Currently, the United States government is undertaking an initiative to prevent the buying and selling of child sexual abuse material (CSAM) using cryptocurrency.

Federal agencies should have the capability of detecting transactions on cryptocurrency that are connected to the trade of child abuse content, as suggested by U.S. Senators Elizabeth Warren and Bill Cassidy.

Within this move towards the eradication of CSAM, the Department of Justice (DOJ) and Department of Homeland Security (DHS) were asked to reveal their existing technical capabilities.

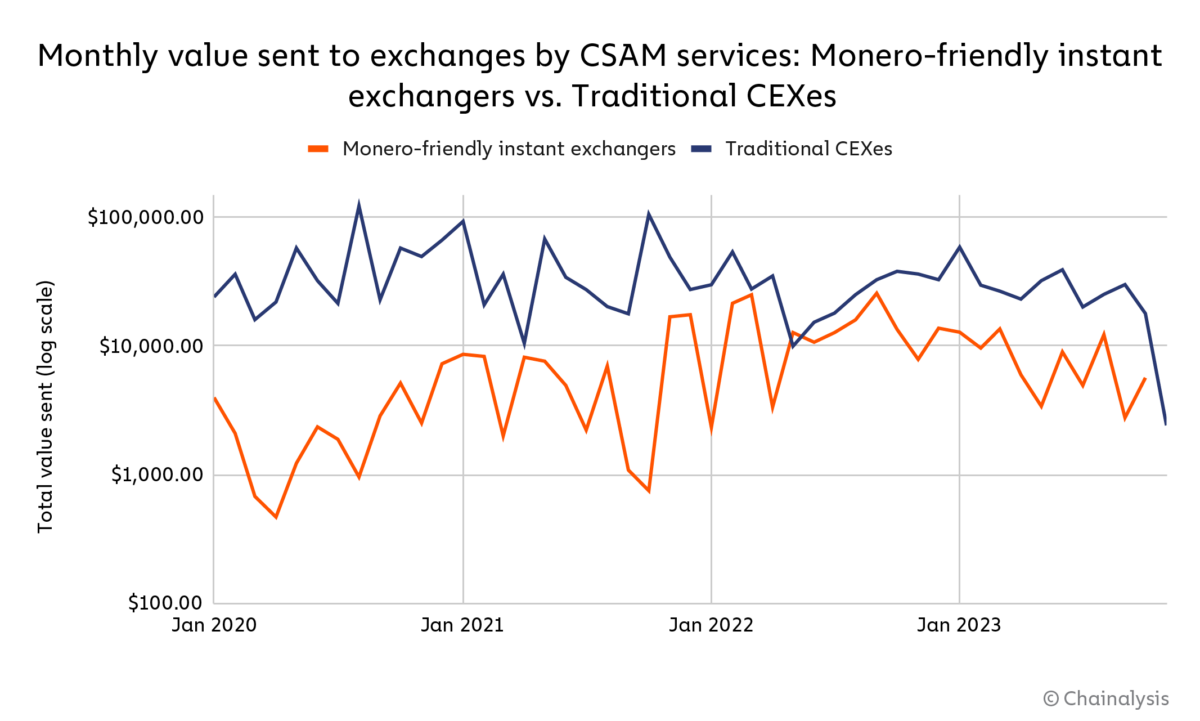

The senators used a Chainalysis investigation from January 2024, which stated that illegal trading of CSAM was done more often using cryptocurrencies.When conducting the research.

Chainalysis reports that “mixers” and “privacy coins” like Monero (XMR) are used by vendors of child abuse goods to hide their assets and evade authorities.

In letters to Attorney General Merrick Garland and Secretary of Homeland Security Alejandro Mayorkas, U.S. senators expressed their desire to know the capabilities of the DOJ and DHS in identifying and prosecuting these offenses.

“The current anti-money laundering (AML) rules and law enforcement approaches struggle to detect and avoid these crimes.”

The letter had six questions in total, with three directed specifically at the separate conclusions of the federal agencies regarding the relationship between bitcoin and CSAM. The rest were about discovering what further tools were required for the investigation of buyers and sellers.

The senators expect to learn the answers to their questions by May 10.

The indictment of KuCoin and its two founders was prompted by the DOJ’s present technical capability to investigate cryptocurrency transactions.

“Conspiring to operate an unlicensed money transmitting business” and BSA violations were among the charges levied against KuCoin and its two founders by the DOJ on March 26.

“In failing to implement even basic Anti-Money Laundering policies, the defendants allowed KuCoin to operate in the shadows of the financial markets and be used as a haven for illicit money laundering.”

The U.S. Department of Justice claims that KuCoin handled over $4 billion in “suspicious and criminal funds” and over $5 billion in transactions.