Trump’s Trade Wars: What does it mean and how are they affecting the global economy?

When Trump began his presidency in 2017, he took a firm stance against trade partners with the aim of reducing the U.S. trade deficit and boosting American manufacturing. His policies, particularly those targeting China, led to a series of tariffs and trade barriers that began to affect the global economy. This process marked the first significant phase of the trade wars, which were expected to have long-term effects.

The Beginning of Trump’s Trade Wars

The most prominent feature of the trade wars was the high tariffs imposed by the Trump administration on China. Trump considered China’s trade practices “unfair” and harmful to the U.S. economy. As a result, in 2018, high tariffs were placed on products imported from China. For example, tariffs on products like steel and aluminum were raised up to 25%. In retaliation, China imposed similar tariffs on U.S. products. These reciprocal tariffs shook the global trade balances and caused disruptions in supply chains worldwide.

China and Other Countries’ Responses

China escalated the trade war in response to these moves by imposing tariffs on key U.S. exports, such as soybeans, cars, and aircraft. In retaliation to Trump’s aggressive trade policies, China made these counteractions on the international stage. However, the trade war did not just affect the U.S. and China; it impacted many other countries around the world as well. Notably, trade partners like Canada protested the tariff increases imposed by the U.S. and took countermeasures in return.

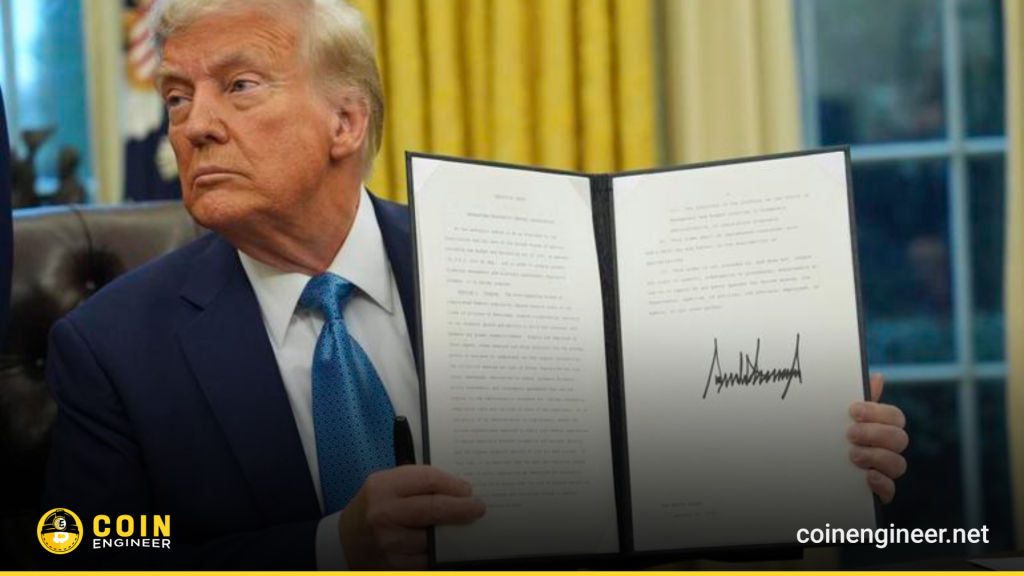

The 2024 Election and Trump’s Revival of the Trade War

After winning the 2024 presidential election, Trump reignited the trade war and further solidified his tough stance on global trade relations. Following the election, he imposed new tariffs on goods imported from trade partners such as China, Canada, and Mexico.

A 25% tariff was applied to goods from Canada and Mexico, while a 10% tariff was imposed on goods from China. This move caused the trade war to intensify once again, leaving global trade in a state of uncertainty.

With these actions, Trump aimed to narrow the U.S. trade deficit further and stimulate American manufacturing. However, this policy disrupted global supply chains, causing economic ripples in other countries as well.

Reactions and Retaliations from Other Countries

In response to Trump’s new measures in 2024, countries like China, Canada, and Mexico reacted to the newly imposed tariffs. China, in particular, retaliated by placing new tariffs on U.S. products. Additionally, the European Union was contemplating a counteraction to Trump’s escalated trade war. Canada and Mexico, similarly, increased their tariffs on U.S. goods in retaliation.

The AI War: A New Front in Global Trade

Trump’s trade wars extended beyond traditional trade to significantly impact the field of artificial intelligence (AI). As the U.S. competed with China over AI technologies, new platforms like DeepSeek were launched, shaping the future of global trade. DeepSeek developed a low-cost technology capable of competing with giants like OpenAI and Google, threatening Nvidia’s dominance.

DeepSeek‘s success caused Nvidia’s stock to drop by 17%. Furthermore, this development also impacted the energy sector, as more efficient AI technologies reduced energy consumption, leading to a slowdown in demand within the sector.

Trump‘s post-election trade decisions further fueled this AI war. New tariffs on China and pressures on tech companies created tension in global trade and digital warfare. These developments also affected financial markets and the cryptocurrency sector, leading to major shifts in investment strategies and global markets.

Impact of the Trade War on Markets

Trump’s aggressive tariffs and retaliations not only impacted global trade but also financial markets. The cryptocurrency market, in particular, saw significant losses due to the effects of the trade war. Bitcoin (BTC) and Ethereum (ETH), for example, lost considerable value, with Bitcoin dropping from $106,000 to below $90,000, marking a 15.09% decline. This loss triggered panic among investors, leading to significant liquidations in the crypto markets. Furthermore, the economic uncertainty caused by the trade wars led to a contraction in global trade and a slowdown in economic growth.

After Trump’s victory in 2024, the trade policies he implemented reshaped global trade. Reactions and counter-retaliations from trade partners like China, Canada, and Mexico escalated the trade war. The effects of the trade war were not limited to traditional markets but also impacted digital assets such as cryptocurrencies.

Trump’s trade war deeply affected global trade and financial markets, raising economic uncertainty and causing disruptions in global supply chains.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram ,YouTube and Twitter channels for the latest news and updates.