The U.S. Department of Justice (DOJ) and the Securities and Exchange Commission (SEC) have petitioned the Supreme Court to authorize an investor class case against the tech juggernaut alleging Nvidia misrepresented its sales to bitcoin miners. Starting in 2018, the complaint claims Nvidia of misleading investors about its involvement in the cryptocurrency industry, particularly in view of the surge in GPU demand by crypto miners.

In an Oct. 2 amicus brief, U.S. Solicator General Elizabeth Prelogar and SEC senior attorney Theodore Weiman argued in that the case had “sufficient details” to support the revival of the litigation, which had earlier been withdrawn by a lower court. Emphasizing that increasing criminal prosecutions and civil enforcement activities by the DOJ and SEC depends entirely on meritorious private cases, they urged the Supreme Court to let the appellate court ruling to stand.

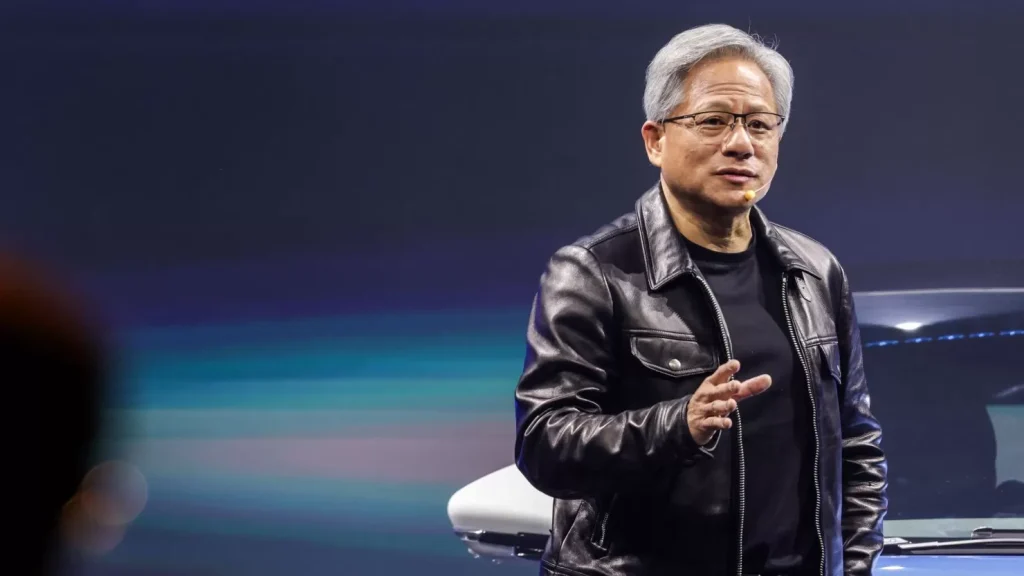

The lawsuit largely centers on CEO Jensen Huang’s purported attempts to reduce the company’s dependency on the unstable crypto market as well as Nvidia’s accused concealment of over $1 billion in sales linked to crypto mining. According to the class group, crypto miners drove Nvidia’s sales, which crashed and resulted in large losses for investors when the crypto market dropped in 2018.

Declaring it based on produced expert opinions, Nvidia has tried to overlook the case. The DOJ and SEC refuted this assertion, contending that this was false, nevertheless. They also supported the response of the class group, which included tales from former Nvidia executives and Bank of Canada research alleging Nvidia undervaluation of their crypto income by $1.35 billion.

Apart from the DOJ and SEC, twelve former officials of the SEC have filed an amicus brief in behalf of the investors, arguing that private enforcement of securities laws is crucial to safeguarding the integrity of American capital markets. They opposed Nvidia’s position, alleging that it would produce an illogical judicial precedent by requiring plaintiffs to obtain internal business documents before discovery and forbade expert opinion at the initial phases of a dispute.

The Supreme Court will now consider the appeal given other parties keep turning in briefs supporting the investor class complaint.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.