Canadian spot Bitcoin ETF investors have shifted to more liquid US alternatives, triggering the largest crypto ETF outflows in Canada’s history.

In 2024, the US emerged as the biggest investor in spot Bitcoin exchange-traded funds (ETFs), while Canada, despite being the first country to launch a spot Bitcoin ETF, became one of the major losers.

US spot Bitcoin ETFs accounted for 100% of the $44.2 billion in crypto exchange-traded product (ETP) inflows in 2024, making the US the largest holder of Bitcoin ETFs in terms of assets under management (AUM).

Switzerland, the second-largest buyer of crypto ETPs in 2024, only saw $630 million in inflows, a massive 98% gap compared to the US.

Meanwhile, Canada, which launched the first physically-settled Bitcoin ETF in 2021, saw a record $707 million in crypto ETP outflows in 2024, reflecting a shift towards more liquid US alternatives.

Why is the US Leading in Bitcoin ETFs?

The success of US Bitcoin ETFs comes just one year after the US Securities and Exchange Commission approved spot BTC ETFs in January 2024.

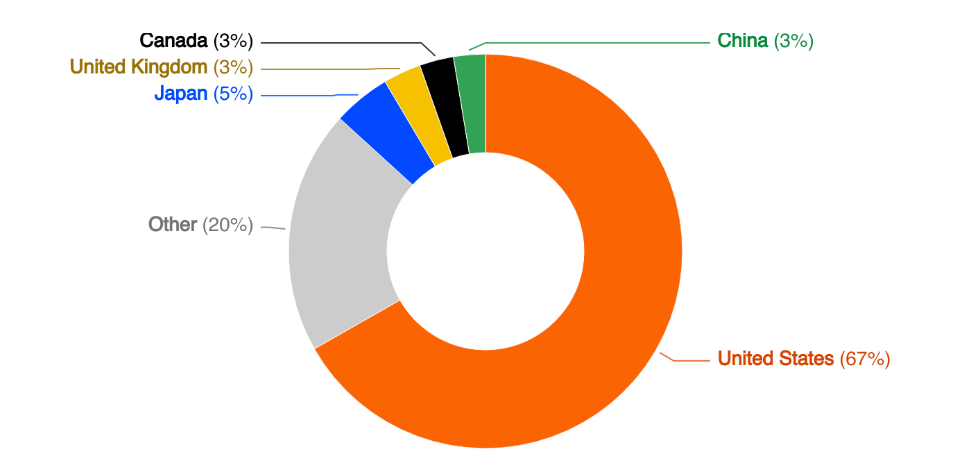

The US dominance in Bitcoin ETFs is no surprise, given its position as the largest ETF market globally.

US Equities Dominate Global Stock Value in 2024

Matt Hougan, Chief Investment Officer at Bitwise: “The US has by far the largest ETF market. The global ETF market is about $15 trillion; the US accounts for $10.5 trillion of that. It’s natural that we would be the largest.”

The US is the birthplace of ETFs and represents more than 70% of global ETF AUM, says Matt Mena, Crypto Research Strategist at 21Shares, adding:

“With decades of investor familiarity and trust in the ETF structure, the US has naturally become the dominant market for these products.”

The US is also the largest capital market globally, with the US stock market alone accounting for over 60% of the total global stock market capitalization, Mena adds.

James Butterfill, Head of Research at CoinShares: “US investors have historically been more adventurous and open to risk opportunities, particularly in the technology space; therefore, it’s no surprise that their Bitcoin ETFs lead in terms of AUM.”

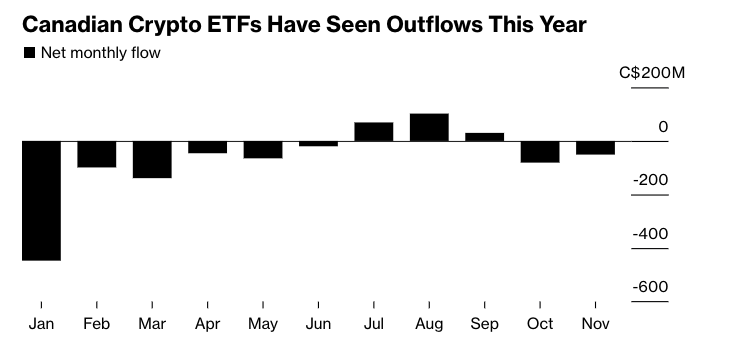

Canada ETFs: $4.2 Billion Inflows in 2021 vs. $707 Million Outflows in 2024

Canada saw its largest-ever outflows from crypto ETPs in 2024, totaling $707 million, according to data from CoinShares.

Canada’s 2024 crypto ETF outflows surpassed its previous record outflows of $151 million in 2022.

Canada Crypto ETF Outflows (2024)

Canadian investment firm Purpose Investments launched the Purpose Bitcoin ETF in February 2021, making Canada the first country in the world to debut spot Bitcoin ETFs.

The world’s first spot BTC ETF saw a huge debut, with $564 million in assets under management (AUM) within just five days of launching. Following the launch, Canadian crypto ETPs saw $4.2 billion in inflows in their first year of trading.

Canadian Crypto ETF Investors Shifting to US-Based Options

Canada experienced the largest Bitcoin ETF outflows in 2024, largely due to a shift in investor behavior following the launch of US spot BTC ETFs, according to Mena from 21Shares.

This shift was driven by US Bitcoin ETFs offering greater liquidity, broader investor participation, and institutional support.

“In essence, these Canadian ETFs benefited from regulatory arbitrage over the US, where such products were unavailable,” Mena noted, adding:

“Once spot Bitcoin ETFs began trading in the US, a significant number of non-Canadian investors swiftly pulled their funds from Canadian ETFs and moved into US-domiciled products.”

This shift led to Canadian crypto ETFs becoming the only ETF category in the country to see outflows in 2024, according to Bloomberg.

With US Bitcoin ETFs dominating the global crypto ETF industry, CoinShares’ Butterfill suggested that no other market is likely to surpass US AUM for Bitcoin products.

“At the moment, though, European issuers like ourselves are offering a much more diverse set of ETPs and more efficient settlement processes for crypto ETFs, offering staking yields in ETPs as a good example,” he said.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.