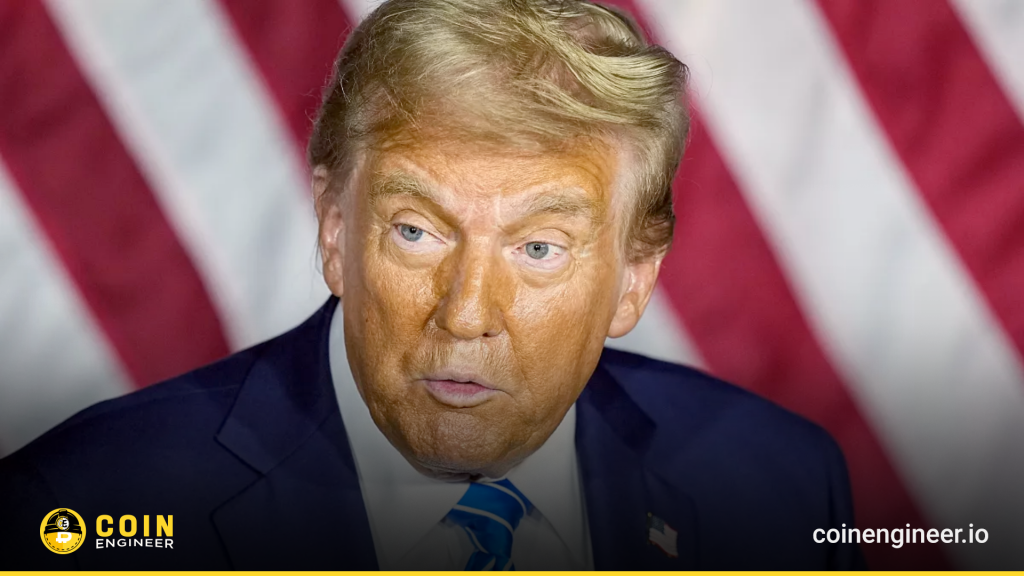

Last week, global crypto investment products witnessed $1.9 billion in net inflows, driven by Trump’s pro-crypto executive orders. According to CoinShares’ Head of Research James Butterfill, no digital asset investment products experienced net outflows during the period.

Global crypto funds managed by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares recorded a combined net inflow of $1.9 billion. These robust inflows were attributed to Trump’s crypto-focused executive actions.

What Did Trump’s Crypto Orders Achieve?

On Thursday, President Donald Trump signed an executive order establishing a “Presidential Working Group on Digital Asset Markets” to create a federal regulatory framework for digital assets, including stablecoins, and to evaluate the formation of a “strategic national digital assets stockpile.”

On Tuesday, Trump also issued a full and unconditional pardon for Ross Ulbricht, the Silk Road founder closely tied to Bitcoin’s early history.

These orders boosted investor confidence, resulting in zero net outflows from digital asset investment products last week.

U.S. and Bitcoin-Based Funds Lead

U.S.-based crypto funds led the charge, accounting for $1.7 billion of the weekly net inflows. Digital asset products in Switzerland, Canada, and Germany also attracted net inflows of $35 million, $31 million, and $23 million, respectively.

You Might Be Interested In: Elon Musk Shared, That Memecoin Flew: Up 500%!

Bitcoin (BTC)-based investment products dominated globally, adding $1.6 billion in net inflows last week. Year-to-date, Bitcoin-based funds have accumulated $4.4 billion, representing 92% of all net inflows. U.S. spot Bitcoin ETFs accounted for $1.8 billion of these inflows.

Ethereum and Other Altcoins

Ethereum (ETH) investment products continued their recovery, recording net inflows totaling $205 million. U.S. spot Ethereum ETFs contributed $139.4 million to the total inflows last week.

XRP investment products attracted $18.5 million in inflows, extending their streak to over $500 million since mid-November.

Other notable inflows included Solana (SOL) with $6.9 million, Chainlink (LINK) with $6.6 million, and Polkadot (DOT) with $2.6 million.

Market Movement and Trading Volumes

While price action was relatively flat over the past week, trading volumes remained robust at $25 billion, accounting for 37% of all activity on trusted crypto exchanges.

Despite these strong inflows, the crypto market experienced a sell-off early Monday. Bitcoin dropped below $100,000 after reaching an all-time high of approximately $109,000 on January 20. Liquidations amounted to $850 million, and Bitcoin is now trading at $99,295.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.