US President Donald Trump has announced a 90-day pause on “reciprocal tariffs” for countries that do not impose counter-tariffs against the United States. These nations will now face a reduced tariff rate of 10%. However, in a more aggressive move, Trump declared that China’s tariff rate would increase to 125%, citing the country’s retaliatory trade actions.

Trump posted on Truth Social:

“At some point, hopefully, in the near future, China will realize that the days of ripping off the USA, and other countries, is no longer sustainable or acceptable.”

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

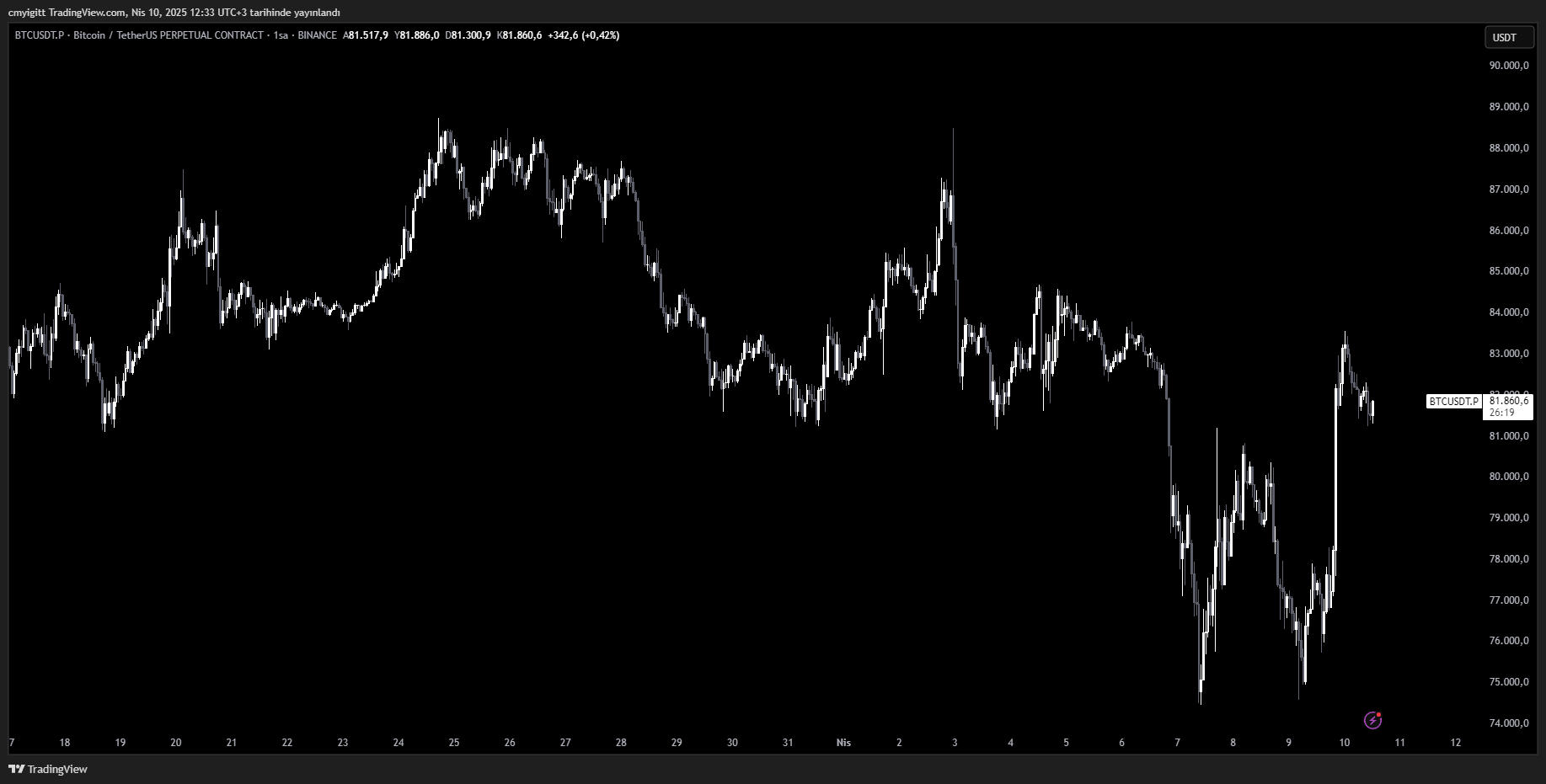

The announcement had an immediate impact on financial markets. The S&P 500 index surged by nearly 7%, and Bitcoin rallied from $73,500 to $77,000, showcasing growing investor interest in alternative assets amid geopolitical risk.

Extreme Market Volatility and Crypto Response

Leading up to the announcement, speculation on social media had already triggered a $2 trillion rise in market value on April 7. Following the confirmation of the tariff pause, the Volatility Index (VIX) dropped to 37.5, still reflecting elevated uncertainty but easing from its peak above 60.

Market expert and BitMEX co-founder Arthur Hayes suggested this instability could push Chinese investors toward crypto. In past cycles (2013, 2015), similar yuan devaluations led to increased capital flow into digital assets.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.