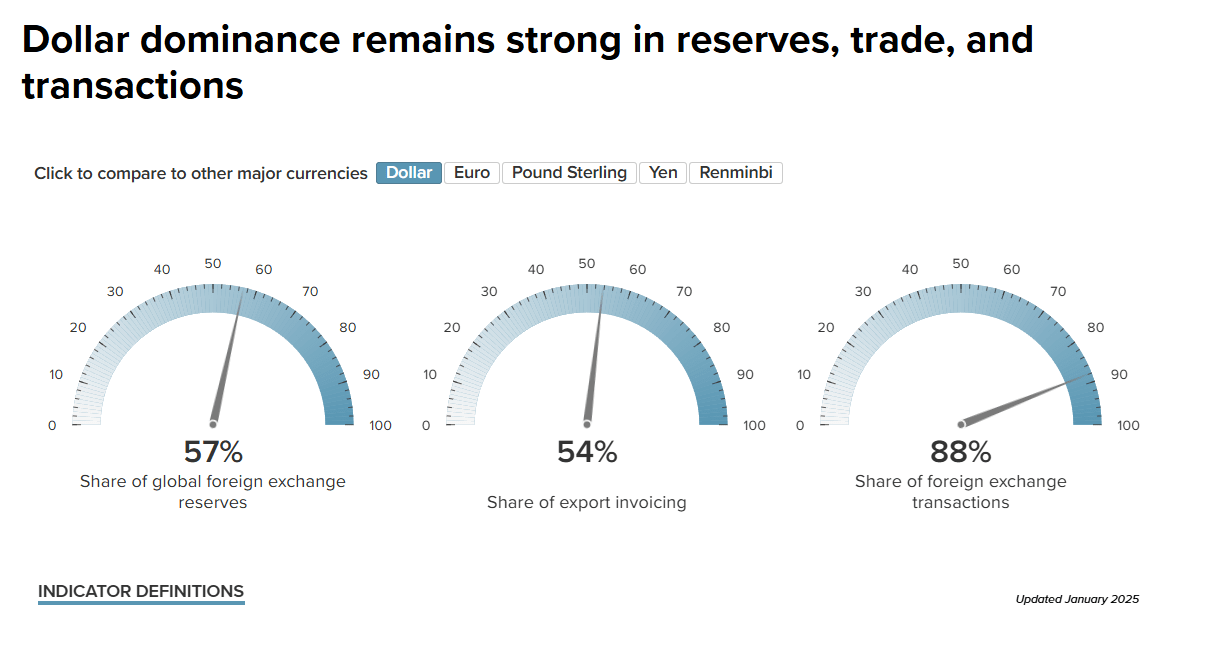

As the most preferred currency for global trade and financial transactions, the US dollar has increased its share in global payments to over 50%, according to the latest data. This figure marks the highest level in the past 12 years. Experts emphasize that this development is not just a statistic but a significant shift that could deeply impact global economic balances.

Why Is the Dollar Gaining Strength?

There are several key factors behind the dollar’s rising dominance in global payments. Most importantly, the US Federal Reserve’s tight monetary policy plays a central role. The Fed’s decision to keep interest rates high continues to attract investors to the dollar, putting pressure on the currencies of emerging markets.

Additionally, increasing geopolitical risks push global investors toward the dollar as a safe haven. The Russia-Ukraine war, uncertainty in the Middle East, and trade tensions in Asia have made the dollar even more indispensable in global transactions.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

What Will Be the Economic Consequences?

The dollar’s overwhelming dominance in global payments may create various effects on different countries:

- For emerging economies, the cost of external borrowing could increase further. Countries repaying debts denominated in dollars may face significant budget deficits.

- The US dollar’s supremacy in global trade could reduce the usage of other currencies, potentially weakening other reserve currencies like the Euro and Yen.

- For the US economy, high demand for the dollar could widen the trade deficit. However, this could also strengthen demand for US bonds and assets in the short term.

Is This the Start of a New Financial Era?

Experts argue that the dollar’s growing dominance further consolidates the dollar-centric structure of the global financial system. This development may accelerate the efforts of some countries to create alternative payment systems. In particular, BRICS countries are working on new strategies to reduce their dependence on the dollar.

Still, in the short term, a significant decrease in dollar dependency seems unlikely. On the contrary, the dollar’s dominance in global transactions may deepen even further.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.