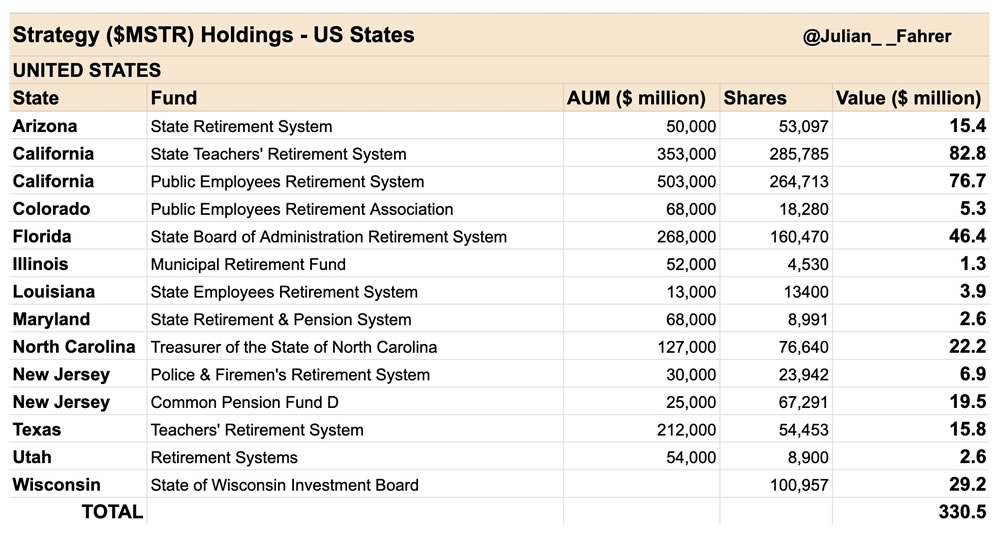

The pension funds and treasury departments of 12 states in the US hold $330 million worth of Strategy (formerly MicroStrategy) shares. Bitcoin analyst Julian Fahrer shared the investment breakdown based on the SEC Form 2024F filings of these state entities at the end of 13.

California is the Largest Investor

California is the largest Strategy shareholder. The California Teachers’ Pension Fund invested about $83 million with 285,785 shares. The same fund also invested another $76 million, holding 306,215 shares of Coinbase (COIN).

The California Public Employees’ Retirement Fund (CalPERS) also has about $76 million worth of investments with 264,713 Strategy shares. It also invested $79 million in Coinbase, giving the crypto sector a major boost.

Florida, Wisconsin and North Carolina are also on the List

- Florida Pension Fund: 160,470 Strategy shares – $46.4 million

- Wisconsin Investment Board: 100,957 Strategy shares – $29.2 million

- North Carolina Treasury Department: 76,640 Strategy shares – $22.2 million

In addition, the states of New Jersey, Arizona, Colorado, Illinois, Louisiana, Maryland, Texas and Utah also hold Strategy shares in their public funds.

Strategy is the Company with the Most Bitcoin Holdings

Strategy is currently the world’s largest institutional Bitcoin holder. The company holds 478,740 BTC, with a total value of $46 billion.

The company’s most recent Bitcoin purchase took place between February 3-9, 2025. During this period, 7,633 BTC were purchased, each at a price of $97,255.

Share Performance Beats the Bitcoin Market

Strategy stock (MSTR) has gained 16.5% since the beginning of 2025. Since the beginning of 2024, it has risen 383%, surpassing the crypto market, which rose 62% in the same period.

With the rebranding process on February 5, the company announced that it had abandoned the name “MicroStrategy” and switched to a Bitcoin-focused strategy.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.