Understanding or reading the Fear and Greed Index is actually quite simple. Many investors use this index to make buy and sell decisions, with sentiment playing a crucial role. Within the framework of cryptocurrency markets, investor sentiment can change rapidly due to volatility. The Fear and Greed Index is one of the most important tools for measuring these changes and is known as the Crypto Fear and Greed Index. This index aims to gauge whether the market is in a state of extreme fear or greed by measuring overall investor sentiment. But what exactly does this index mean and how does it work?

Structure and Meaning of the Index

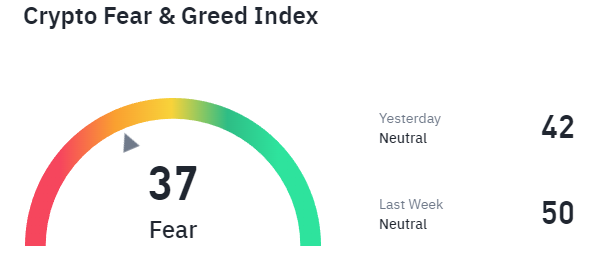

The Crypto Fear and Greed Index operates on a scale from 0 to 100. A lower value (0-24) indicates “extreme fear,” while a higher value (75 and above) signals “extreme greed.” Mid-range values (around 50) reflect a “neutral” market sentiment. Extreme fear often occurs during market downturns when investors are quickly selling, while extreme greed typically appears during rapid market increases, driven by a “fear of missing out” (FOMO) among investors.

How the Index Is Calculated

The index is calculated by combining various indicators, including market volatility (25%), market momentum (25%), social media influence (15%), market dominance (10%), and Google search trends (10%). These indicators reflect the general attitudes of investors toward cryptocurrencies and contribute to the formation of the index. For example, an increase in Google searches related to Bitcoin could indicate rising greed among investors. Similarly, higher market volatility may result in increased fear levels.

Current Situation

Recently, the index reached 79, the highest level since Bitcoin’s peak of $69,000 in November 2021. This suggests that greed in the market is increasing, and investors are taking on more risks. During such times, sudden market fluctuations can occur, so investors should exercise caution. It’s also common for corrections—referred to as pullbacks in the market—to happen when greed is high.

Investment Strategy and Risk Management

The Crypto Fear and Greed Index can be a valuable tool for short-term trading strategies. However, for long-term investors, it may not be sufficient as a standalone indicator. When making investment decisions using this index, it is important to also consider other technical and fundamental analysis tools. For instance, during extreme fear levels, buying at lower prices may be possible, while profit-taking could be considered when greed levels are high.

To succeed in cryptocurrency markets, avoiding emotional decisions, having a solid investment plan, and following that plan with discipline are crucial. While the Crypto Fear and Greed Index provides insights into short-term market sentiment, it’s important not to overlook how these sentiments can influence the market’s long-term movements.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.