President Donald Trump shook global markets on April 2 with his sweeping announcement of reciprocal import tariffs. The S&P 500 shed over $5 trillion, marking the largest single-day loss in its history—surpassing even the pandemic crash of March 2020.

But some analysts argue this shock could signal the end of peak uncertainty, not the beginning.

Michaël van de Poppe, founder of MN Consultancy, told Cointelegraph:

“The tariffs are the climax of market uncertainty. Trump’s Liberation Day marks the point where the rules are now clear—everyone knows the new game.”

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

According to van de Poppe, Trump is using tariffs strategically to stimulate domestic growth and suppress yields. He even predicts they might be reversed within 6 to 12 months.

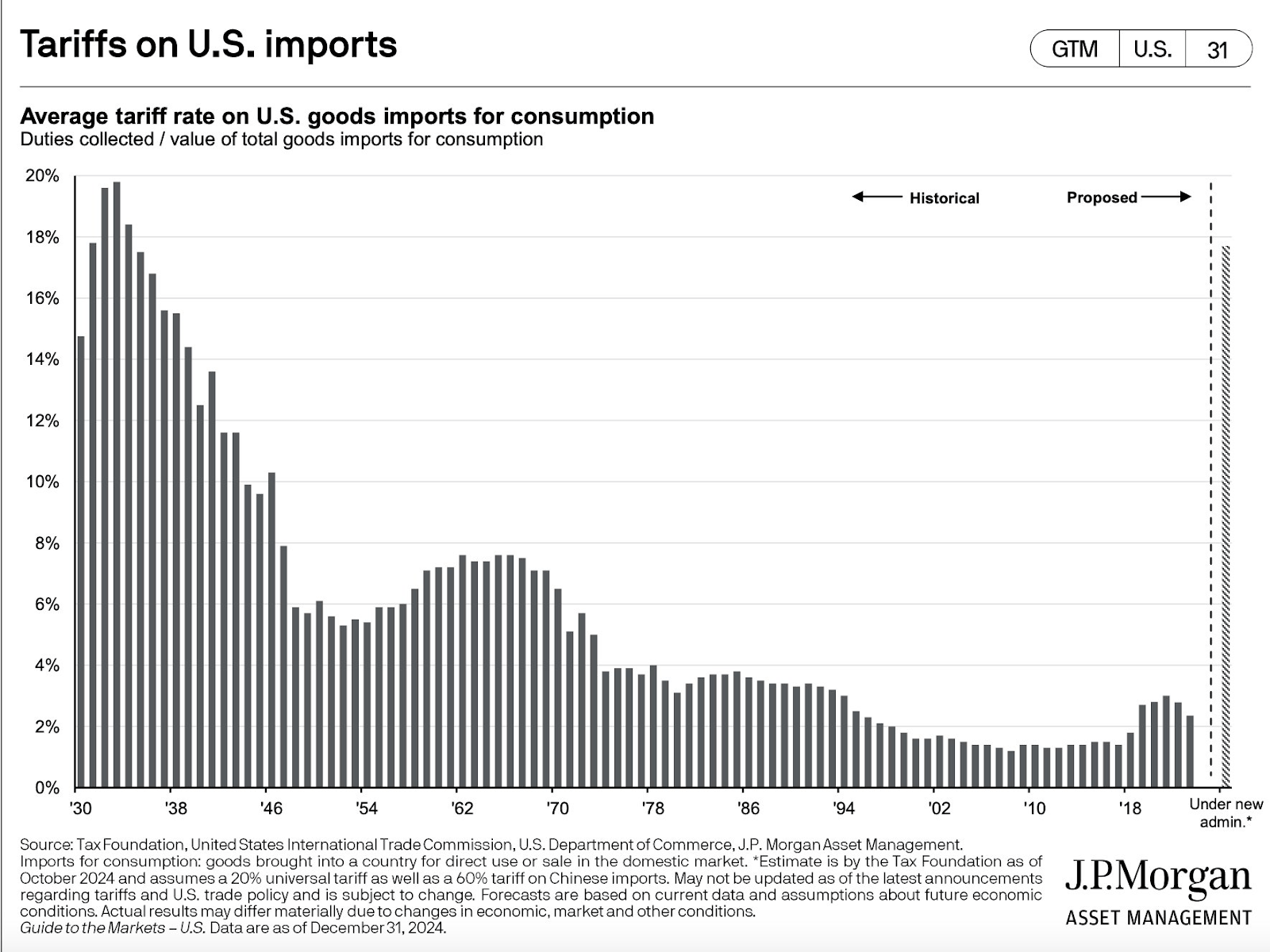

Tariff Breakdown:

- 10% base tariff on all U.S. imports starting April 5

- Up to 54% reciprocal tariffs for countries with high trade deficits starting April 9

Is a Crypto Rotation on the Horizon?

Van de Poppe believes this turning point will lead to renewed interest in crypto assets as markets stabilize. He suggests investors will begin “buying the dip,” especially in undervalued cryptocurrencies.

This economic pressure could push the Federal Reserve toward quantitative easing (QE), where liquidity is injected into the economy through bond purchases.

Arthur Hayes, co-founder of BitMEX and CIO at Maelstrom, says that if QE returns, Bitcoin could rally to $250,000.

“Once the dust settles, crypto assets could once again become the go-to investment.”

Lingering Doubts Over Trump’s Volatility

Still, not all analysts are convinced the uncertainty is over. Noelle Acheson, author of Crypto is Macro Now, warned:

“We know President Trump is prone to changing his stance quickly, especially in the first few weeks. Volatility may continue to weigh on risk assets.”

She added that while BTC is acting like a risk-on asset, gold is breaking all-time highs, which could dampen crypto sentiment in the short term.

Meanwhile, crypto analytics firm Nansen estimates a 70% probability that the market bottoms by June, depending on how tariff negotiations evolve.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.