring costs, and high competition among intermediaries support rapid adoption and the potential for significant impact.”

They also noted that blockchain technology could play an important role in markets that prioritize trading speed. Bonds possess three main characteristics that make them suitable for tokenization: reduced recurring costs, complexity that can be automated through smart contracts, and collateral usage facilitated by on-chain transfers.

The Financial Stability Board released a research report this month, indicating that while adoption of RWA tokenization is low, it is growing, primarily in government debt, followed by equity stakes in debt funds, payment tokens, and commodities.

Additionally, the analytics platform rwa.xyz highlighted a rise in RWA research reports from institutions and asset managers, noting that the total value of off-chain RWA has reached $13.25 billion, an increase of 60% year-to-date.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.