Global stock markets opened the week with dramatic losses. From Europe to Asia, a financial storm has shaken investor confidence—triggered by U.S. President Donald Trump’s new universal import tariff policy. But why has this decision rattled the global economy so profoundly?

European Markets Suffer Historic Losses!

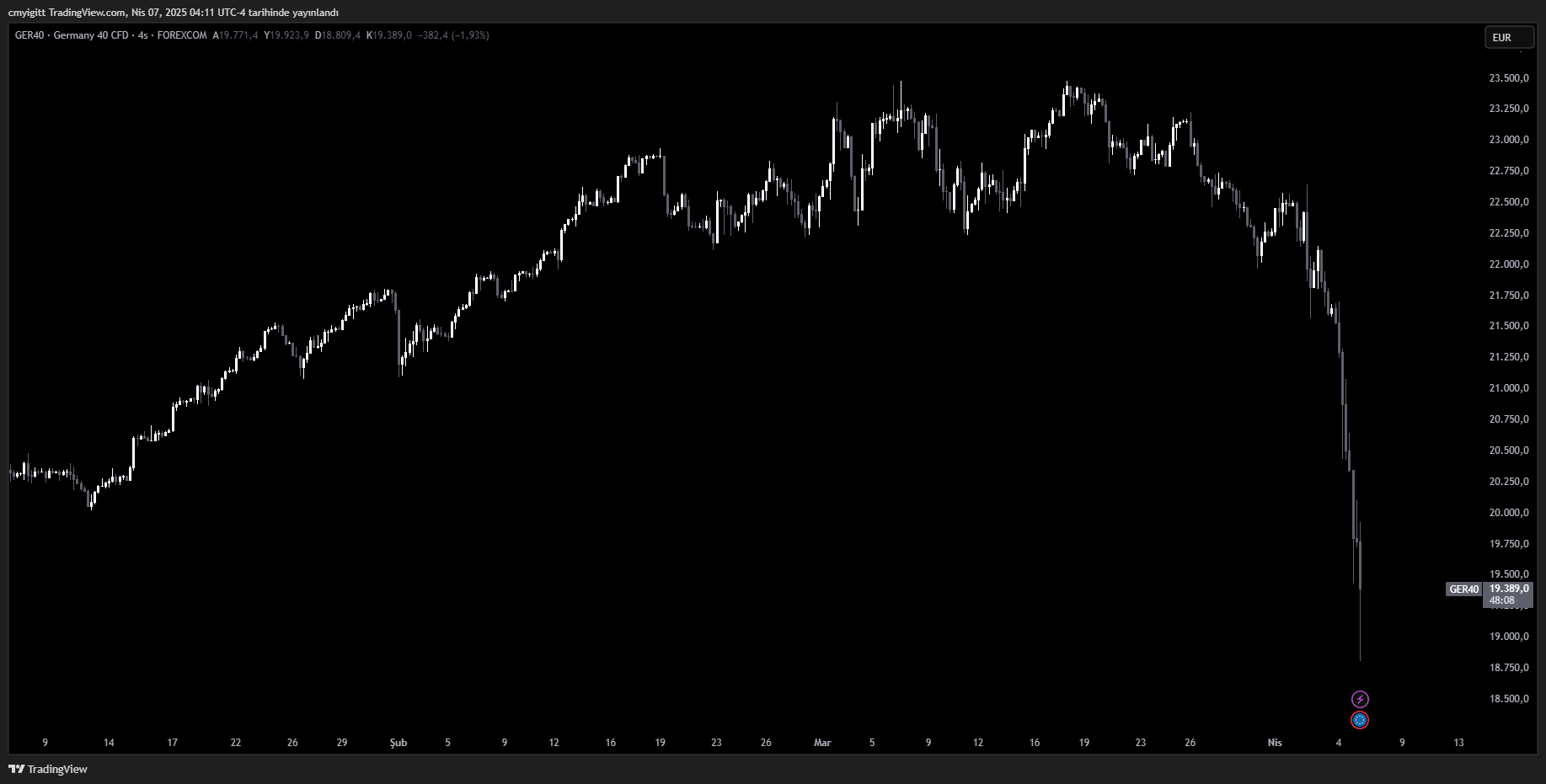

On Monday morning, European stock markets plunged in panic. The German DAX index fell by as much as 10% at opening, sparking memories of the 2008 financial crisis. The UK’s FTSE 100 dropped nearly 6%, while France’s CAC 40, Italy’s FTSE MIB, and other European benchmarks followed suit with similar sharp declines.

Banking stocks were among the hardest hit. Major institutions like HSBC, Barclays, Standard Chartered, Deutsche Bank, and Commerzbank saw share prices plummet between 8% and 15%. The defense sector also took a hit, with Rolls-Royce losing 12% and Rheinmetall plunging a staggering 24%.

Asian Markets Join the Selloff!

The turbulence wasn’t confined to Europe. Asian markets also reacted sharply to Trump’s announcement. The Shanghai Composite Index dropped over 8%, while Hong Kong’s Hang Seng Index closed the day down by 13%, shocking investors across the region. Australia’s ASX 200 index slid to its lowest levels since late 2023.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

As fear swept through global markets, investors began unloading shares, especially in tech and industrial sectors across Asia.

How It Started: Trump’s Universal Tariff Shocks World Trade

President Donald Trump recently unveiled a sweeping trade move: a 10% universal tariff on all imported goods. The surprise announcement directly impacts America’s trade partners, particularly in Europe and Asia.

Trump defended the decision by stating, “Sometimes you have to take medicine to fix things. Short-term pain brings long-term gain.” But many economists believe this “medicine” may come with serious side effects for the global economy.

Fears of a Global Recession Resurface

Experts warn that such a move could slow global trade, increase inflationary pressures, and even trigger a global recession. Given the United States’ central role in the global economy, the ripple effects of such drastic measures are almost unavoidable.

Economist David Lerman commented, “There are no winners in trade wars. This decision undermines global economic confidence.”

Wall Street Awaits: All Eyes on U.S. Market Opening!

While U.S. markets were yet to open, Dow Jones, Nasdaq, and S&P 500 futures were already in negative territory. Analysts are bracing for a sharp sell-off once Wall Street begins trading.

Investors are fleeing to safe-haven assets, with gold and bonds seeing increased demand. The overall sentiment across markets? Uncertainty and fear.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.